Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1A: Multiple Choice (10 marks) 1) During a fiscal period, a business suffered a loss of $12 000, began the period with a

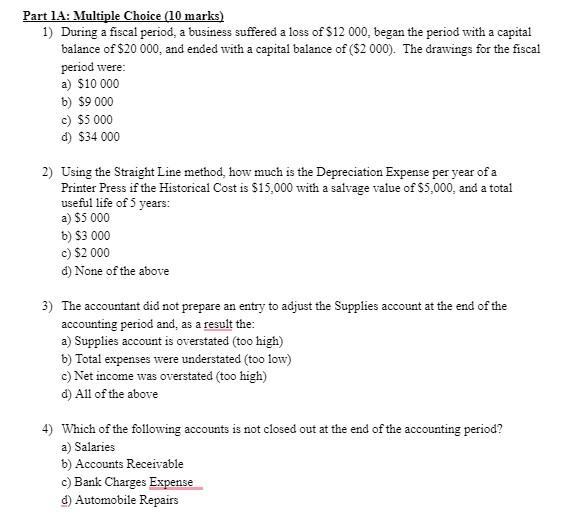

Part 1A: Multiple Choice (10 marks) 1) During a fiscal period, a business suffered a loss of $12 000, began the period with a capital balance of $20 000, and ended with a capital balance of ($2 000). The drawings for the fiscal period were: a) $10 000 b) $9.000 c) $5 000 d) $34.000 2) Using the Straight Line method, how much is the Depreciation Expense per year of a Printer Press if the Historical Cost is $15,000 with a salvage value of $5,000, and a total useful life of 5 years: a) $5 000 b) $3000 c) $2.000 d) None of the above 3) The accountant did not prepare an entry to adjust the Supplies account at the end of the accounting period and, as a result the: a) Supplies account is overstated (too high) b) Total expenses were understated (too low) c) Net income was overstated (too high) d) All of the above 4) Which of the following accounts is not closed out at the end of the accounting period? a) Salaries b) Accounts Receivable c) Bank Charges Expense d) Automobile Repairs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started