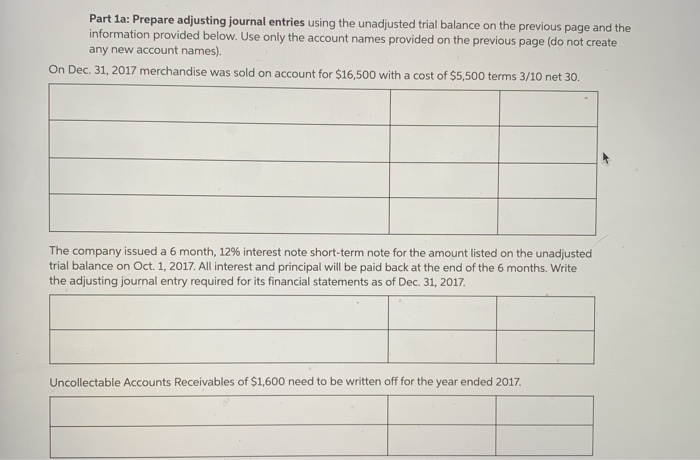

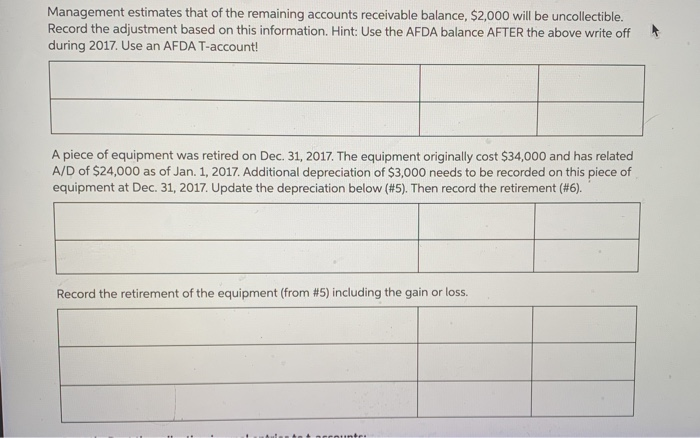

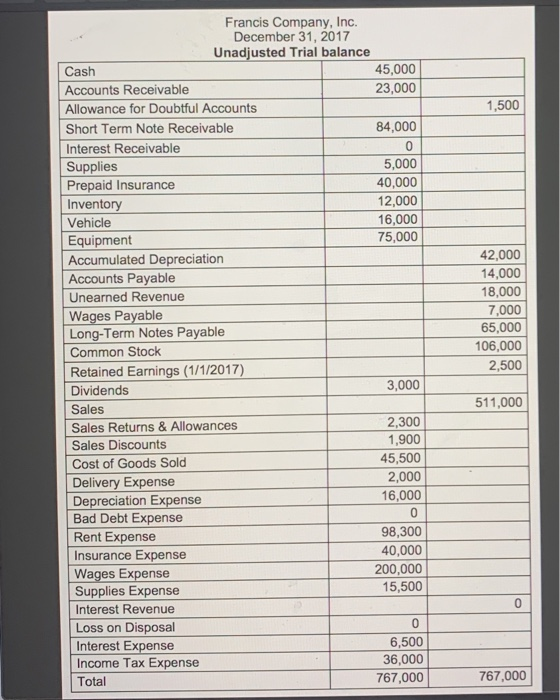

Part 1a: Prepare adjusting journal entries using the unadjusted trial balance on the previous page and the information provided below. Use only the account names provided on the previous page (do not create any new account names). On Dec 31, 2017 merchandise was sold on account for $16,500 with a cost of $5,500 terms 3/10 net 30. The company issued a 6 month, 12% interest note short-term note for the amount listed on the unadjusted trial balance on Oct. 1, 2017. All interest and principal will be paid back at the end of the 6 months. Write the adjusting journal entry required for its financial statements as of Dec 31, 2017. Uncollectable Accounts Receivables of $1,600 need to be written off for the year ended 2017 Management estimates that of the remaining accounts receivable balance, $2,000 will be uncollectible. Record the adjustment based on this information. Hint: Use the AFDA balance AFTER the above write off during 2017. Use an AFDA T-account! A piece of equipment was retired on Dec 31, 2017. The equipment originally cost $34,000 and has related A/D of $24,000 as of Jan. 1, 2017. Additional depreciation of $3,000 needs to be recorded on this piece of equipment at Dec. 31, 2017. Update the depreciation below (#5). Then record the retirement (#6). Record the retirement of the equipment (from #5) including the gain or loss. 1,500 Francis Company, Inc. December 31, 2017 Unadjusted Trial balance Cash 45,000 Accounts Receivable 23,000 Allowance for Doubtful Accounts Short Term Note Receivable 84,000 Interest Receivable 0 Supplies 5,000 Prepaid Insurance 40,000 Inventory 12,000 Vehicle 16,000 Equipment 75,000 Accumulated Depreciation Accounts Payable Unearned Revenue Wages Payable Long-Term Notes Payable Common Stock Retained Earnings (1/1/2017) Dividends 3,000 Sales Sales Returns & Allowances 2,300 Sales Discounts 1,900 Cost of Goods Sold 45,500 Delivery Expense 2,000 Depreciation Expense 16,000 Bad Debt Expense 0 Rent Expense 98,300 Insurance Expense 40,000 Wages Expense 200,000 Supplies Expense 15,500 Interest Revenue Loss on Disposal 0 Interest Expense 6,500 Income Tax Expense 36,000 Total 767,000 42,000 14,000 18,000 7,000 65,000 106,000 2,500 511,000 0 767,000