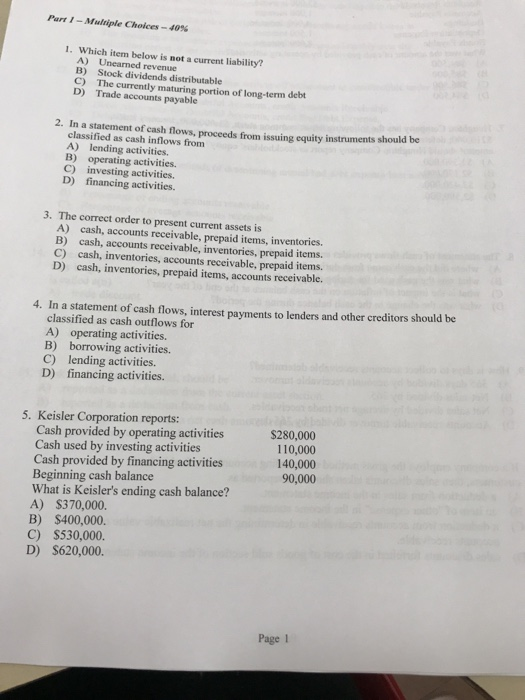

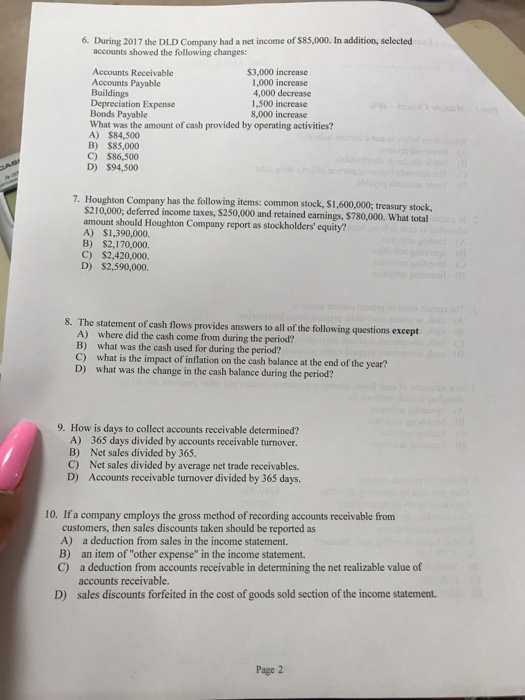

Part 1-Multiple Choices-40% 1. Which item below is not a current liability? A) Unearned revenue B) Stock dividends distributable C) The currently maturing portion of long-term D) Trade accounts payable debt 2. In a statement of cash flows, proceeds from issuing equity instruments should be classified as cash inflows fromm A) lending activities. B) operating activities. C) investing activities. D) financing activities. 3The correct order to present current assets is A) cash, accounts receivable, prepaid items, inventories. B) cash, accounts receivable, inventories, prepaid items. C) cash, inventories, accounts receivable, prepaid items. D) cash, inventories, prepaid items, accounts receivable. 4. In a statement of cash flows, interest payments to lenders and other creditors should be classified as cash outflows for A) operating activities. B) borrowing activities. C) lending activities. D) financing activities. 5. Keisler Corporation reports: $280,000 110,000 140,000 90,000 Cash provided by operating activities Cash used by investing activities Cash provided by financing activities Beginning cash balance What is Keisler's ending cash balance? A) S370,000. B) $400,000. C) $530,000. D) S620,000. Page 1 6. During 2017 the DLD Company had a net income of $85,000. In addition, selected accounts showed the following changes: Accounts Receivable Accounts Payable Buildings Depreciation Expense Bonds Payable What was the amount of cash provided by operating activities? A) $84,500 B) $85,000 C) $86,500 D) $94,500 $3,000 increase 1,000 increase 4,000 decrease 1,500 increase 8,000 increase 7. Houghton Company has the following items: common stock, $1,600,000; treasury stock, S210,000: deferred income taxes, $250,000 and retained earmings, $780,000. amount should Houghton Company report as stockholders' equity? A) $1,390,000. B) $2,170,000. C) $2,420,000. D) $2,590,000. 8. The statement of cash flows provides answers to all of the following questions except A) B) where did the cash come from during the period? what was the cash used for during the period? e impact of inflation on the cash balance at the end of the year? D) what was the change in the cash balance during the period? 9. How is days to collect accounts receivable determined? A) B) C) D) 365 days divided by accounts receivable turnover. Net sales divided by 365. Net sales divided by average net trade receivables. Accounts receivable turnover divided by 365 days. 10. If a company employs the gross method of recording accounts receivable from customers, then sales discounts taken should be reported as A) a deduction from sales in the income statement B) an item of "other expense" in the income statement C) a deduction from accounts receivable in determining the net realizable value of accounts receivable. sales discounts forfeited in the cost of goods sold section of the income statement. D) Page 2