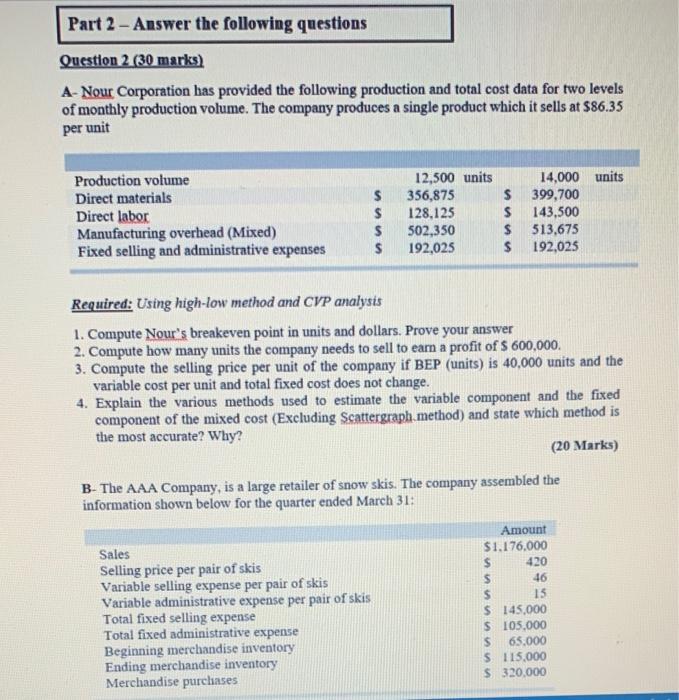

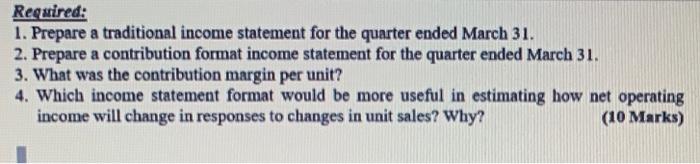

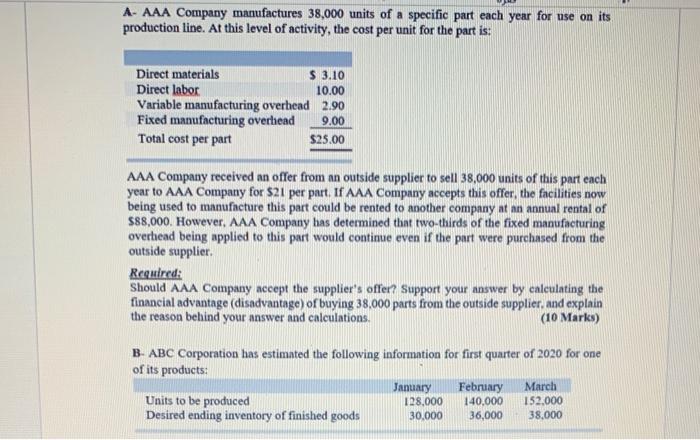

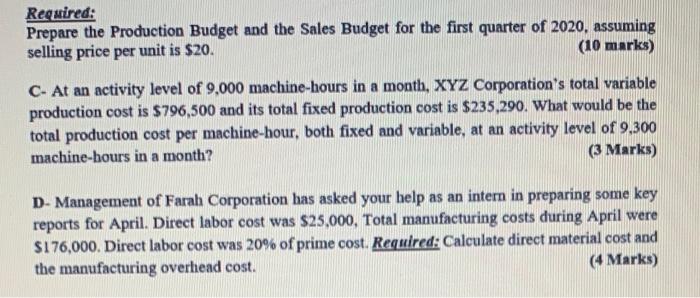

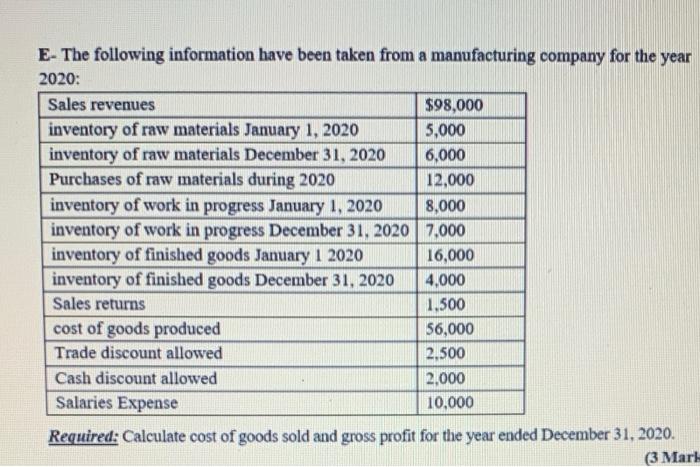

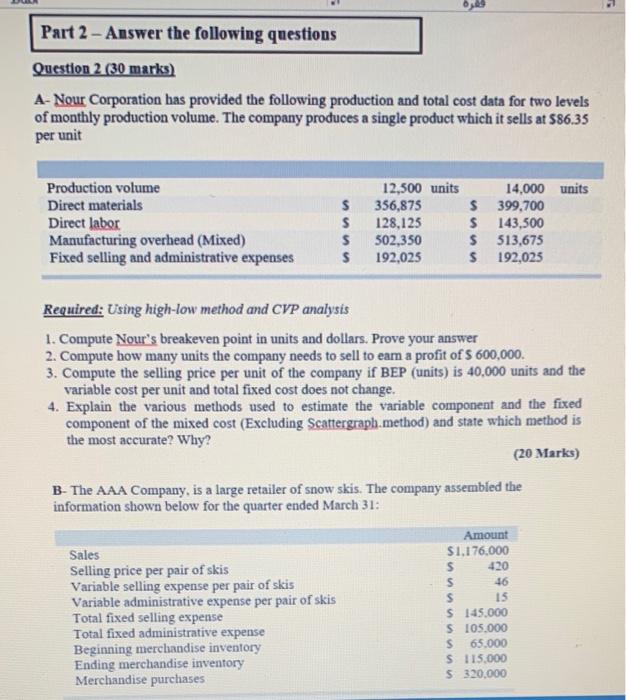

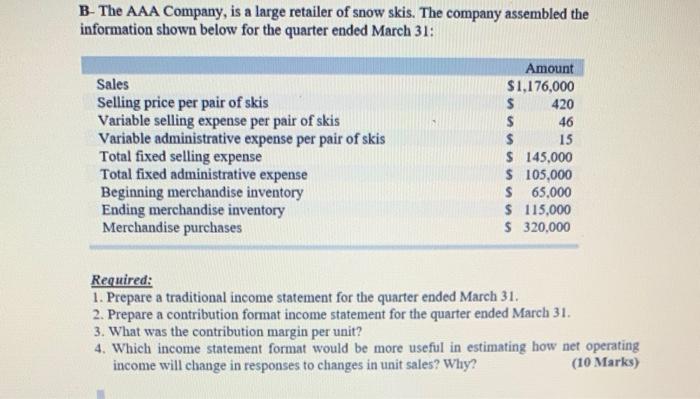

Part 2 - Answer the following questions Question 2 (30 marks) A- Nour Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product which it sells at $86.35 per unit Production volume Direct materials Direct labor Manufacturing overhead (Mixed) Fixed selling and administrative expenses $ $ $ $ 12,500 units 356,875 128,125 502,350 192,025 14,000 units $ 399,700 $ 143,500 $ 513,675 $ 192,025 Required: Using high-low method and CVP analysis 1. Compute Nour's breakeven point in units and dollars. Prove your answer 2. Compute how many units the company needs to sell to earn a profit of $ 600,000 3. Compute the selling price per unit of the company if BEP (units) is 40,000 units and the variable cost per unit and total fixed cost does not change. 4. Explain the various methods used to estimate the variable component and the fixed component of the mixed cost (Excluding Scattergraph method) and state which method is the most accurate? Why? (20 Marks) B- The AAA Company, is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31: Sales Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Amount $1.176,000 $ 420 S 46 S 15 $ 145,000 $ 105,000 S 65.000 S 115.000 $ 320,000 Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a contribution format income statement for the quarter ended March 31. 3. What was the contribution margin per unit? 4. Which income statement format would be more useful in estimating how net operating income will change in responses to changes in unit sales? Why? (10 Marks) A- AAA Company manufactures 38,000 units of a specific part each year for use on its production line. At this level of activity, the cost per unit for the part is: Direct materials $ 3.10 Direct labor 10.00 Variable manufacturing overhead 2.90 Fixed manufacturing overhead 9.00 Total cost per part $25.00 AAA Company received an offer from an outside supplier to sell 38,000 units of this part each year to AAA Company for $21 per part. If AAA Company accepts this offer, the facilities now being used to manufacture this part could be rented to another company at an annual rental of $88,000. However, AAA Company has determined that two-thirds of the fixed manufacturing overhead being applied to this part would continue even if the part were purchased from the outside supplier. Required: Should AAA Company accept the supplier's offer? Support your answer by calculating the financial advantage (disadvantage) of buying 38.000 parts from the outside supplier, and explain the reason behind your answer and calculations. (10 Marks) B- ABC Corporation has estimated the following information for first quarter of 2020 for one of its products: January February March Units to be produced 128.000 140,000 152.000 Desired ending inventory of finished goods 30,000 36,000 38.000 Required: Prepare the Production Budget and the Sales Budget for the first quarter of 2020, assuming selling price per unit is $20. (10 marks) C- At an activity level of 9,000 machine-hours in a month, XYZ Corporation's total variable production cost is $796,500 and its total fixed production cost is $235,290. What would be the total production cost per machine-hour, both fixed and variable, at an activity level of 9,300 machine-hours in a month? (3 Marks) D- Management of Farah Corporation has asked your help as an intern in preparing some key reports for April. Direct labor cost was $25,000, Total manufacturing costs during April were $176,000. Direct labor cost was 20% of prime cost. Required: Calculate direct material cost and the manufacturing overhead cost. (4 Marks) E- The following information have been taken from a manufacturing company for the year 2020: Sales revenues $98,000 inventory of raw materials January 1, 2020 5,000 inventory of raw materials December 31, 2020 6,000 Purchases of raw materials during 2020 12,000 inventory of work in progress January 1, 2020 8,000 inventory of work in progress December 31, 2020 7.000 inventory of finished goods January 1 2020 16,000 inventory of finished goods December 31, 2020 4,000 Sales returns 1,500 cost of goods produced 56,000 Trade discount allowed 2.500 Cash discount allowed 2,000 Salaries Expense 10,000 Required: Calculate cost of goods sold and gross profit for the year ended December 31, 2020. (3 Mart Part 2 - Answer the following questions Question 2 (30 marks) A-Nour Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product which it sells at 586.35 per unit Production volume Direct materials Direct labor Manufacturing overhead (Mixed) Fixed selling and administrative expenses $ $ $ $ 12,500 units 356,875 128,125 502,350 192,025 14,000 units $ 399,700 $ 143,500 $ 513,675 $ 192,025 Required: Using high-low method and CVP analysis 1. Compute Nour's breakeven point in units and dollars. Prove your answer 2. Compute how many units the company needs to sell to eam a profit of $ 600,000. 3. Compute the selling price per unit of the company if BEP (units) is 40,000 units and the variable cost per unit and total fixed cost does not change. 4. Explain the various methods used to estimate the variable component and the fixed component of the mixed cost (Excluding Scattergraph.method) and state which method is the most accurate? Why? (20 Marks) B- The AAA Company, is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31: Sales Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Amount $1.176.000 $ 420 S 46 $ 15 $ 145,000 S 105,000 S 65.00 S 115.000 $320.000 B- The AAA Company, is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31: Sales Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Amount $1,176,000 $ 420 $ 46 $ 15 $ 145,000 $ 105,000 $ 65,000 $ 115,000 $ 320,000 Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a contribution format income statement for the quarter ended March 31. 3. What was the contribution margin per unit? 4. Which income statement format would be more useful in estimating how net operating income will change in responses to changes in unit sales? Why? (10 Marks) Part 2 - Answer the following questions Question 2 (30 marks) A- Nour Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product which it sells at $86.35 per unit Production volume Direct materials Direct labor Manufacturing overhead (Mixed) Fixed selling and administrative expenses $ $ $ $ 12,500 units 356,875 128,125 502,350 192,025 14,000 units $ 399,700 $ 143,500 $ 513,675 $ 192,025 Required: Using high-low method and CVP analysis 1. Compute Nour's breakeven point in units and dollars. Prove your answer 2. Compute how many units the company needs to sell to earn a profit of $ 600,000 3. Compute the selling price per unit of the company if BEP (units) is 40,000 units and the variable cost per unit and total fixed cost does not change. 4. Explain the various methods used to estimate the variable component and the fixed component of the mixed cost (Excluding Scattergraph method) and state which method is the most accurate? Why? (20 Marks) B- The AAA Company, is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31: Sales Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Amount $1.176,000 $ 420 S 46 S 15 $ 145,000 $ 105,000 S 65.000 S 115.000 $ 320,000 Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a contribution format income statement for the quarter ended March 31. 3. What was the contribution margin per unit? 4. Which income statement format would be more useful in estimating how net operating income will change in responses to changes in unit sales? Why? (10 Marks) A- AAA Company manufactures 38,000 units of a specific part each year for use on its production line. At this level of activity, the cost per unit for the part is: Direct materials $ 3.10 Direct labor 10.00 Variable manufacturing overhead 2.90 Fixed manufacturing overhead 9.00 Total cost per part $25.00 AAA Company received an offer from an outside supplier to sell 38,000 units of this part each year to AAA Company for $21 per part. If AAA Company accepts this offer, the facilities now being used to manufacture this part could be rented to another company at an annual rental of $88,000. However, AAA Company has determined that two-thirds of the fixed manufacturing overhead being applied to this part would continue even if the part were purchased from the outside supplier. Required: Should AAA Company accept the supplier's offer? Support your answer by calculating the financial advantage (disadvantage) of buying 38.000 parts from the outside supplier, and explain the reason behind your answer and calculations. (10 Marks) B- ABC Corporation has estimated the following information for first quarter of 2020 for one of its products: January February March Units to be produced 128.000 140,000 152.000 Desired ending inventory of finished goods 30,000 36,000 38.000 Required: Prepare the Production Budget and the Sales Budget for the first quarter of 2020, assuming selling price per unit is $20. (10 marks) C- At an activity level of 9,000 machine-hours in a month, XYZ Corporation's total variable production cost is $796,500 and its total fixed production cost is $235,290. What would be the total production cost per machine-hour, both fixed and variable, at an activity level of 9,300 machine-hours in a month? (3 Marks) D- Management of Farah Corporation has asked your help as an intern in preparing some key reports for April. Direct labor cost was $25,000, Total manufacturing costs during April were $176,000. Direct labor cost was 20% of prime cost. Required: Calculate direct material cost and the manufacturing overhead cost. (4 Marks) E- The following information have been taken from a manufacturing company for the year 2020: Sales revenues $98,000 inventory of raw materials January 1, 2020 5,000 inventory of raw materials December 31, 2020 6,000 Purchases of raw materials during 2020 12,000 inventory of work in progress January 1, 2020 8,000 inventory of work in progress December 31, 2020 7.000 inventory of finished goods January 1 2020 16,000 inventory of finished goods December 31, 2020 4,000 Sales returns 1,500 cost of goods produced 56,000 Trade discount allowed 2.500 Cash discount allowed 2,000 Salaries Expense 10,000 Required: Calculate cost of goods sold and gross profit for the year ended December 31, 2020. (3 Mart Part 2 - Answer the following questions Question 2 (30 marks) A-Nour Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product which it sells at 586.35 per unit Production volume Direct materials Direct labor Manufacturing overhead (Mixed) Fixed selling and administrative expenses $ $ $ $ 12,500 units 356,875 128,125 502,350 192,025 14,000 units $ 399,700 $ 143,500 $ 513,675 $ 192,025 Required: Using high-low method and CVP analysis 1. Compute Nour's breakeven point in units and dollars. Prove your answer 2. Compute how many units the company needs to sell to eam a profit of $ 600,000. 3. Compute the selling price per unit of the company if BEP (units) is 40,000 units and the variable cost per unit and total fixed cost does not change. 4. Explain the various methods used to estimate the variable component and the fixed component of the mixed cost (Excluding Scattergraph.method) and state which method is the most accurate? Why? (20 Marks) B- The AAA Company, is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31: Sales Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Amount $1.176.000 $ 420 S 46 $ 15 $ 145,000 S 105,000 S 65.00 S 115.000 $320.000 B- The AAA Company, is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31: Sales Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Amount $1,176,000 $ 420 $ 46 $ 15 $ 145,000 $ 105,000 $ 65,000 $ 115,000 $ 320,000 Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a contribution format income statement for the quarter ended March 31. 3. What was the contribution margin per unit? 4. Which income statement format would be more useful in estimating how net operating income will change in responses to changes in unit sales? Why? (10 Marks)