Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 2 : As an MBA student, you are curious about the inverse relationship between bond prices and interest rate. More specifically, you want to

Part :

As an MBA student, you are curious about the inverse relationship between bond prices and interest rate.

More specifically, you want to figure out how interest rate sensitivity affects bonds of varying maturities. So

you decide to analyze two bond issues: Bond S and Bond L Both bond S and Bond L have coupons, make

semiannual payments, and are priced at par value meaning their PV is $ Bond S matures in years,

whereas Bond L matures in years. Given this information:

a If interest rates suddenly rise by what is the percentage change in the price in both bonds S and

L points

b If rates suddenly fall by instead, what would the percentage change in the price of both bond S

and L points

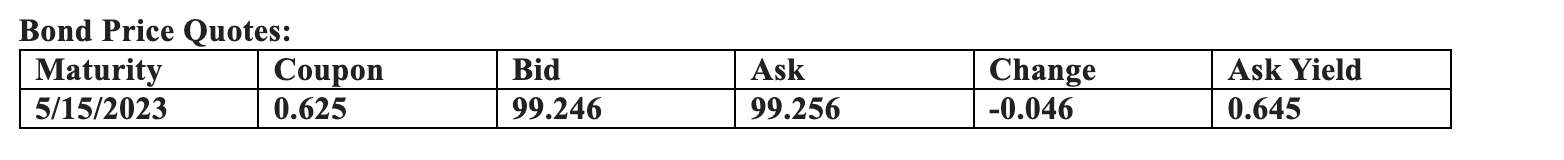

c What does this problem tell you about the interest rate risk of longterm bonds? pointsBond Price Quotes:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started