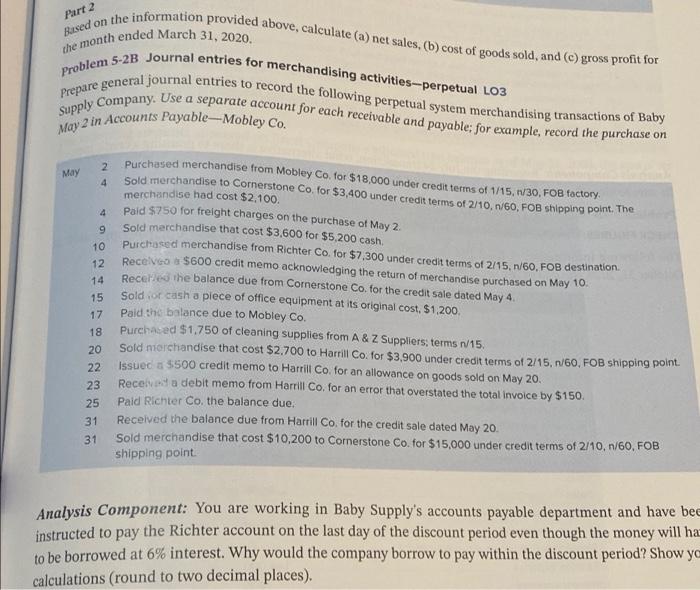

Part 2 Based on the information provided above, calculate (a) net sales. (b) cost of goods sold, and (c) gross profit for the month ended March 31, 2020. Problem 5-2B Journal entries for merchandising activities--perpetual LO3 Prepare general journal entries to record the following perpetual system merchandising transactions of Baby Supply Company. Use a separate account for each receivable and payable: for example, record the purchase on May2 in Accounts Payable-Mobley Co. May 2 4 4 9 10 12 14 15 17 18 20 22 23 25 31 31 shipping point Purchased merchandise from Mobley Co. for $18,000 under credit terms of 1/15, 1/30, FOB factory Sold merchandise to Cornerstone Co. for $3,400 under credit terms of 2/10, 1/60, FOB shipping point. The merchandise had cost $2,100. Paid $750 for freight charges on the purchase of May 2 Sold merchandise that cost $3,600 for $5,200 cash Purchased merchandise from Richter Co. for $7,300 under credit terms of 2/15, n/60, FOB destination Receive a $600 credit memo acknowledging the return of merchandise purchased on May 10 Recettes the balance due from Cornerstone Co. for the credit sale dated May 4 Sold or cash a piece of office equipment at its original cost, $1,200. Paid the balance due to Mobley Co. Purchased $1,750 of cleaning supplies from A & Z Suppliers, terms r/15. Sold merchandise that cost $2.700 to Harrill Co. for $3,900 under credit terms of 2/15./60. FOB shipping point Issuec s 5500 credit memo to Harril Co. for an allowance on goods sold on May 20, Receita debit memo from Harrill Co. for an error that overstated the total invoice by $150. Paid Richter Co. the balance due. Received the balance due from Harrill Co. for the credit sale dated May 20. Sold merchandise that cost $10,200 to Cornerstone Co. for $15,000 under credit terms of 2/10, 1/60, FOB Analysis Component: You are working in Baby Supply's accounts payable department and have bee instructed to pay the Richter account on the last day of the discount period even though the money will ha to be borrowed at 6% interest. Why would the company borrow to pay within the discount period? Show yo calculations (round to two decimal places)