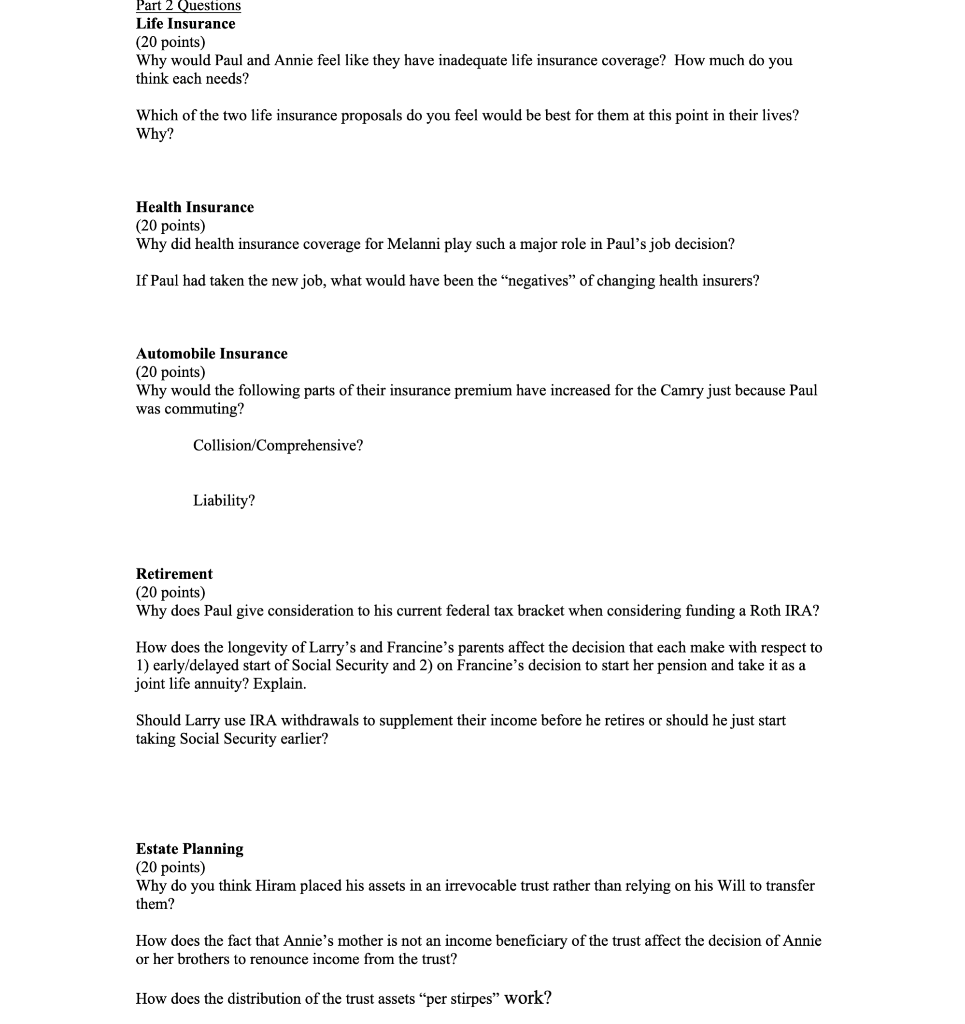

Part 2 Case Study Fall 2022 due by midnight Dec. 6th After careful consideration and discussion with Annie, Paul has decided to decline the job offer in Omaha. They both felt that the strain of the commuting would be too much and that the full financial impact on the family (particularly Melanni's health insurance and her continued care) was a big factor. If they moved to Omaha, Annie's family health coverage would have been very expensive to COBRA and they were concerned that they would not be able to include Melanni under a new plan. Paul was also concerned that they might not be able to qualify for a mortgage on a new home given their FICO score. That meant that if Paul took the job, they would have to remain living in Lincoln and Paul would commute. Additionally, Paul would have had to drive Annie's Camry for the commute since his truck was too old and unreliable for continuous Interstate driving. They found out that the additional 30,000 miles per year would increase their automobile insurance annual premium by nearly $1,600. They know their life insurance coverage is inadequate and have been seriously shopping to get more. Currently, the only coverage each has is through their employer sponsored group life benefit and each has named the other as sole beneficiary with Melanni as the contingent beneficiary. As of now, in the event of Paul's death, Annie would get a lump sum of $70,000 which is two times Paul's annual salary. Paul would get a single lump sum of $36,000 which is equal to Annie's annual salary if she died. They have been comparing recommendations from agents and they have narrowed their choices to two competing proposals with identical annual premiums. The first proposal would provide them each with a 20-years level term policy with a death benefit of $500,000 with a monthly premium of $70 for Paul and $55 for Annie. The second proposal would be a permanent whole life policy on just Paul's life with a $120,000 death benefit and a monthly premium of \$125. Paul likes the idea that whole life would build up a cash value and the agent projected that the policy would achieve "paid up" status by Paul's 60th birthday. Annie, however, is inclined to take the term policies for the higher level of protection for the next 20 years. Paul's parents (Larry and Francine Riley, both 62) came over for dinner last week and Francine told him she planned to retire at the end of November. For the last 25 years she has been a receptionist at Ameritas but she decided that she would rather take early retirement and enjoy her leisure time while was still young enough to appreciate it. She could have received a pension for the rest of her life of $1160/mo. but she chose a joint pension of $995 with a 60% survivor benefit for Larry. She will also start receiving early Social Security of $1080 per month. Had she waited to start SS at 66 , she would have received $1410 monthly. On the other hand, Larry (a barber) loves his job and his customers, so he plans to keep at it until he can't stand up anymore. He could start taking regular Social Security retirement of $1830/mo. at 66 but he plans to delay starting until age 70 . Larry also has $240,000 in his IRA and he believes it could build to $400,000 by the time he turns 70. Both Francine's and Larry's outlook on life has been influenced by the longevity of each of their parents. Both of her parents died of heart disease, her Mom at 56 and her Dad at 68. Both of Larry's parents are still alive and going strong (ages 90 and 87 ). Annie's grandfather, Hiram Gloucester age 78, remarried last month after 15 years as a widower. Prior to the wedding both Hiram and his bride established trusts for the ultimate benefit of the offspring from their previous marriages. Hiram placed most of his financial assets (nearly $4 million) in an irrevocable trust to be uses to support him and his new wife. Once they are both gone, the trust income will go to Annie's father (an only child) for the rest of his life. Then the income will be split evenly between Annie and her two brothers once her father dies. There is a provision that allows Annie and her brothers to each renounce this income in favor of their mother, Teresa. Once Annie and her brothers die, the trust is dissolved and the assets are dispersed to Hiram's great-grandchildren "per stirpes." Life Insurance (20 points) Why would Paul and Annie feel like they have inadequate life insurance coverage? How much do you think each needs? Which of the two life insurance proposals do you feel would be best for them at this point in their lives? Why? Health Insurance (20 points) Why did health insurance coverage for Melanni play such a major role in Paul's job decision? If Paul had taken the new job, what would have been the "negatives" of changing health insurers? Automobile Insurance (20 points) Why would the following parts of their insurance premium have increased for the Camry just because Paul was commuting? Collision/Comprehensive? Liability? Retirement (20 points) Why does Paul give consideration to his current federal tax bracket when considering funding a Roth IRA? How does the longevity of Larry's and Francine's parents affect the decision that each make with respect to 1) early/delayed start of Social Security and 2) on Francine's decision to start her pension and take it as a joint life annuity? Explain. Should Larry use IRA withdrawals to supplement their income before he retires or should he just start taking Social Security earlier? Estate Planning (20 points) Why do you think Hiram placed his assets in an irrevocable trust rather than relying on his Will to transfer them? How does the fact that Annie's mother is not an income beneficiary of the trust affect the decision of Annie or her brothers to renounce income from the trust? How does the distribution of the trust assets "per stirpes" work? Part 2 Case Study Fall 2022 due by midnight Dec. 6th After careful consideration and discussion with Annie, Paul has decided to decline the job offer in Omaha. They both felt that the strain of the commuting would be too much and that the full financial impact on the family (particularly Melanni's health insurance and her continued care) was a big factor. If they moved to Omaha, Annie's family health coverage would have been very expensive to COBRA and they were concerned that they would not be able to include Melanni under a new plan. Paul was also concerned that they might not be able to qualify for a mortgage on a new home given their FICO score. That meant that if Paul took the job, they would have to remain living in Lincoln and Paul would commute. Additionally, Paul would have had to drive Annie's Camry for the commute since his truck was too old and unreliable for continuous Interstate driving. They found out that the additional 30,000 miles per year would increase their automobile insurance annual premium by nearly $1,600. They know their life insurance coverage is inadequate and have been seriously shopping to get more. Currently, the only coverage each has is through their employer sponsored group life benefit and each has named the other as sole beneficiary with Melanni as the contingent beneficiary. As of now, in the event of Paul's death, Annie would get a lump sum of $70,000 which is two times Paul's annual salary. Paul would get a single lump sum of $36,000 which is equal to Annie's annual salary if she died. They have been comparing recommendations from agents and they have narrowed their choices to two competing proposals with identical annual premiums. The first proposal would provide them each with a 20-years level term policy with a death benefit of $500,000 with a monthly premium of $70 for Paul and $55 for Annie. The second proposal would be a permanent whole life policy on just Paul's life with a $120,000 death benefit and a monthly premium of \$125. Paul likes the idea that whole life would build up a cash value and the agent projected that the policy would achieve "paid up" status by Paul's 60th birthday. Annie, however, is inclined to take the term policies for the higher level of protection for the next 20 years. Paul's parents (Larry and Francine Riley, both 62) came over for dinner last week and Francine told him she planned to retire at the end of November. For the last 25 years she has been a receptionist at Ameritas but she decided that she would rather take early retirement and enjoy her leisure time while was still young enough to appreciate it. She could have received a pension for the rest of her life of $1160/mo. but she chose a joint pension of $995 with a 60% survivor benefit for Larry. She will also start receiving early Social Security of $1080 per month. Had she waited to start SS at 66 , she would have received $1410 monthly. On the other hand, Larry (a barber) loves his job and his customers, so he plans to keep at it until he can't stand up anymore. He could start taking regular Social Security retirement of $1830/mo. at 66 but he plans to delay starting until age 70 . Larry also has $240,000 in his IRA and he believes it could build to $400,000 by the time he turns 70. Both Francine's and Larry's outlook on life has been influenced by the longevity of each of their parents. Both of her parents died of heart disease, her Mom at 56 and her Dad at 68. Both of Larry's parents are still alive and going strong (ages 90 and 87 ). Annie's grandfather, Hiram Gloucester age 78, remarried last month after 15 years as a widower. Prior to the wedding both Hiram and his bride established trusts for the ultimate benefit of the offspring from their previous marriages. Hiram placed most of his financial assets (nearly $4 million) in an irrevocable trust to be uses to support him and his new wife. Once they are both gone, the trust income will go to Annie's father (an only child) for the rest of his life. Then the income will be split evenly between Annie and her two brothers once her father dies. There is a provision that allows Annie and her brothers to each renounce this income in favor of their mother, Teresa. Once Annie and her brothers die, the trust is dissolved and the assets are dispersed to Hiram's great-grandchildren "per stirpes." Life Insurance (20 points) Why would Paul and Annie feel like they have inadequate life insurance coverage? How much do you think each needs? Which of the two life insurance proposals do you feel would be best for them at this point in their lives? Why? Health Insurance (20 points) Why did health insurance coverage for Melanni play such a major role in Paul's job decision? If Paul had taken the new job, what would have been the "negatives" of changing health insurers? Automobile Insurance (20 points) Why would the following parts of their insurance premium have increased for the Camry just because Paul was commuting? Collision/Comprehensive? Liability? Retirement (20 points) Why does Paul give consideration to his current federal tax bracket when considering funding a Roth IRA? How does the longevity of Larry's and Francine's parents affect the decision that each make with respect to 1) early/delayed start of Social Security and 2) on Francine's decision to start her pension and take it as a joint life annuity? Explain. Should Larry use IRA withdrawals to supplement their income before he retires or should he just start taking Social Security earlier? Estate Planning (20 points) Why do you think Hiram placed his assets in an irrevocable trust rather than relying on his Will to transfer them? How does the fact that Annie's mother is not an income beneficiary of the trust affect the decision of Annie or her brothers to renounce income from the trust? How does the distribution of the trust assets "per stirpes" work