Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 2 Diraster Ltd ('Diraster') is a hedge fund that is listed on the JSE Ltd with a 31 January year end. Diraster researches

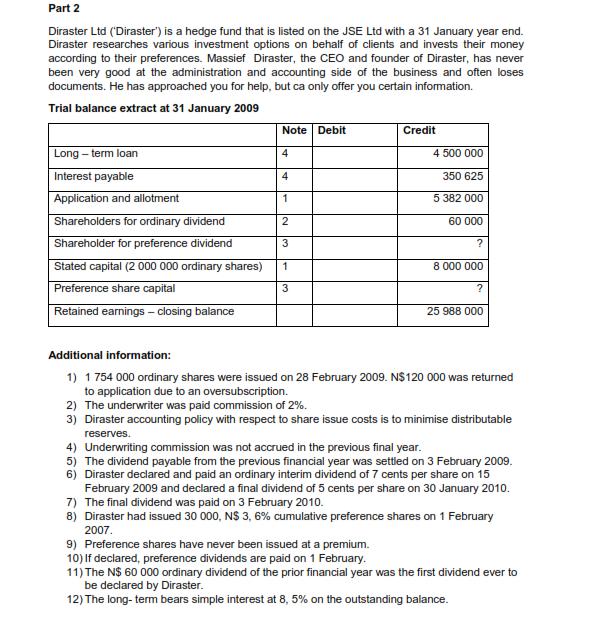

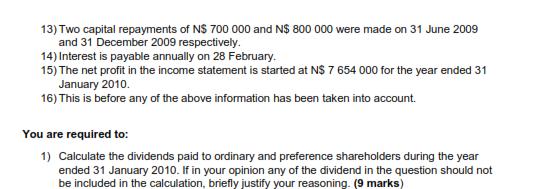

Part 2 Diraster Ltd ('Diraster') is a hedge fund that is listed on the JSE Ltd with a 31 January year end. Diraster researches various investment options on behalf of clients and invests their money according to their preferences. Massief Diraster, the CEO and founder of Diraster, has never been very good at the administration and accounting side of the business and often loses documents. He has approached you for help, but ca only offer you certain information. Trial balance extract at 31 January 2009 Long-term loan Interest payable Application and allotment Shareholders for ordinary dividend Shareholder for preference dividend Stated capital (2 000 000 ordinary shares) Preference share capital Retained earnings - closing balance Note Debit 4 4 1 2 3 1 3 Credit 4 500 000 350 625 5 382 000 60 000 ? 8 000 000 ? 25 988 000 Additional information: 1) 1 754 000 ordinary shares were issued on 28 February 2009. N$120 000 was returned to application due to an oversubscription. 2) The underwriter was paid commission of 2%. 3) Diraster accounting policy with respect to share issue costs is to minimise distributable reserves. 4) Underwriting commission was not accrued in the previous final year. 5) The dividend payable from the previous financial year was settled on 3 February 2009. 6) Diraster declared and paid an ordinary interim dividend of 7 cents per share on 15 February 2009 and declared a final dividend of 5 cents per share on 30 January 2010. 7) The final dividend was paid on 3 February 2010. 8) Diraster had issued 30 000, N$ 3, 6% cumulative preference shares on 1 February 2007. 9) Preference shares have never been issued at a premium. 10) If declared, preference dividends are paid on 1 February. 11) The N$ 60 000 ordinary dividend of the prior financial year was the first dividend ever to be declared by Diraster. 12) The long-term bears simple interest at 8, 5% on the outstanding balance. 13) Two capital repayments of N$ 700 000 and N$ 800 000 were made on 31 June 2009 and 31 December 2009 respectively. 14) Interest is payable annually on 28 February. 15) The net profit in the income statement is started at N$ 7 654 000 for the year ended 31 January 2010. 16) This is before any of the above information has been taken into account. You are required to: 1) Calculate the dividends paid to ordinary and preference shareholders during the year ended 31 January 2010. If in your opinion any of the dividend in the question should not be included in the calculation, briefly justify your reasoning. (9 marks)

Step by Step Solution

★★★★★

3.31 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

2 Preference shares more commonly referred to as preferred stock are shares of a companys stock with ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started