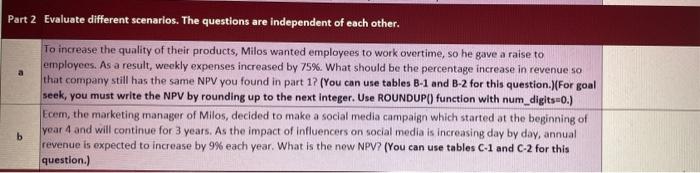

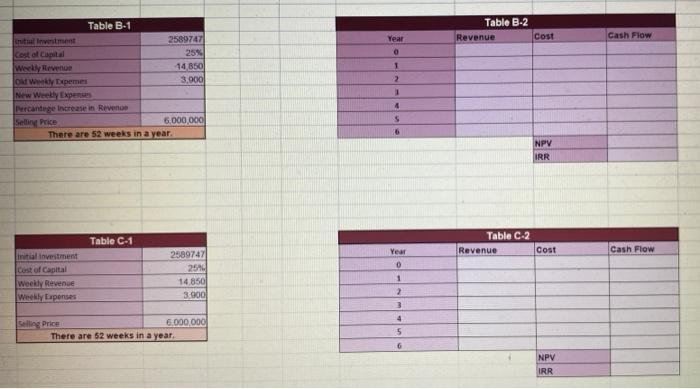

Part 2 Evaluate different scenarios. The questions are independent of each other. To increase the quality of their products, Milos wanted employees to work overtime, so he gave a raise to employees. As a result, weekly expenses increased by 75%. What should be the percentage increase in revenue so that company still has the same NPV you found in part 12 (You can use tables B-1 and B-2 for this question.)(For goal seek, you must write the NPV by rounding up to the next Integer. Use ROUNDUP() function with num_digits-0.) Ecem, the marketing manager of Milos, decided to make a social media campaign which started at the beginning of year 4 and will continue for 3 years. As the impact of influencers on social media is increasing day by day, annual b revenue is expected to increase by 9% each year. What is the new NPV? (You can use tables C-1 and C-2 for this question.) Table B-2 Revenue Cost Cash Flow Year o 1 Table B.1 mutual Istment 2589747) Cost al Capital 25 Weekly Revenge 14.350 OM WExpemes 3,000 New Weekly Expenses Percandege Increase in Revenge Selling Price 6.000.000 There are 52 weeks in a year. 2 1 4 S 6 NPV IRR Table C-1 Table C-2 Revenue Cost Year Cash Flow Initial investment Cost of Capital Weekly Revenue Weekly Lipenses 25897471 2546 14 850 3.900 0 1 2 3 Selling Price 6.000.000 There are 52 weeks in a year 4 5 6 NPV IRR Part 2 Evaluate different scenarios. The questions are independent of each other. To increase the quality of their products, Milos wanted employees to work overtime, so he gave a raise to employees. As a result, weekly expenses increased by 75%. What should be the percentage increase in revenue so that company still has the same NPV you found in part 12 (You can use tables B-1 and B-2 for this question.)(For goal seek, you must write the NPV by rounding up to the next Integer. Use ROUNDUP() function with num_digits-0.) Ecem, the marketing manager of Milos, decided to make a social media campaign which started at the beginning of year 4 and will continue for 3 years. As the impact of influencers on social media is increasing day by day, annual b revenue is expected to increase by 9% each year. What is the new NPV? (You can use tables C-1 and C-2 for this question.) Table B-2 Revenue Cost Cash Flow Year o 1 Table B.1 mutual Istment 2589747) Cost al Capital 25 Weekly Revenge 14.350 OM WExpemes 3,000 New Weekly Expenses Percandege Increase in Revenge Selling Price 6.000.000 There are 52 weeks in a year. 2 1 4 S 6 NPV IRR Table C-1 Table C-2 Revenue Cost Year Cash Flow Initial investment Cost of Capital Weekly Revenue Weekly Lipenses 25897471 2546 14 850 3.900 0 1 2 3 Selling Price 6.000.000 There are 52 weeks in a year 4 5 6 NPV IRR