Answered step by step

Verified Expert Solution

Question

1 Approved Answer

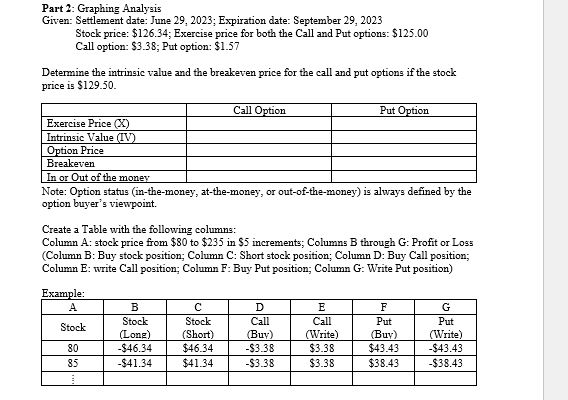

Part 2 : Graphing Analysis Given: Settlement date: June 2 9 , 2 0 2 3 ; Expiration date: September 2 9 , 2 0

Part : Graphing Analysis

Given: Settlement date: June ; Expiration date: September

Stock price: $; Exercise price for both the Call and Put options: $

Call option: $; Put option: $

Determine the intrinsic value and the breakeven price for the call and put options if the stock

price is $

Note: Option status inthemoney, atthemoney, or outofthemoney is always defined by the

option buyer's viewpoint.

Create a Table with the following columns:

Column A: stock price from $ to $ in $ increments; Columns B through G: Profit or Loss

Column B: Buy stock position; Column C: Short stock position; Column D: Buy Call position;

Column E: write Call position; Column F: Buy Put position; Column G: Write Put position

Example:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started