Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help for #2 Duela Dent is single and had $180,000 in taxable income. Using the rates from:Table 23 calculate her income taxes. What is

please help

for #2

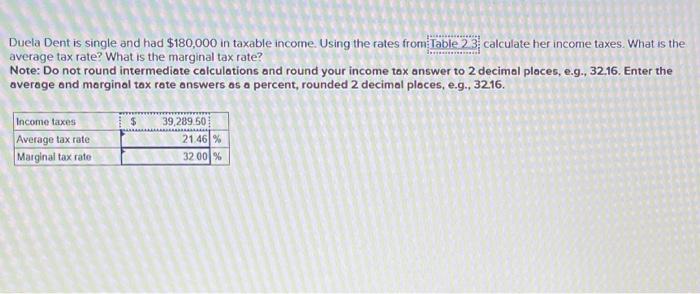

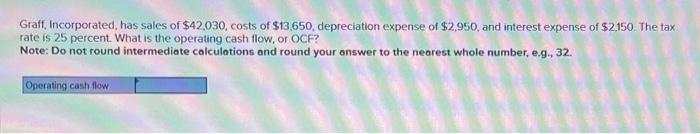

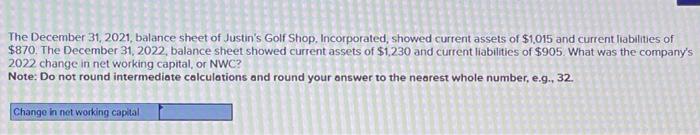

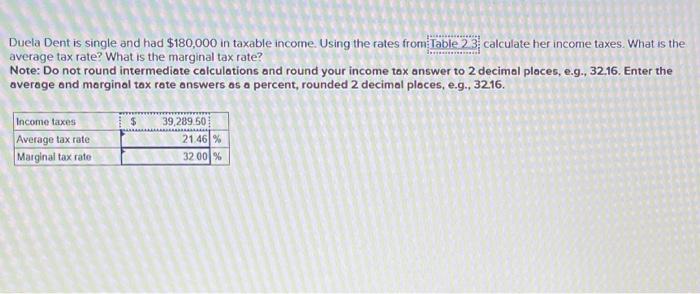

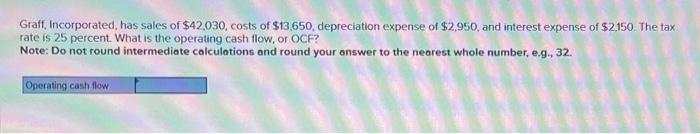

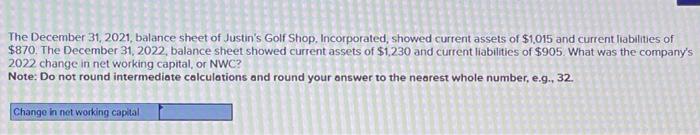

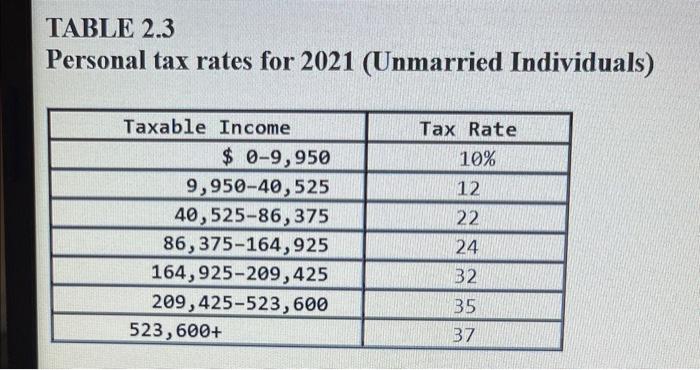

Duela Dent is single and had $180,000 in taxable income. Using the rates from:Table 23 calculate her income taxes. What is the average tax rate? What is the marginal tax rate? Note: Do not round intermediate calculations and round your income tax answer to 2 decimal places, e.9., 32.16. Enter the average and marginal tax rate answers os a percent, rounded 2 decimal ploces, e.g., 3216 . Graff, Incorporated, has sales of $42,030, costs of $13,650, depreciation expense of $2,950, and interest expense of $2,150. The tax rate is 25 percent. What is the operating cash flow, or OCF? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32 . The December 31,2021 , balance sheet of Justin's Golf Shop, Incorporated, showed current assets of $1,015 and current liabilities of $870. The December 31,2022 , balance sheet showed current assets of $1,230 and current liabilities of $905. What was the company's 2022 change in net working capital, or NWC? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32 . CABELC 2.2 Personal tax rates for 2021 (Unmarried Individuals)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started