Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART 2: If any math is done, please tell me how so I can understand. Thank you. On March 31, the Federal Unemployment Tax Payable

PART 2:

If any math is done, please tell me how so I can understand. Thank you.

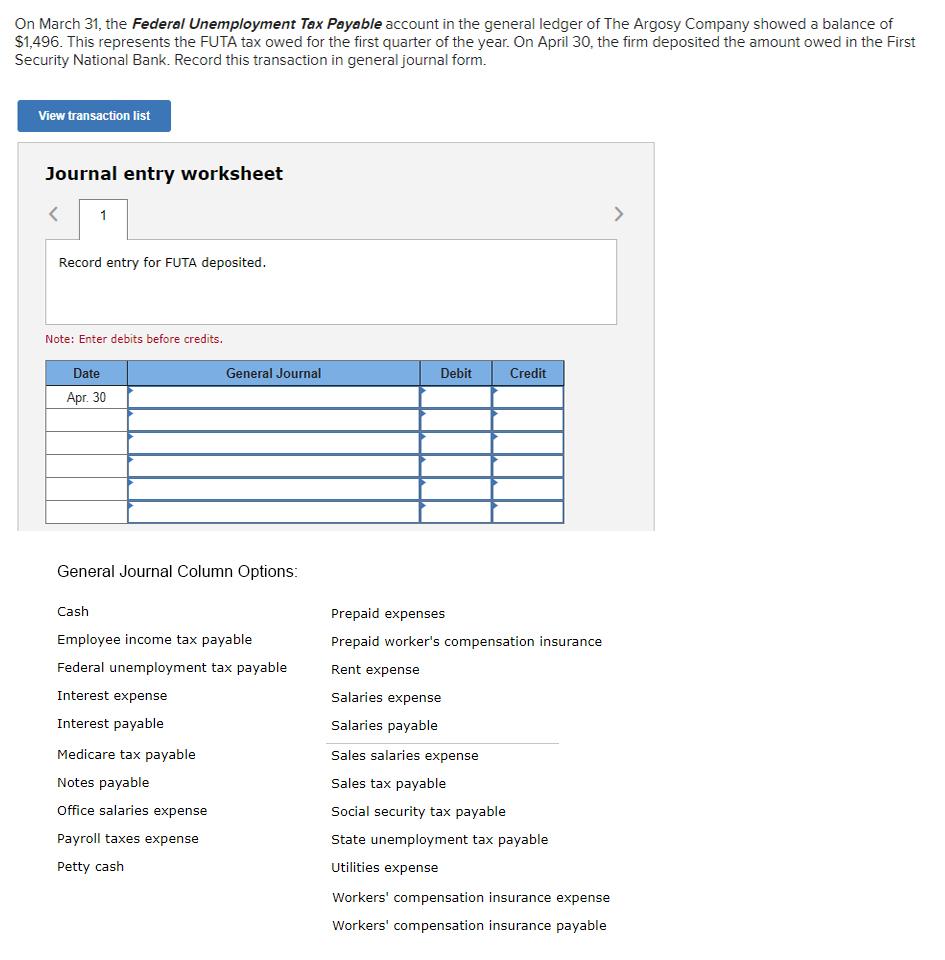

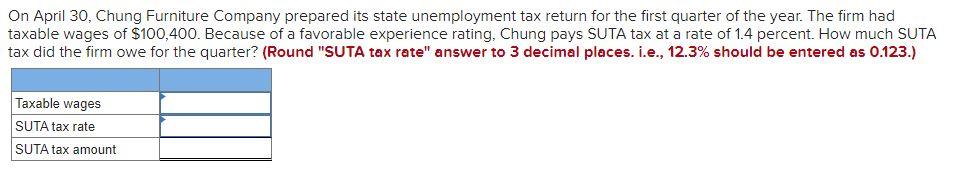

On March 31, the Federal Unemployment Tax Payable account in the general ledger of The Argosy Company showed a balance of $1,496. This represents the FUTA tax owed for the first quarter of the year. On April 30 , the firm deposited the amount owed in the First Security National Bank. Record this transaction in general journal form. Journal entry worksheet Note: Enter debits before credits. General Journal Column Options: On April 30 , Chung Furniture Company prepared its state unemployment tax return for the first quarter of the year. The firm had taxable wages of $100,400. Because of a favorable experience rating, Chung pays SUTA tax at a rate of 1.4 percent. How much SUTA tax did the firm owe for the quarter? (Round "SUTA tax rate" answer to 3 decimal places. i.e., 12.3% should be entered as 0.123. )Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started