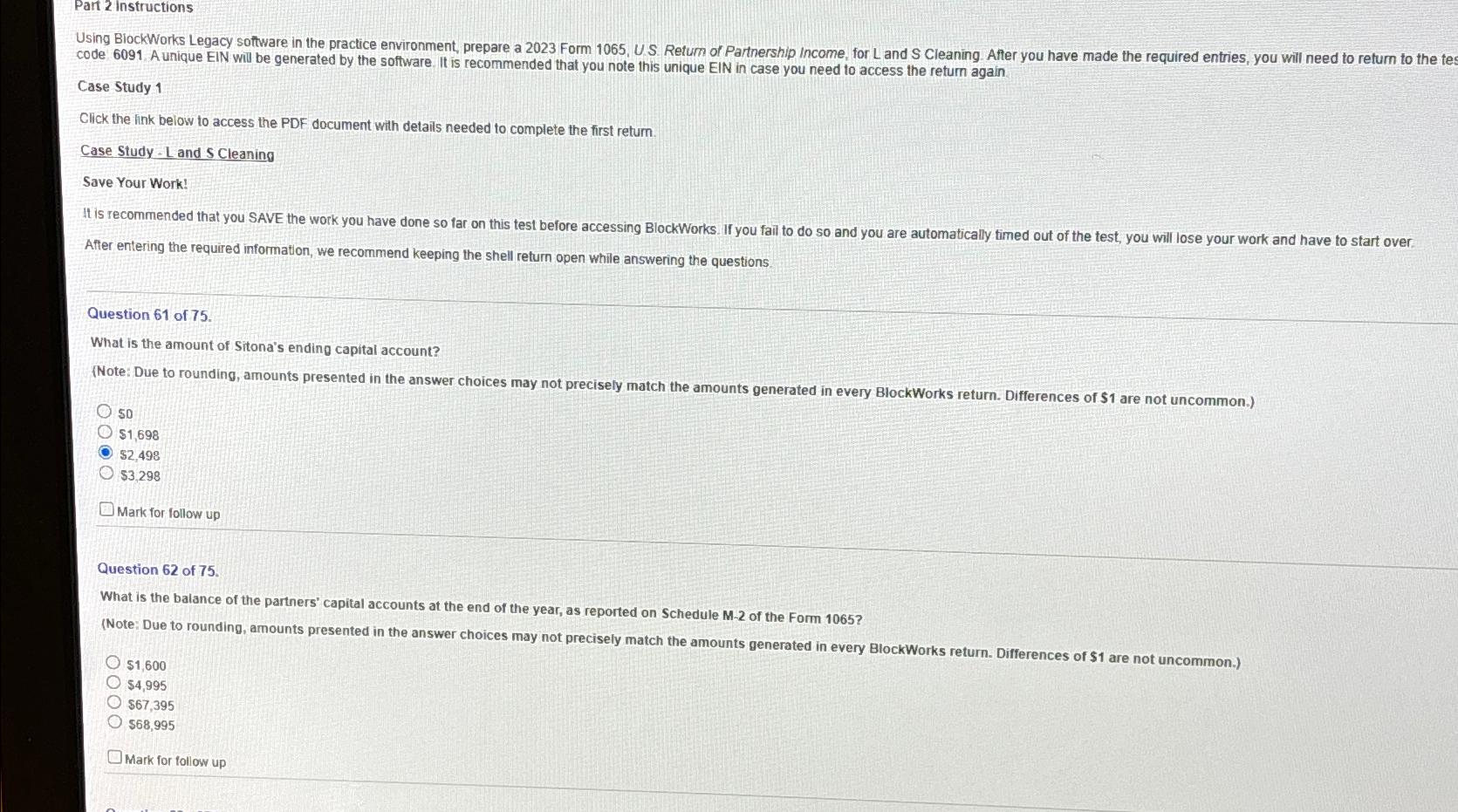

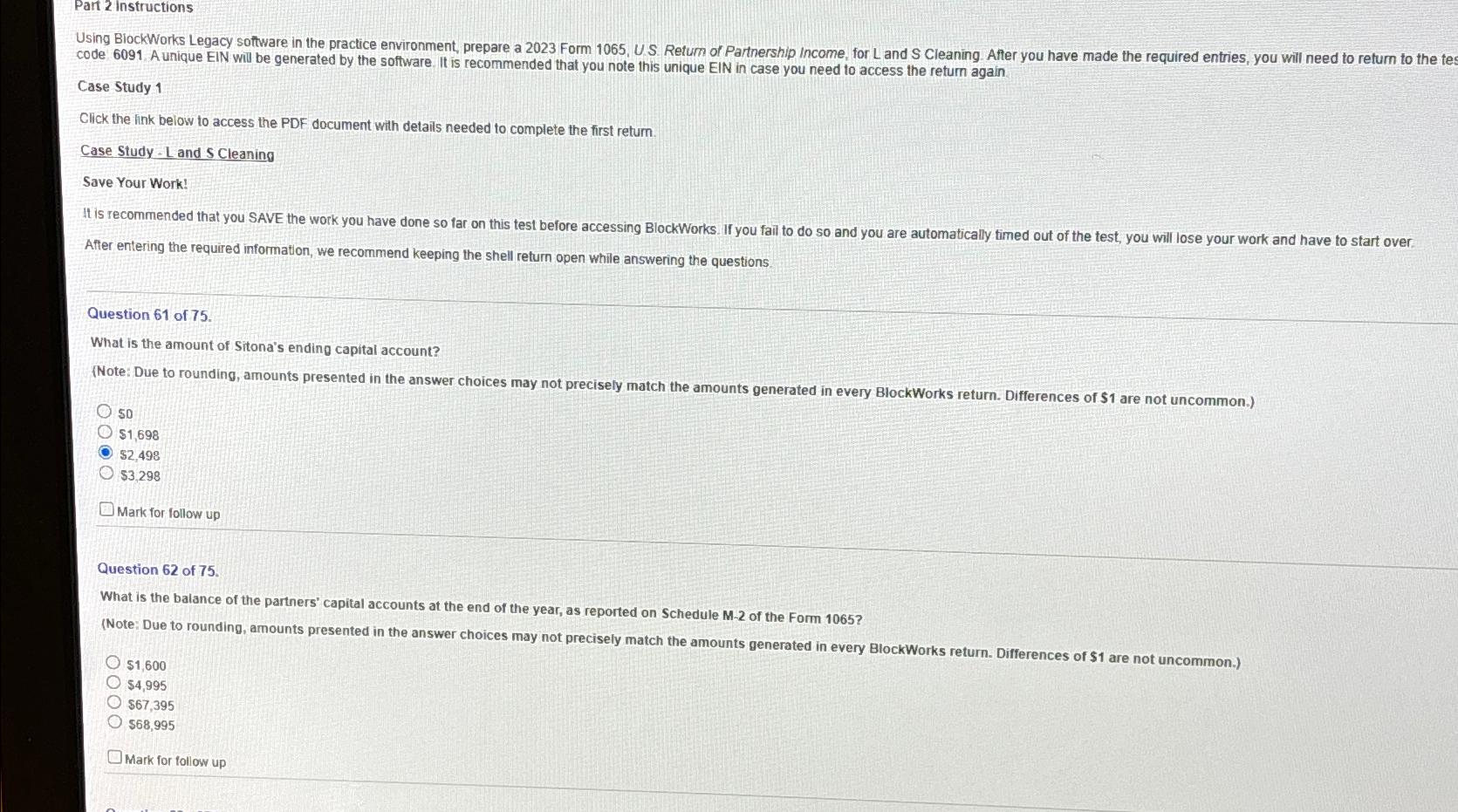

Part 2 instructions code 6091 A unique EIN will be generated by the software. It is recommended that you note this unique EIN in case you need to access the return again\ Case Study 1\ Click the link below to access the PDF document with details needed to complete the first return.\ Case Study - L and S Cleaning\ Save Your Work!\ Affer entering the required information, we recommend keeping the shell return open while answering the questions.\ Question 61 of 75.\ What is the amount of Sitona's ending capital account?\ (Note: Due to rounding, amounts presented in the answer choices may not precisely match the amounts generated in every BlockWorks return. Differences of

$1 are not uncommon.)\ 50\

$1,698\

$2,498\

$3,298\ Mark for follow up\ Question 62 of 75.\ What is the balance of the partners' capital accounts at the end of the year, as reported on Schedule M-2 of the Form 1065?\ (Note: Due to rounding, amounts presented in the answer choices may not precisely match the amounts generated in every BlockWorks return. Differences of

$1 are not uncommon.)\

$1,600\ $4,995\ $67,395\ $68,995\ Mark for follow up

Using BlockWorks Legacy sottware in the practice environment, prepare a 2023 Form 1065, U S. Retum or Partnership Income, for L and S Cleaning. After you have made the required entries, you will need to return to the te code 6091 . A unique EIN will be generated by the software. It is recommended that you note this unique EIN in case you need to access the return again. Case Study 1 Click the link beiow to access the PDF document with details needed to complete the first retum. Case Study - L and S Cleaning Save Your Work! It is recommended that you SAVE the work you have done so far on this test before accessing BlockWorks. If you fail to do so and you are automatically fimed out of the test, you will lose your work and have to start over. After entering the required information, we recommend keeping the shell return open while answering the questions. Question 61 of 75 . What is the amount of Sitona's ending capital account? (Note: Due to rounding, amounts presented in the answer choices may not precisely match the amounts generated in every BlockWorks return. Differences of $1 are not uncommon.) so $1,698 $2,498 $3,298 Mark for follow up Question 62 of 75 . What is the balance of the partners' capital accounts at the end of the year, as reported on Schedule M-2 of the Form 1065? (Note: Due to rounding, amounts presented in the answer choices may not precisely match the amounts generated in every BlockWorks return. Differences of $1 are not uncommon.) $1,600 $4,995 $67,395 $68,995 Mark for follow up Using BlockWorks Legacy sottware in the practice environment, prepare a 2023 Form 1065, U S. Retum or Partnership Income, for L and S Cleaning. After you have made the required entries, you will need to return to the te code 6091 . A unique EIN will be generated by the software. It is recommended that you note this unique EIN in case you need to access the return again. Case Study 1 Click the link beiow to access the PDF document with details needed to complete the first retum. Case Study - L and S Cleaning Save Your Work! It is recommended that you SAVE the work you have done so far on this test before accessing BlockWorks. If you fail to do so and you are automatically fimed out of the test, you will lose your work and have to start over. After entering the required information, we recommend keeping the shell return open while answering the questions. Question 61 of 75 . What is the amount of Sitona's ending capital account? (Note: Due to rounding, amounts presented in the answer choices may not precisely match the amounts generated in every BlockWorks return. Differences of $1 are not uncommon.) so $1,698 $2,498 $3,298 Mark for follow up Question 62 of 75 . What is the balance of the partners' capital accounts at the end of the year, as reported on Schedule M-2 of the Form 1065? (Note: Due to rounding, amounts presented in the answer choices may not precisely match the amounts generated in every BlockWorks return. Differences of $1 are not uncommon.) $1,600 $4,995 $67,395 $68,995 Mark for follow up