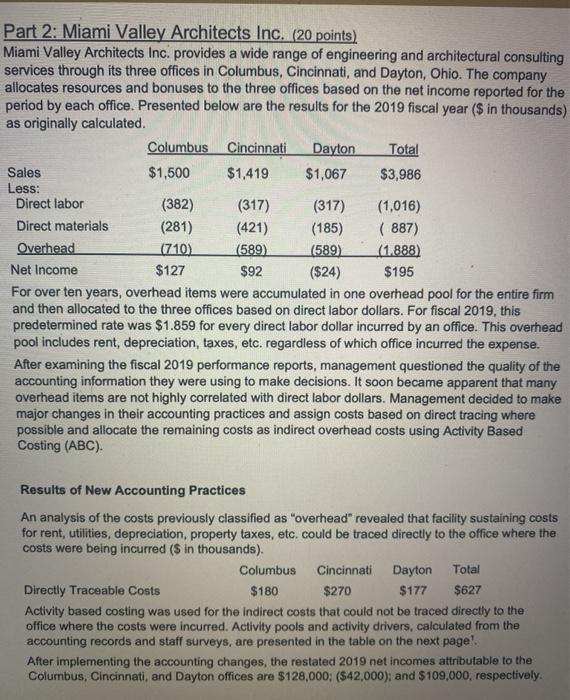

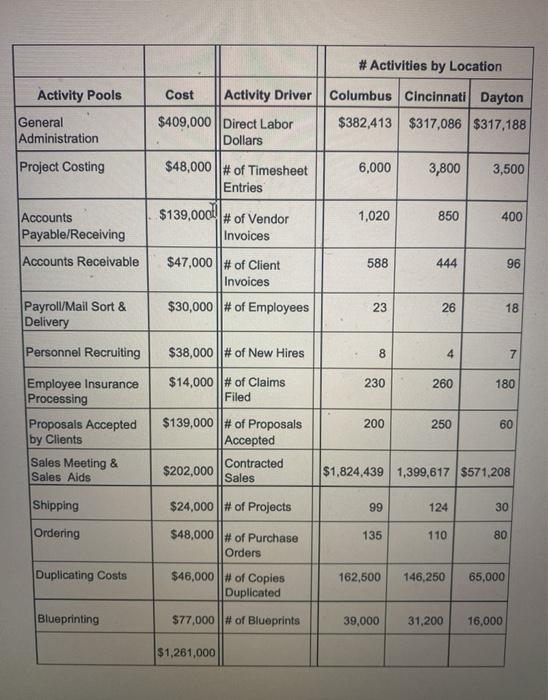

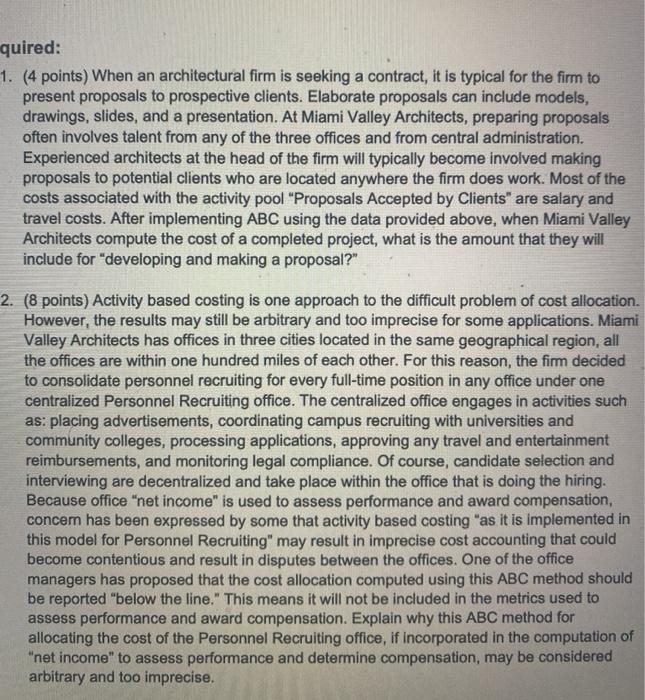

Part 2: Miami Valley Architects Inc. (20 points) Miami Valley Architects Inc. provides a wide range of engineering and architectural consulting services through its three offices in Columbus, Cincinnati, and Dayton, Ohio. The company allocates resources and bonuses to the three offices based on the net income reported for the period by each office. Presented below are the results for the 2019 fiscal year ($ in thousands) as originally calculated. Columbus Cincinnati Dayton Total Sales $1,500 $1.419 $1,067 $3,986 Less: Direct labor (382) (317) (317) (1,016) Direct materials (281) (421) (185) (887) Overhead (710) (589) (589) (1.888) Net Income $127 $92 ($24) $195 For over ten years, overhead items were accumulated in one overhead pool for the entire firm and then allocated to the three offices based on direct labor dollars. For fiscal 2019, this predetermined rate was $1.859 for every direct labor dollar incurred by an office. This overhead pool includes rent, depreciation, taxes, etc. regardless of which office incurred the expense. After examining the fiscal 2019 performance reports, management questioned the quality of the accounting information they were using to make decisions. It soon became apparent that many overhead items are not highly correlated with direct labor dollars. Management decided to make major changes in their accounting practices and assign costs based on direct tracing where possible and allocate the remaining costs as indirect overhead costs using Activity Based Costing (ABC). Results of New Accounting Practices An analysis of the costs previously classified as "overhead" revealed that facility sustaining costs for rent, utilities, depreciation, property taxes, etc. could be traced directly to the office where the costs were being incurred ($ in thousands). Columbus Cincinnati Dayton Total Directly Traceable Costs $180 $270 $177 $627 Activity based costing was used for the Indirect costs that could not be traced directly to the office where the costs were incurred. Activity pools and activity drivers, calculated from the accounting records and staff surveys, are presented in the table on the next page! After implementing the accounting changes, the restated 2019 net incomes attributable to the Columbus, Cincinnati, and Dayton offices are $128,000: ($42,000); and $109,000, respectively. # Activities by Location Activity Pools General Administration Project Costing $139,0000 # of Vendor Cost Activity Driver Columbus Cincinnati Dayton $409,000 Direct Labor $382,413 $317,086 $317,188 Dollars $48,000 || # of Timesheet 6,000 3,800 3,500 Entries 1,020 850 400 Invoices $47,000 ||# of Client 588 444 96 Invoices $30,000 ||# of Employees 23 26 18 Accounts Payable/Receiving Accounts Receivable Payroll/Mail Sort & Delivery Personnel Recruiting $38,000 ||# of New Hires 8 4 7 230 260 Employee Insurance Processing $14,000 ||# of Claims Filed 180 200 250 60 $139,000 ||# of Proposals Accepted Proposals Accepted by Clients Sales Meeting & Sales Aids $202,000 Contracted Sales $1,824,439 1.399,617 $571 208 Shipping $24,000 ||# of Projects 99 124 30 Ordering 135 110 80 $48,000 || # of Purchase Orders Duplicating Costs $46,000 # of Copies Duplicated 162,500 146,250 65.000 Blueprinting $77,000 # of Blueprints 39,000 31,200 16,000 $1,261,000 quired: 1. (4 points) When an architectural firm is seeking a contract, it is typical for the firm to present proposals to prospective clients. Elaborate proposals can include models, drawings, slides, and a presentation. At Miami Valley Architects, preparing proposals often involves talent from any of the three offices and from central administration. Experienced architects at the head of the firm will typically become involved making proposals to potential clients who are located anywhere the firm does work. Most of the costs associated with the activity pool "Proposals Accepted by Clients" are salary and travel costs. After implementing ABC using the data provided above, when Miami Valley Architects compute the cost of a completed project, what is the amount that they will include for "developing and making a proposal?" 2. (8 points) Activity based costing is one approach to the difficult problem of cost allocation. However, the results may still be arbitrary and too imprecise for some applications. Miami Valley Architects has offices in three cities located in the same geographical region, all the offices are within one hundred miles of each other. For this reason, the firm decided to consolidate personnel recruiting for every full-time position in any office under one centralized Personnel Recruiting office. The centralized office engages in activities such as: placing advertisements, coordinating campus recruiting with universities and community colleges, processing applications, approving any travel and entertainment reimbursements, and monitoring legal compliance. Of course, candidate selection and interviewing are decentralized and take place within the office that is doing the hiring. Because office "net income" is used to assess performance and award compensation, concer has been expressed by some that activity based costing "as it is implemented in this model for Personnel Recruiting" may result in imprecise cost accounting that could become contentious and result in disputes between the offices. One of the office managers has proposed that the cost allocation computed using this ABC method should be reported "below the line." This means it will not be included in the metrics used to assess performance and award compensation. Explain why this ABC method for allocating the cost of the Personnel Recruiting office, if incorporated in the computation of "net income" to assess performance and determine compensation, may be considered arbitrary and too imprecise