Part 2: Miami Valley Architects Inc. (20 points) Miami Valley Architects Inc. provides a wide range of engineering and architectural consulting services through its

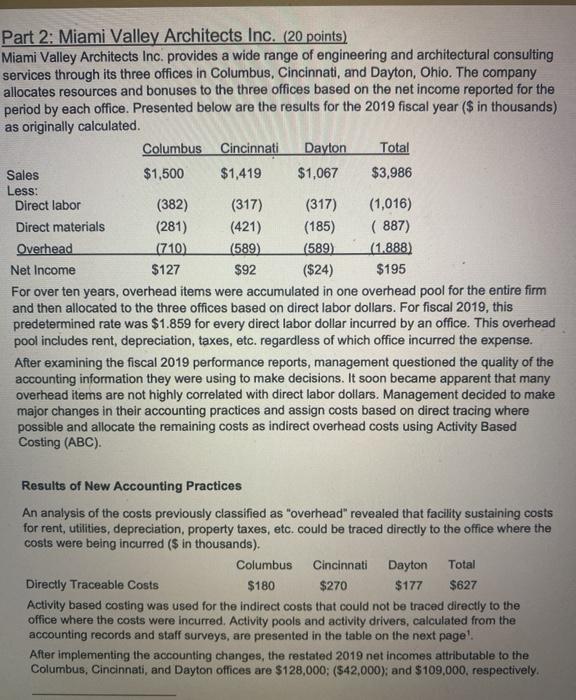

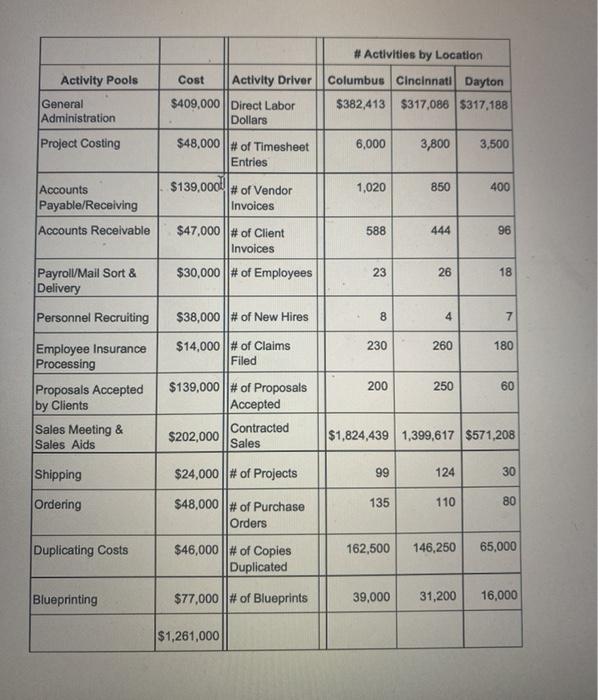

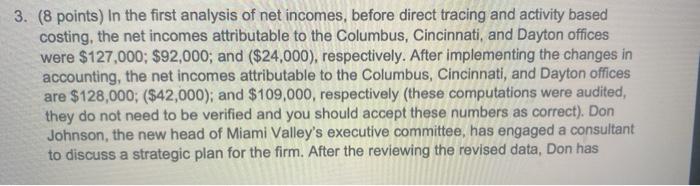

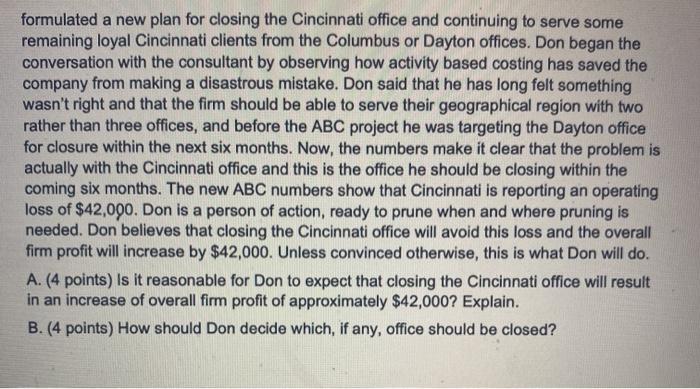

Part 2: Miami Valley Architects Inc. (20 points) Miami Valley Architects Inc. provides a wide range of engineering and architectural consulting services through its three offices in Columbus, Cincinnati, and Dayton, Ohio. The company allocates resources and bonuses to the three offices based on the net income reported for the period by each office. Presented below are the results for the 2019 fiscal year ($ in thousands) as originally calculated. Columbus Cincinnati Dayton Total Sales $1,500 $1,419 $1,067 $3,986 Less: Direct labor (382) (317) (317) (1,016) Direct materials (281) (421) (185) (887) Overhead (710) (589) (589) (1.888) Net Income $127 $92 ($24) $195 For over ten years, overhead items were accumulated in one overhead pool for the entire firm and then allocated to the three offices based on direct labor dollars. For fiscal 2019, this predetermined rate was $1.859 for every direct labor dollar incurred by an office. This overhead pool includes rent, depreciation, taxes, etc. regardless of which office incurred the expense. After examining the fiscal 2019 performance reports, management questioned the quality of the accounting information they were using to make decisions. It soon became apparent that many overhead items are not highly correlated with direct labor dollars. Management decided to make major changes in their accounting practices and assign costs based on direct tracing where possible and allocate the remaining costs as indirect overhead costs using Activity Based Costing (ABC). Results of New Accounting Practices An analysis of the costs previously classified as "overhead" revealed that facility sustaining costs for rent, utilities, depreciation, property taxes, etc. could be traced directly to the office where the costs were being incurred ($ in thousands). Directly Traceable Costs Columbus $180 Cincinnati Dayton $270 $177 Total $627 Activity based costing was used for the indirect costs that could not be traced directly to the office where the costs were incurred. Activity pools and activity drivers, calculated from the accounting records and staff surveys, are presented in the table on the next page!. After implementing the accounting changes, the restated 2019 net incomes attributable to the Columbus, Cincinnati, and Dayton offices are $128,000; ($42,000); and $109,000, respectively. #Activities by Location Activity Pools General Cost Activity Driver $409,000 Direct Labor Columbus Cincinnati Dayton $382,413 $317,086 $317,188 Administration Dollars Project Costing $48,000 # of Timesheet Entries 6,000 3,800 3,500 Accounts Payable/Receiving $139,000 # of Vendor 1,020 850 400 Invoices Accounts Receivable $47,000 # of Client Invoices 588 444 96 96 Payroll/Mail Sort & Delivery $30,000 # of Employees 23 23 26 18 Personnel Recruiting $38,000 # of New Hires 8 4 7 Employee Insurance Processing $14,000 # of Claims Filed 230 260 180 Proposals Accepted by Clients $139,000 # of Proposals Accepted 200 250 60 60 Sales Meeting & $202,000 Sales Aids Contracted Sales $1,824,439 1,399,617 $571,208 Shipping $24,000 # of Projects 99 124 30 Ordering $48,000 # of Purchase 135 110 80 Orders Duplicating Costs $46,000 # of Copies Duplicated 162,500 146,250 65,000 Blueprinting $77,000 # of Blueprints 39,000 31,200 16,000 $1,261,000 3. (8 points) In the first analysis of net incomes, before direct tracing and activity based costing, the net incomes attributable to the Columbus, Cincinnati, and Dayton offices were $127,000; $92,000; and ($24,000), respectively. After implementing the changes in accounting, the net incomes attributable to the Columbus, Cincinnati, and Dayton offices are $128,000; ($42,000); and $109,000, respectively (these computations were audited, they do not need to be verified and you should accept these numbers as correct). Don Johnson, the new head of Miami Valley's executive committee, has engaged a consultant to discuss a strategic plan for the firm. After the reviewing the revised data, Don has formulated a new plan for closing the Cincinnati office and continuing to serve some remaining loyal Cincinnati clients from the Columbus or Dayton offices. Don began the conversation with the consultant by observing how activity based costing has saved the company from making a disastrous mistake. Don said that he has long felt something wasn't right and that the firm should be able to serve their geographical region with two rather than three offices, and before the ABC project he was targeting the Dayton office for closure within the next six months. Now, the numbers make it clear that the problem is actually with the Cincinnati office and this is the office he should be closing within the coming six months. The new ABC numbers show that Cincinnati is reporting an operating loss of $42,000. Don is a person of action, ready to prune when and where pruning is needed. Don believes that closing the Cincinnati office will avoid this loss and the overall firm profit will increase by $42,000. Unless convinced otherwise, this is what Don will do. A. (4 points) Is it reasonable for Don to expect that closing the Cincinnati office will result in an increase of overall firm profit of approximately $42,000? Explain. B. (4 points) How should Don decide which, if any, office should be closed?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part A Is it reasonable for Don to expect that closing the Cincinnati office will result in an incre...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started