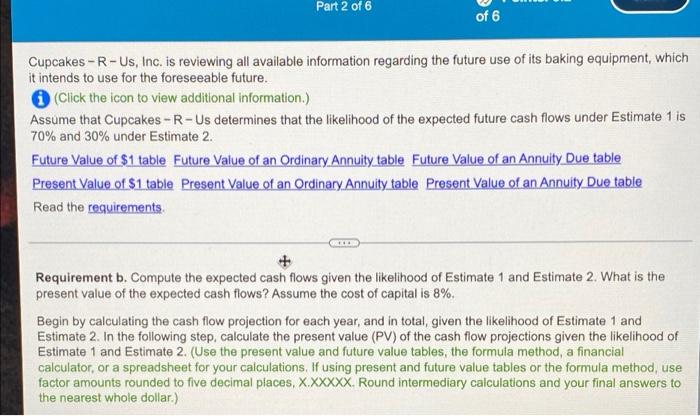

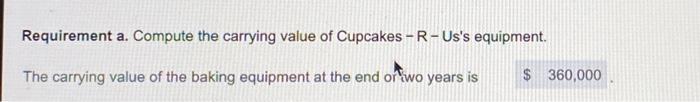

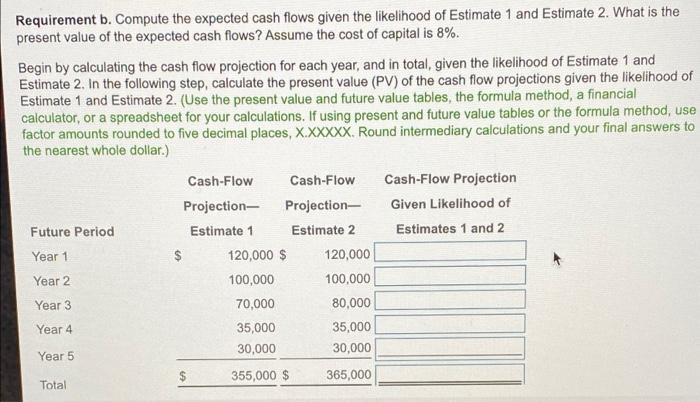

Part 2 of 6 of 6 Cupcakes -R- Us, Inc. is reviewing all available information regarding the future use of its baking equipment, which it intends to use for the foreseeable future. (Click the icon to view additional information.) Assume that Cupcakes -R-Us determines that the likelihood of the expected future cash flows under Estimate 1 is 70% and 30% under Estimate 2. Future Value of $1 table Future Value of an Ordinary Annuity table Future Value of an Annuity Due table Present Value of $1 table Present Value of an Ordinary Annuity table Present Value of an Annuity Due table Read the requirements + Requirement b. Compute the expected cash flows given the likelihood of Estimate 1 and Estimate 2. What is the present value of the expected cash flows? Assume the cost of capital is 8%. Begin by calculating the cash flow projection for each year, and in total, given the likelihood of Estimate 1 and Estimate 2. In the following step, calculate the present value (PV) of the cash flow projections given the likelihood of Estimate 1 and Estimate 2. (Use the present value and future value tables, the formula method, a financial calculator, or a spreadsheet for your calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round intermediary calculations and your final answers to the nearest whole dollar.) Requirement a. Compute the carrying value of Cupcakes -R-Us's equipment. The carrying value of the baking equipment at the end or two years is $360,000 Requirement b. Compute the expected cash flows given the likelihood of Estimate 1 and Estimate 2. What is the present value of the expected cash flows? Assume the cost of capital is 8%. Begin by calculating the cash flow projection for each year, and in total, given the likelihood of Estimate 1 and Estimate 2. In the following step, calculate the present value (PV) of the cash flow projections given the likelihood of Estimate 1 and Estimate 2. (Use the present value and future value tables, the formula method, a financial calculator, or a spreadsheet for your calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round intermediary calculations and your final answers to the nearest whole dollar.) Cash-Flow Cash-Flow Cash-Flow Projection Projection- Projection- Given Likelihood of Future Period Estimate 1 Estimate 2 Estimates 1 and 2 Year 1 $ 120,000 $ 120,000 Year 2 100,000 100,000 Year 3 70,000 80,000 Year 4 35,000 35,000 Year 5 30,000 30,000 $ 355,000 $ 365,000 Total