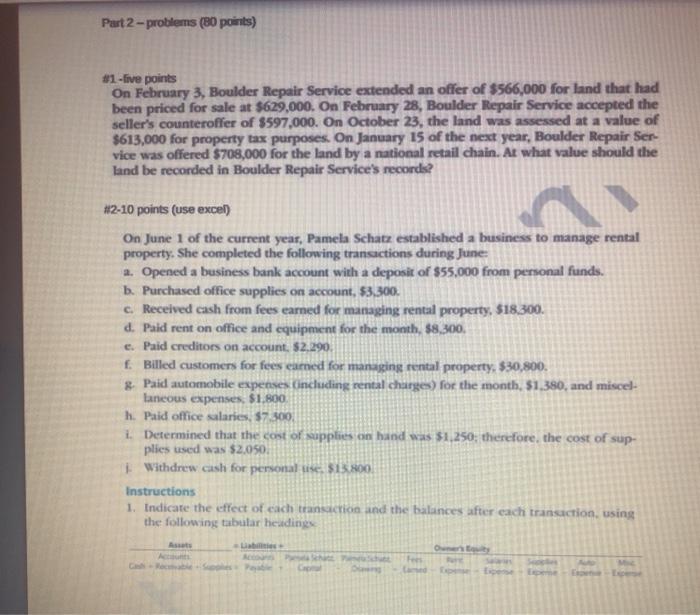

Part 2 - problems (80 points) 61-five points On February 3, Boulder Repair Service extended an offer of $566,000 for land that had been priced for sale at $629,000. On February 28, Boulder Repair Service accepted the seller's counteroffer of $597,000. On October 23, the land was assessed at a value of $613,000 for property tax purposes. On January 15 of the next year, Boulder Repair Ser vice was offered $708,000 for the land by a national retail chain. At what value should the land be recorded in Boulder Repair Service's records? 112-10 points (use excel) On June 1 of the current year, Pamela Schatz established a business to manage rental property. She completed the following transactions during June: 2. Opened a business bank account with a deposit of $55,000 from personal funds. b. Purchased office supplies on account, $3.300. c. Received cash from fees earned for managing rental property, $18,300. d. Paid rent on office and equipment for the month, $8,300 e. Paid creditors on account. $2,290. f. Billed customers for fees earned for managing rental property, $30,800. & Paid automobile expenses including rental charges) for the month. 51.380, and miscel- laneous expenses $1.800 h. Paid office salaries, $7.500 1. Determined that the cost of supplies on hand was $1,250, therefore, the cost of sup- plies used was $2.050. Withdrew cash for personal use. $13.800 Instructions 1. Indicate the effect of each transaction and the balances after each transaction using the following tubular heidings Ats Oy ht Part 2 - problems (80 points) 61-five points On February 3, Boulder Repair Service extended an offer of $566,000 for land that had been priced for sale at $629,000. On February 28, Boulder Repair Service accepted the seller's counteroffer of $597,000. On October 23, the land was assessed at a value of $613,000 for property tax purposes. On January 15 of the next year, Boulder Repair Ser vice was offered $708,000 for the land by a national retail chain. At what value should the land be recorded in Boulder Repair Service's records? 112-10 points (use excel) On June 1 of the current year, Pamela Schatz established a business to manage rental property. She completed the following transactions during June: 2. Opened a business bank account with a deposit of $55,000 from personal funds. b. Purchased office supplies on account, $3.300. c. Received cash from fees earned for managing rental property, $18,300. d. Paid rent on office and equipment for the month, $8,300 e. Paid creditors on account. $2,290. f. Billed customers for fees earned for managing rental property, $30,800. & Paid automobile expenses including rental charges) for the month. 51.380, and miscel- laneous expenses $1.800 h. Paid office salaries, $7.500 1. Determined that the cost of supplies on hand was $1,250, therefore, the cost of sup- plies used was $2.050. Withdrew cash for personal use. $13.800 Instructions 1. Indicate the effect of each transaction and the balances after each transaction using the following tubular heidings Ats Oy ht