Answered step by step

Verified Expert Solution

Question

1 Approved Answer

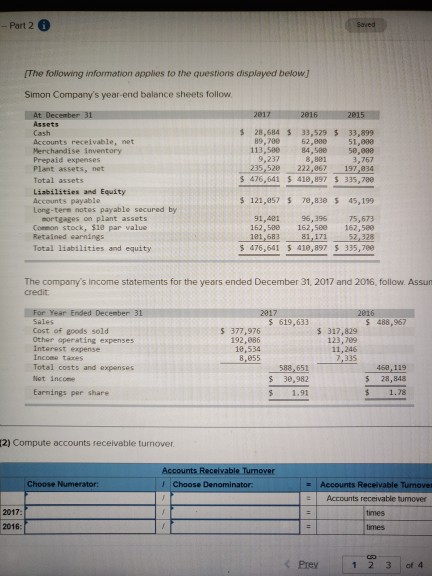

- Part 2 [The following information applies to the questions displayed below) Simon Company's year-end balance sheets follow at Deceber 31 2017 2015 2015 $

- Part 2 [The following information applies to the questions displayed below) Simon Company's year-end balance sheets follow at Deceber 31 2017 2015 2015 $ 28,684$ 33,529 5 33,899 89,700 2,000 51.000 113.500 4,500 50,000 9.237 8.301 3.757 235,520 222,067 197,034 $ 476.6415 410,897 S 335,700 Cash Accounts receivable, et Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-tere notes payable secured by sortgages on plant assets Coon stock, $10 par value Retained earnings Total liabilities and equity $121.257 $ 70,830 45,199 91.401 96.296 162.50 162,5ee 101,683 1,171 $ 476.641 $ 410,897 75,673 162,500 52,378 335,700 The company's income statements for the years ended December 31, 2017 and 2016, follow. Assut Credit For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income taxes Total costs and expenses Not Income Earnings per share 2917 $ 619,633 5377,976 192,086 10.534 8,055 588,551 $ 39,982 S488,967 5312,829 123,709 11,246 7,335 10.119 28,845 $ 1.78 2) Compute accounts receivable turnover Accounts Receivable Tumover Choose Denominator. Choose Numerator: = Accounts Receivable Turnover Accounts receivatie tumover = = 2017: 2016

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started