Answered step by step

Verified Expert Solution

Question

1 Approved Answer

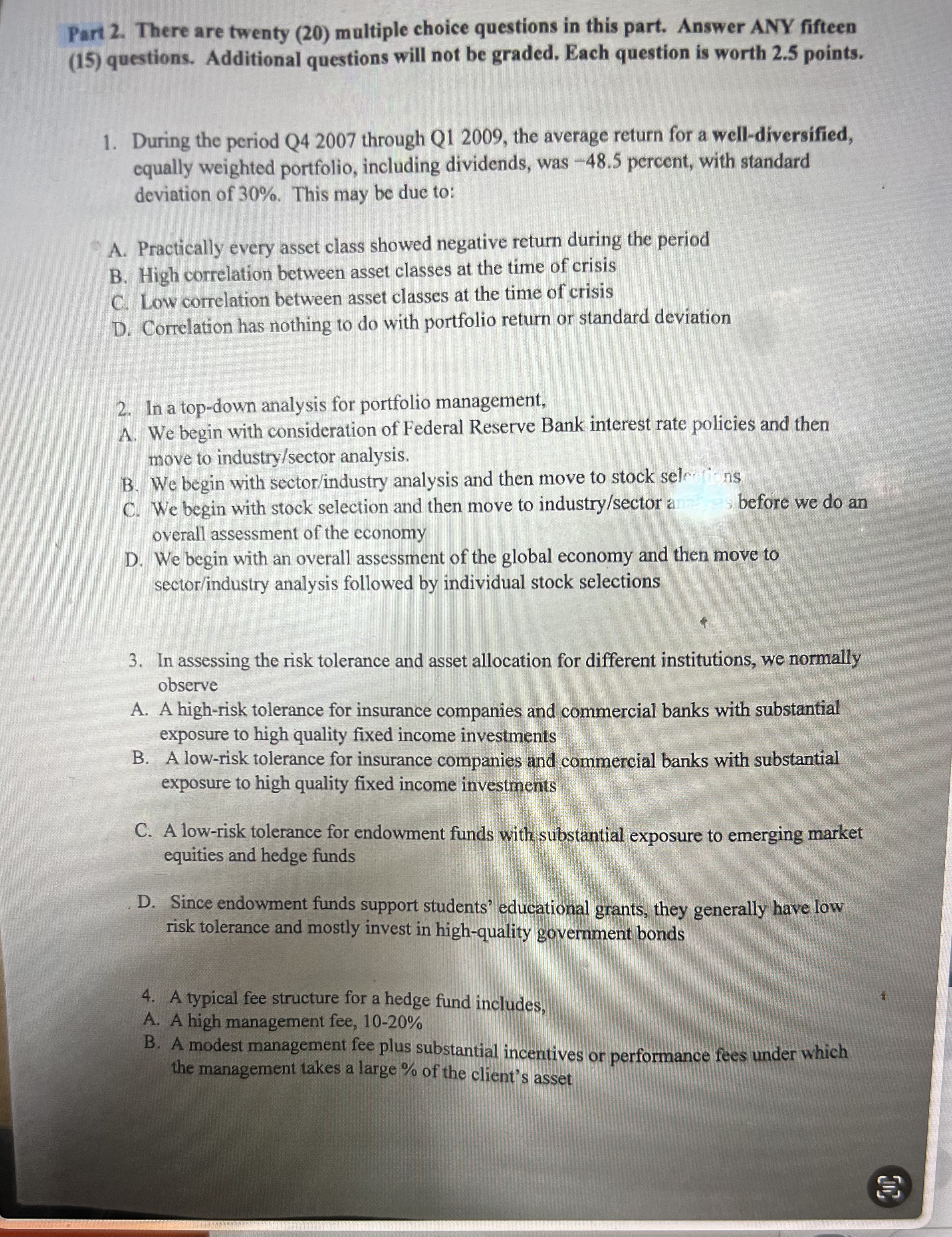

Part 2 . There are twenty ( 2 0 ) multiple choice questions in this part. Answer ANY fifteen ( 1 5 ) questions. Additional

Part There are twenty multiple choice questions in this part. Answer ANY fifteen

questions. Additional questions will not be graded. Each question is worth points.

During the period Q through Q the average return for a welldiversified,

equally weighted portfolio, including dividends, was percent, with standard

deviation of This may be due to:

A Practically every asset class showed negative return during the period

B High correlation between asset classes at the time of crisis

C Low correlation between asset classes at the time of crisis

D Correlation has nothing to do with portfolio return or standard deviation

In a topdown analysis for portfolio management,

A We begin with consideration of Federal Reserve Bank interest rate policies and then

move to industrysector analysis.

B We begin with sectorindustry analysis and then move to stock sele ns

C We begin with stock selection and then move to industrysector a

before we do an

overall assessment of the economy

D We begin with an overall assessment of the global economy and then move to

sectorindustry analysis followed by individual stock selections

In assessing the risk tolerance and asset allocation for different institutions, we normally

observe

A A highrisk tolerance for insurance companies and commercial banks with substantial

exposure to high quality fixed income investments

B A lowrisk tolerance for insurance companies and commercial banks with substantial

exposure to high quality fixed income investments

C A lowrisk tolerance for endowment funds with substantial exposure to emerging market

equities and hedge funds

D Since endowment funds support students' educational grants, they generally have low

risk tolerance and mostly invest in highquality government bonds

A typical fee structure for a hedge fund includes,

A A high management fee,

B A modest management fee plus substantial incentives or performance fees under which

the management takes a large of the client's asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started