Answered step by step

Verified Expert Solution

Question

1 Approved Answer

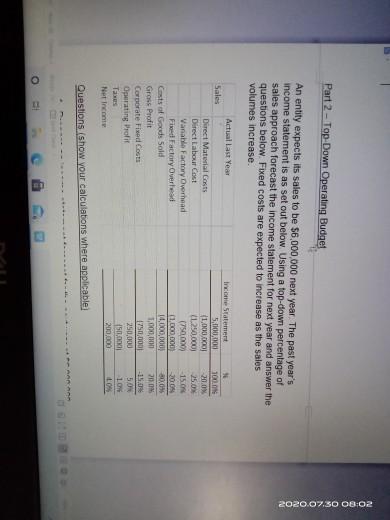

Part 2 - Top-Down Operating Budget 2020.07.30 06:02 An entity expects its sales to be $6,000,000 next year. The past year's income statement is as

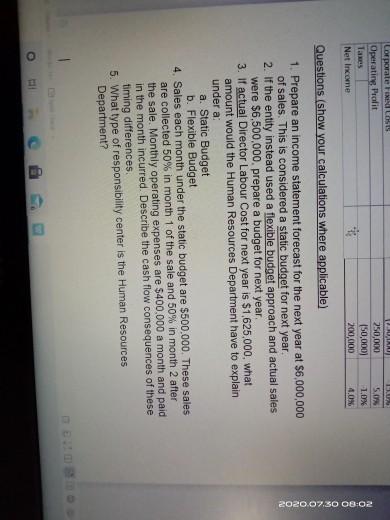

Part 2 - Top-Down Operating Budget 2020.07.30 06:02 An entity expects its sales to be $6,000,000 next year. The past year's income statement is as set out below. Using a top-down percentage of sales approach forecast the income statement for next year and answer the questions below. Fixed costs are expected to increase as the sales volumes increase Actuallast Year Sales Direct Material Corts Direct Labour Cost Vanatia Factory Overhead Fixed Factory Overhead Gasts of Goods Sold Grass Profit Corporate Fixed Costi Operating profil Taxes Net Income Income Statement 5,000,000 (1,000.00 (1.250,000) (750,000 (1,000,000 14,000,000 1,000,000 1750 000 250,000 150.00 200,000 100.0 20.0 25.01 -150 2008 30.05 200 -15.0 5.00 10 LOS Questions. (show your calculations where applicable O Corporate FE LOS Operating Profit Takes Net Income IA 250,000 (50,000) 200,000 LU 5.0 1.0% 4,0% * Questions (show your calculations where applicable) 2020.07.30 08:02 1. Prepare an income statement forecast for the next year at $6,000,000 of sales. This is considered a static budget for next year. 2. If the entity instead used a flexible budget approach and actual sales were $6,500,000. prepare a budget for next year 3. If actual Director Labour Cost for next year is $1,625,000, what amount would the Human Resources Department have to explain under a: a. Static Budget b. Flexible Budget 4. Sales each month under the static budget are $500.000. These sales are collected 50% in month 1 of the sale and 50% in month 2 after the sale. Monthly operating expenses are $400.000 a month and paid in the month incurred. Describe the cash flow consequences of these timing differences 5. What type of responsibility center is the Human Resources Department

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started