Question

Part 2: XYZ Divisions TG Product Line Alex & Co managers in its XYZ Division has discovered that a product (TG) it now manufactures at

Part 2: XYZ Divisions TG Product Line

Alex & Co managers in its XYZ Division has discovered that a product (TG) it now manufactures at a cost of $1.00 per unit could be bought elsewhere for $0.82 per unit. Alex & Co has fixed costs of $0.20 per unit of which $0.15 per unit cannot be eliminated by buying this unit. Alex & Co needs 460,000 of these products each year.

If Alex & Co decides to buy rather than produce the product, it can devote the machinery and labor to making a different product (AB) it now buys from another company. Alex & Co uses approximately 500 of these products (AB) each year. The cost of product (AB) is $12.66. The cost of producing the units would be $9.90 a unit which includes the purchase of a new machine for $2,345 to aid in the production.

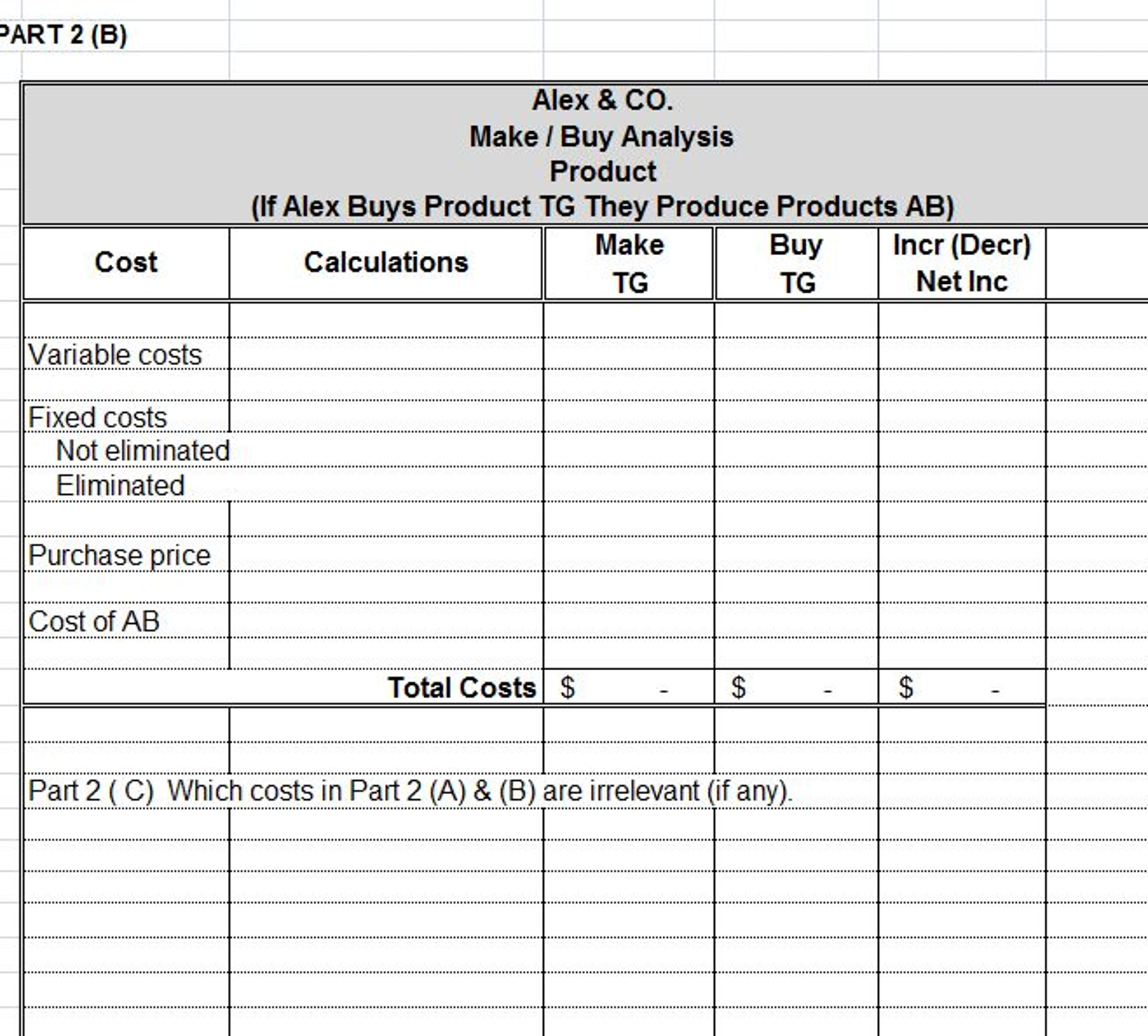

B. Prepare an analysis to show the financial impact if Alexs decision is to buy the product (TG) and manufacture the product (AB)? C. Which costs in Part 2 (A) & (B) are irrelevant (if any).

Part 2B.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started