Answered step by step

Verified Expert Solution

Question

1 Approved Answer

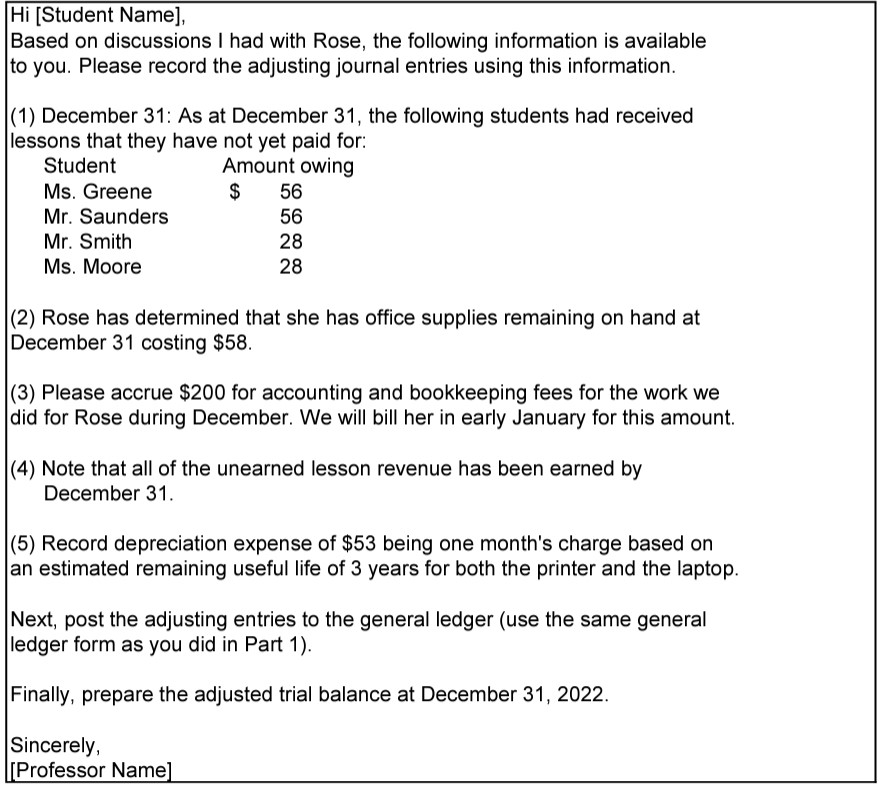

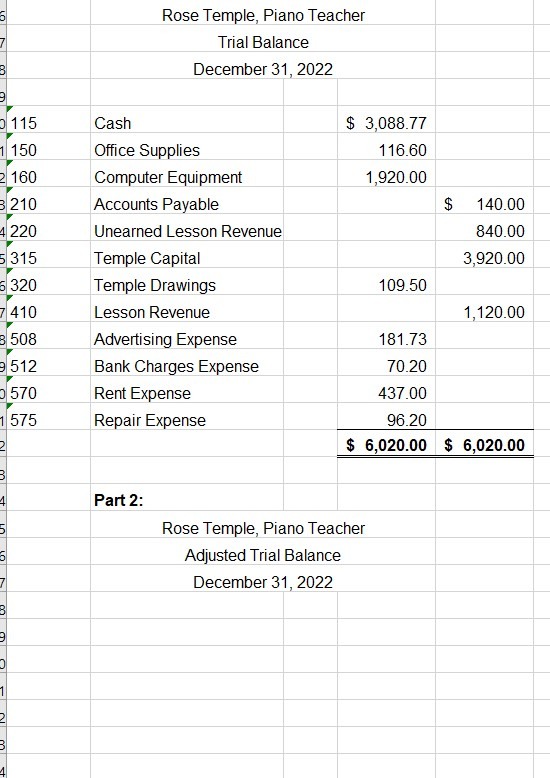

Part 2. You will continue on using the SAME general journal and the SAME general ledger as you used in Part 1. First, prepare the

Part 2. You will continue on using the SAME general journal and the SAME general ledger as you used in Part 1. First, prepare the (unadjusted) trial balance, make adjusting journal entry and ledger.

please see below journal entries from dec 1 to 31 if you needed for the adjusting entry

Note: part 1 is the 2nd and 3rd picture attached here. Already finished that

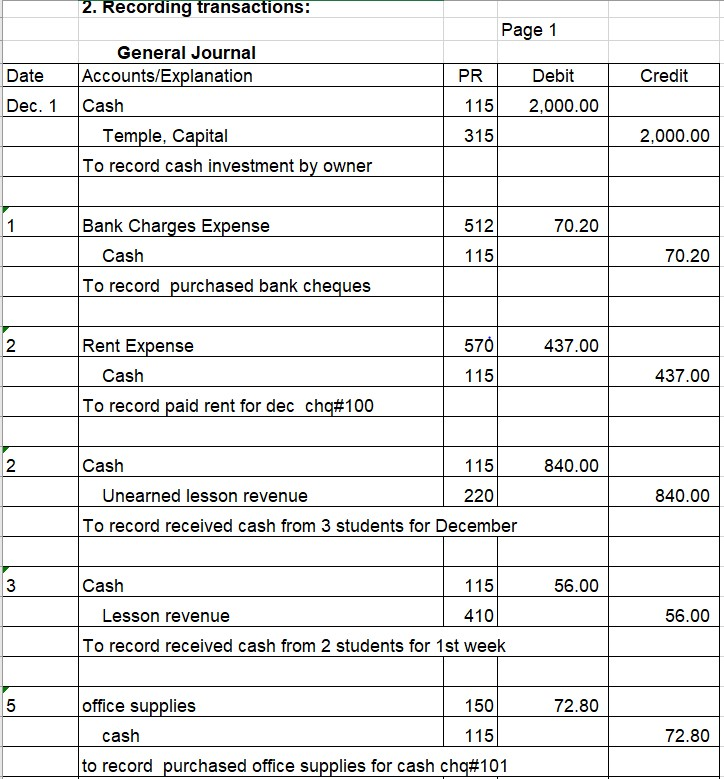

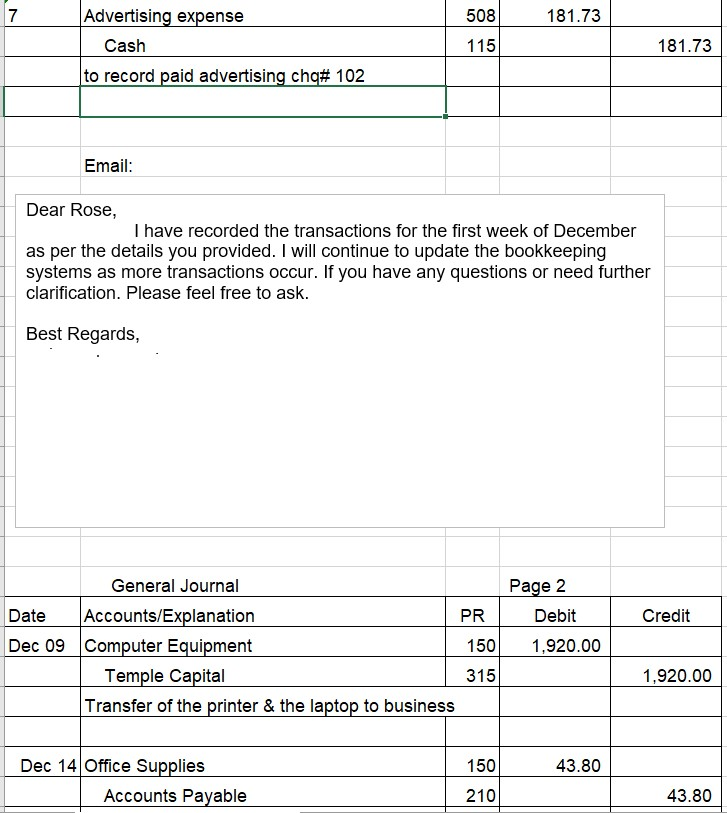

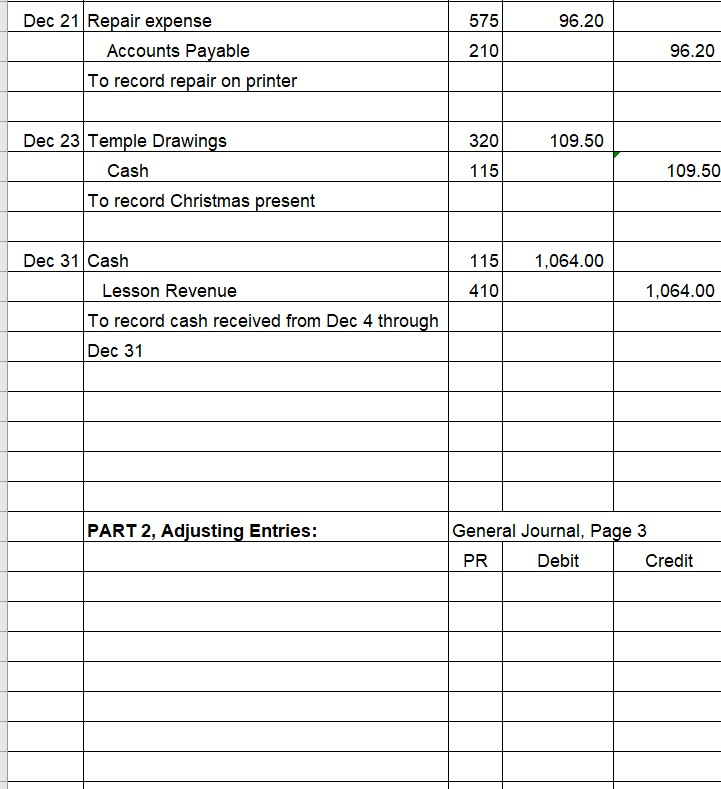

\begin{tabular}{|c|c|c|c|c|} \hline & 2. Recording transactions: & & & \\ \hline & & & Page 1 & \\ \hline & General Journal & & & \\ \hline Date & Accounts/Explanation & PR & Debit & Credit \\ \hline Dec. 1 & Cash & 115 & 2,000.00 & \\ \hline & Temple, Capital & 315 & & 2,000.00 \\ \hline & To record cash investment by owner & & & \\ \hline 1 & Bank Charges Expense & 512 & 70.20 & \\ \hline & Cash & 115 & & 70.20 \\ \hline & To record purchased bank cheques & & & \\ \hline 2 & Rent Expense & 570 & 437.00 & \\ \hline & Cash & 115 & & 437.00 \\ \hline & To record paid rent for dec chq #100 & & & \\ \hline 2 & Cash & 115 & 840.00 & \\ \hline & Unearned lesson revenue & 220 & & 840.00 \\ \hline & To record received cash from 3 stude & ecemb & & \\ \hline 3 & Cash & 115 & 56.00 & \\ \hline & Lesson revenue & 410 & & 56.00 \\ \hline & To record received cash from 2 stude & st week & & \\ \hline 5 & office supplies & 150 & 72.80 & \\ \hline & cash & 115 & & 72.80 \\ \hline & to record purchased office supplies & q#10 & & \\ \hline \end{tabular} Dear Rose, I have recorded the transactions for the first week of December as per the details you provided. I will continue to update the bookkeeping systems as more transactions occur. If you have any questions or need further clarification. Please feel free to ask. Best Regards, \begin{tabular}{|c|c|c|c|c|} \hline Dec 21 & Repair expense & 575 & 96.20 & \\ \hline & Accounts Payable & 210 & & 96.20 \\ \hline & To record repair on printer & & & \\ \hline \multirow[t]{3}{*}{Dec23} & Temple Drawings & 320 & 109.50 & \\ \hline & Cash & 115 & & 109.50 \\ \hline & To record Christmas present & & & \\ \hline \multirow[t]{16}{*}{ Dec 31} & Cash & 115 & 1,064.00 & \\ \hline & Lesson Revenue & 410 & & 1,064.00 \\ \hline & To record cash received from Dec 4 through & & & \\ \hline & Dec31 & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & PART 2, Adjusting Entries: & Gener & Journal, Pa & \\ \hline & & PR & Debit & Credit \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} Hi [Student Name], Based on discussions I had with Rose, the following information is available to you. Please record the adjusting journal entries using this information. (1) December 31: As at December 31, the following students had received lessons that they have not yet paid for: (2) Rose has determined that she has office supplies remaining on hand at December 31 costing $58. (3) Please accrue $200 for accounting and bookkeeping fees for the work we did for Rose during December. We will bill her in early January for this amount. (4) Note that all of the unearned lesson revenue has been earned by December 31. (5) Record depreciation expense of $53 being one month's charge based on an estimated remaining useful life of 3 years for both the printer and the laptop. Next, post the adjusting entries to the general ledger (use the same general ledger form as you did in Part 1). Finally, prepare the adjusted trial balance at December 31, 2022. Sincerely, \begin{tabular}{|c|c|c|c|} \hline & \multicolumn{2}{|c|}{ Rose Temple, Piano Teacher } & \\ \hline & \multicolumn{2}{|c|}{ Trial Balance } & \\ \hline & \multicolumn{2}{|c|}{ December 31, 2022} & \\ \hline 115 & Cash & $3,088.77 & \\ \hline 1150 & Office Supplies & 116.60 & \\ \hline 160 & Computer Equipment & 1,920.00 & \\ \hline 3210 & Accounts Payable & & $140.00 \\ \hline 4220 & Unearned Lesson Revenue & & 840.00 \\ \hline 5315 & Temple Capital & & 3,920.00 \\ \hline 6320 & Temple Drawings & 109.50 & \\ \hline 7410 & Lesson Revenue & & 1,120.00 \\ \hline 8508 & Advertising Expense & 181.73 & \\ \hline 9512 & Bank Charges Expense & 70.20 & \\ \hline 570 & Rent Expense & 437.00 & \\ \hline \multirow[t]{2}{*}{1575} & Repair Expense & 96.20 & \\ \hline & & $6,020.00 & $6,020.00 \\ \hline & Part 2: & & \\ \hline & \multicolumn{2}{|c|}{ Rose Temple, Piano Teacher } & \\ \hline & \multicolumn{2}{|c|}{ Adjusted Trial Balance } & \\ \hline & \multicolumn{2}{|c|}{ December 31, 2022} & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|c|} \hline & 2. Recording transactions: & & & \\ \hline & & & Page 1 & \\ \hline & General Journal & & & \\ \hline Date & Accounts/Explanation & PR & Debit & Credit \\ \hline Dec. 1 & Cash & 115 & 2,000.00 & \\ \hline & Temple, Capital & 315 & & 2,000.00 \\ \hline & To record cash investment by owner & & & \\ \hline 1 & Bank Charges Expense & 512 & 70.20 & \\ \hline & Cash & 115 & & 70.20 \\ \hline & To record purchased bank cheques & & & \\ \hline 2 & Rent Expense & 570 & 437.00 & \\ \hline & Cash & 115 & & 437.00 \\ \hline & To record paid rent for dec chq #100 & & & \\ \hline 2 & Cash & 115 & 840.00 & \\ \hline & Unearned lesson revenue & 220 & & 840.00 \\ \hline & To record received cash from 3 stude & ecemb & & \\ \hline 3 & Cash & 115 & 56.00 & \\ \hline & Lesson revenue & 410 & & 56.00 \\ \hline & To record received cash from 2 stude & st week & & \\ \hline 5 & office supplies & 150 & 72.80 & \\ \hline & cash & 115 & & 72.80 \\ \hline & to record purchased office supplies & q#10 & & \\ \hline \end{tabular} Dear Rose, I have recorded the transactions for the first week of December as per the details you provided. I will continue to update the bookkeeping systems as more transactions occur. If you have any questions or need further clarification. Please feel free to ask. Best Regards, \begin{tabular}{|c|c|c|c|c|} \hline Dec 21 & Repair expense & 575 & 96.20 & \\ \hline & Accounts Payable & 210 & & 96.20 \\ \hline & To record repair on printer & & & \\ \hline \multirow[t]{3}{*}{Dec23} & Temple Drawings & 320 & 109.50 & \\ \hline & Cash & 115 & & 109.50 \\ \hline & To record Christmas present & & & \\ \hline \multirow[t]{16}{*}{ Dec 31} & Cash & 115 & 1,064.00 & \\ \hline & Lesson Revenue & 410 & & 1,064.00 \\ \hline & To record cash received from Dec 4 through & & & \\ \hline & Dec31 & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & PART 2, Adjusting Entries: & Gener & Journal, Pa & \\ \hline & & PR & Debit & Credit \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} Hi [Student Name], Based on discussions I had with Rose, the following information is available to you. Please record the adjusting journal entries using this information. (1) December 31: As at December 31, the following students had received lessons that they have not yet paid for: (2) Rose has determined that she has office supplies remaining on hand at December 31 costing $58. (3) Please accrue $200 for accounting and bookkeeping fees for the work we did for Rose during December. We will bill her in early January for this amount. (4) Note that all of the unearned lesson revenue has been earned by December 31. (5) Record depreciation expense of $53 being one month's charge based on an estimated remaining useful life of 3 years for both the printer and the laptop. Next, post the adjusting entries to the general ledger (use the same general ledger form as you did in Part 1). Finally, prepare the adjusted trial balance at December 31, 2022. Sincerely, \begin{tabular}{|c|c|c|c|} \hline & \multicolumn{2}{|c|}{ Rose Temple, Piano Teacher } & \\ \hline & \multicolumn{2}{|c|}{ Trial Balance } & \\ \hline & \multicolumn{2}{|c|}{ December 31, 2022} & \\ \hline 115 & Cash & $3,088.77 & \\ \hline 1150 & Office Supplies & 116.60 & \\ \hline 160 & Computer Equipment & 1,920.00 & \\ \hline 3210 & Accounts Payable & & $140.00 \\ \hline 4220 & Unearned Lesson Revenue & & 840.00 \\ \hline 5315 & Temple Capital & & 3,920.00 \\ \hline 6320 & Temple Drawings & 109.50 & \\ \hline 7410 & Lesson Revenue & & 1,120.00 \\ \hline 8508 & Advertising Expense & 181.73 & \\ \hline 9512 & Bank Charges Expense & 70.20 & \\ \hline 570 & Rent Expense & 437.00 & \\ \hline \multirow[t]{2}{*}{1575} & Repair Expense & 96.20 & \\ \hline & & $6,020.00 & $6,020.00 \\ \hline & Part 2: & & \\ \hline & \multicolumn{2}{|c|}{ Rose Temple, Piano Teacher } & \\ \hline & \multicolumn{2}{|c|}{ Adjusted Trial Balance } & \\ \hline & \multicolumn{2}{|c|}{ December 31, 2022} & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started