Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 3: Applied Questions. Answer all questions and upload your responses. Make sure you show all your work. This Section has a total of 50

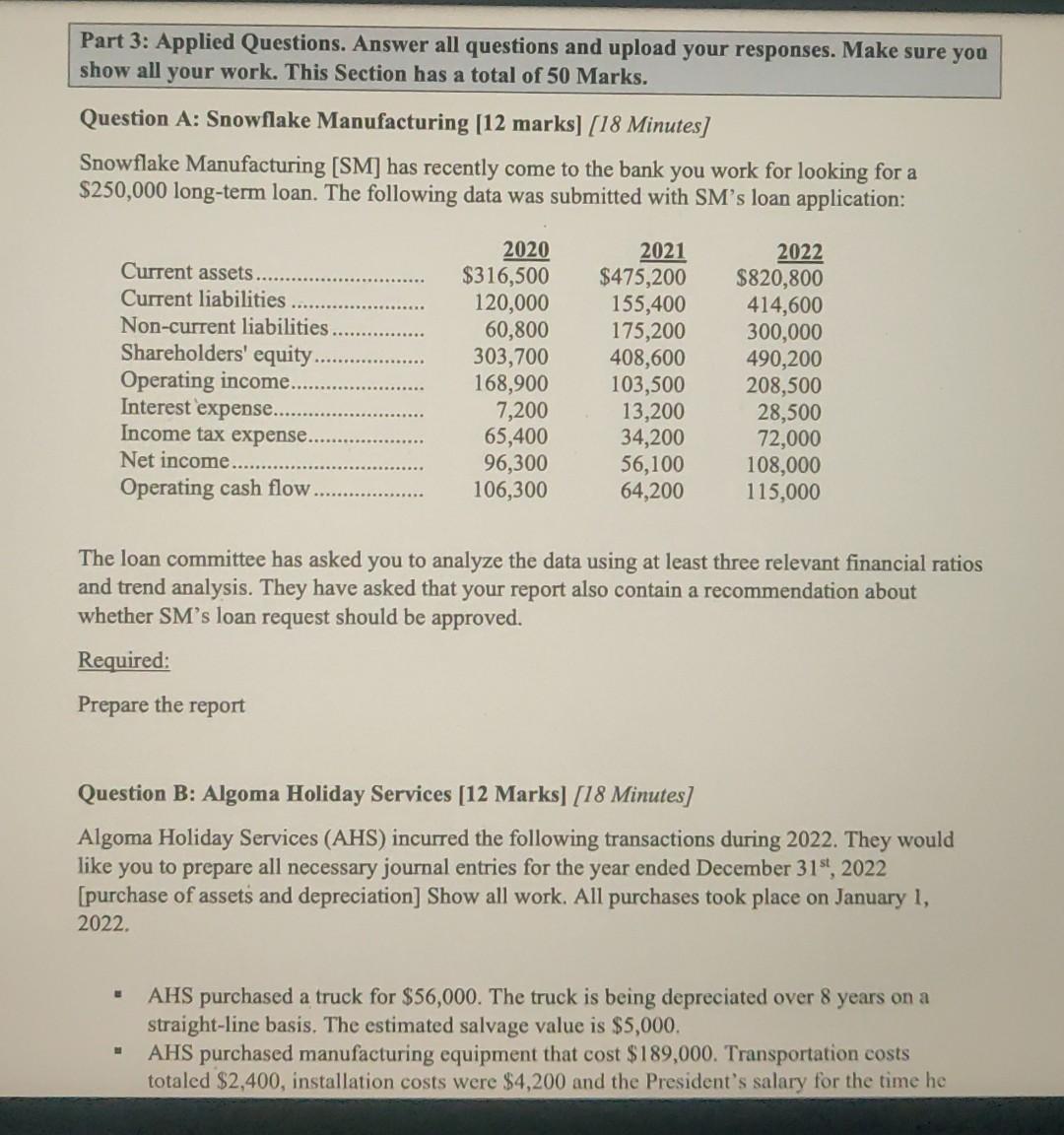

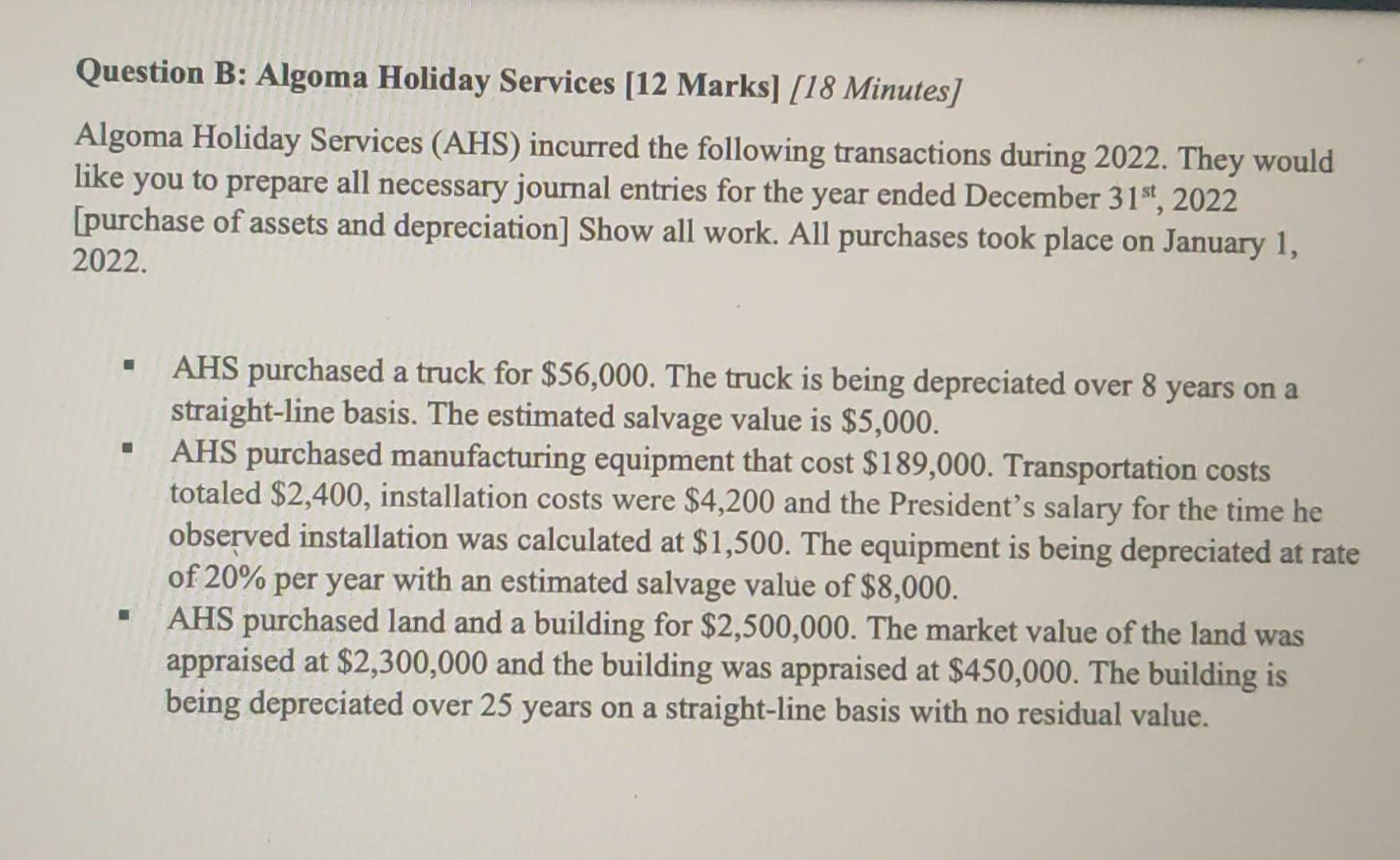

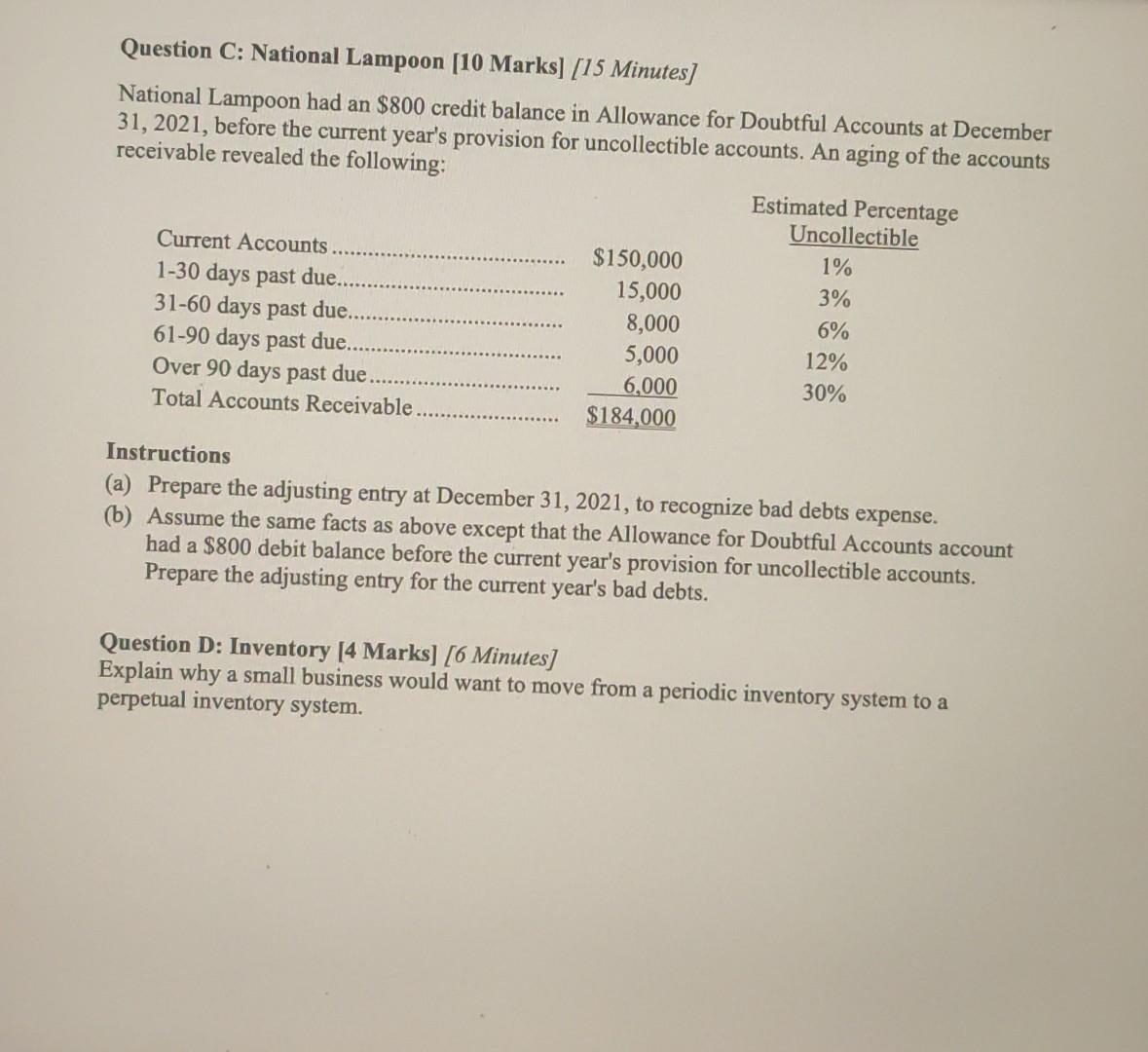

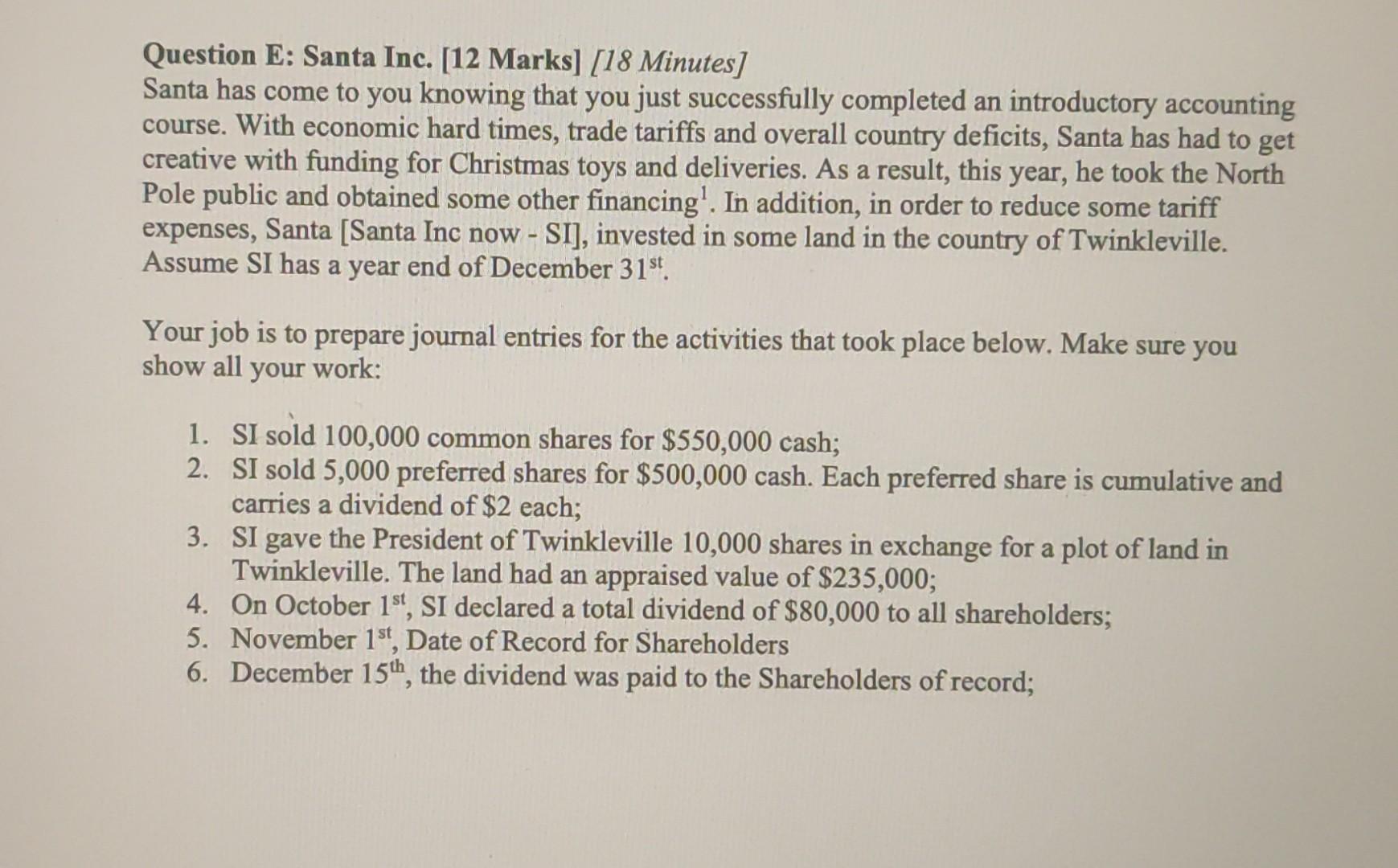

Part 3: Applied Questions. Answer all questions and upload your responses. Make sure you show all your work. This Section has a total of 50 Marks. Question A: Snowflake Manufacturing [12 marks] [18 Minutes] Snowflake Manufacturing [SM] has recently come to the bank you work for looking for a $250,000 long-term loan. The following data was submitted with SM's loan application: The loan committee has asked you to analyze the data using at least three relevant financial ratios and trend analysis. They have asked that your report also contain a recommendation about whether SM's loan request should be approved. Required: Prepare the report Question B: Algoma Holiday Services [12 Marks] [18 Minutes] Algoma Holiday Services (AHS) incurred the following transactions during 2022. They would like you to prepare all necessary journal entries for the year ended December 31st,2022 [purchase of assets and depreciation] Show all work. All purchases took place on January 1, 2022. - AHS purchased a truck for $56,000. The truck is being depreciated over 8 years on a straight-line basis. The estimated salvage value is $5,000. - AHS purchased manufacturing equipment that cost $189,000. Transportation costs totaled $2,400, installation costs were $4,200 and the President's salary for the time he Question B: Algoma Holiday Services [12 Marks] [18 Minutes] Algoma Holiday Services (AHS) incurred the following transactions during 2022. They would like you to prepare all necessary journal entries for the year ended December 31st,2022 [purchase of assets and depreciation] Show all work. All purchases took place on January 1, 2022. - AHS purchased a truck for $56,000. The truck is being depreciated over 8 years on a straight-line basis. The estimated salvage value is $5,000. - AHS purchased manufacturing equipment that cost $189,000. Transportation costs totaled $2,400, installation costs were $4,200 and the President's salary for the time he observed installation was calculated at $1,500. The equipment is being depreciated at rate of 20% per year with an estimated salvage value of $8,000. - AHS purchased land and a building for $2,500,000. The market value of the land was appraised at $2,300,000 and the building was appraised at $450,000. The building is being depreciated over 25 years on a straight-line basis with no residual value. Question C: National Lampoon [10 Marks] [15 Minutes] National Lampoon had an $800 credit balance in Allowance for Doubtful Accounts at December 31,2021 , before the current year's provision for uncollectible accounts. An aging of the accounts receivable revealed the following: Instructions (a) Prepare the adjusting entry at December 31, 2021, to recognize bad debts expense. (b) Assume the same facts as above except that the Allowance for Doubtful Accounts account had a $800 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting entry for the current year's bad debts. Question D: Inventory [4 Marks] [6 Minutes] Explain why a small business would want to move from a periodic inventory system to a perpetual inventory system. Question E: Santa Inc. [12 Marks] [18 Minutes] Santa has come to you knowing that you just successfully completed an introductory accounting course. With economic hard times, trade tariffs and overall country deficits, Santa has had to get creative with funding for Christmas toys and deliveries. As a result, this year, he took the North Pole public and obtained some other financing 1. In addition, in order to reduce some tariff expenses, Santa [Santa Inc now - SI], invested in some land in the country of Twinkleville. Assume SI has a year end of December 31st. Your job is to prepare journal entries for the activities that took place below. Make sure you show all your work: 1. SI sold 100,000 common shares for $550,000 cash; 2. SI sold 5,000 preferred shares for $500,000 cash. Each preferred share is cumulative and carries a dividend of $2 each; 3. SI gave the President of Twinkleville 10,000 shares in exchange for a plot of land in Twinkleville. The land had an appraised value of $235,000; 4. On October 1st, SI declared a total dividend of $80,000 to all shareholders; 5. November 1st, Date of Record for Shareholders 6. December 15th, the dividend was paid to the Shareholders of record

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started