PART 3 ) Because Natalie has had such a successful first few months, she is considering other opportunities to develop her business. One opportunity is to become the exclusive distributor of a line of fine European mixers. The current cost of a mixer is approximately $550, and Natalie would sell each one for $1,100. Natalie comes to you for advice on how to account for these mixers. Each appliance has a serial number and can be easily identified.

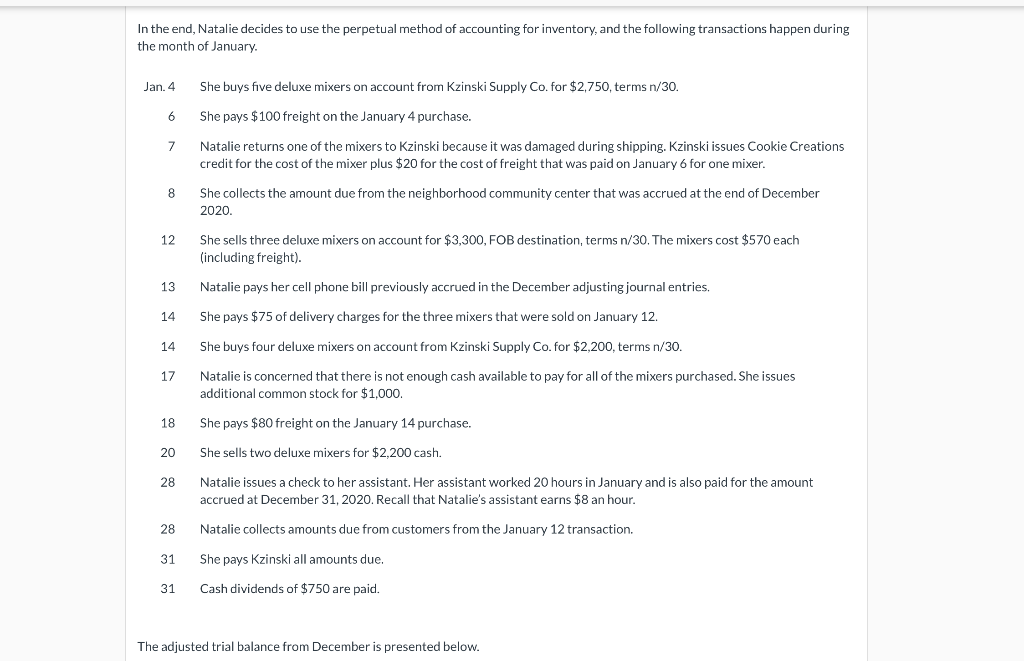

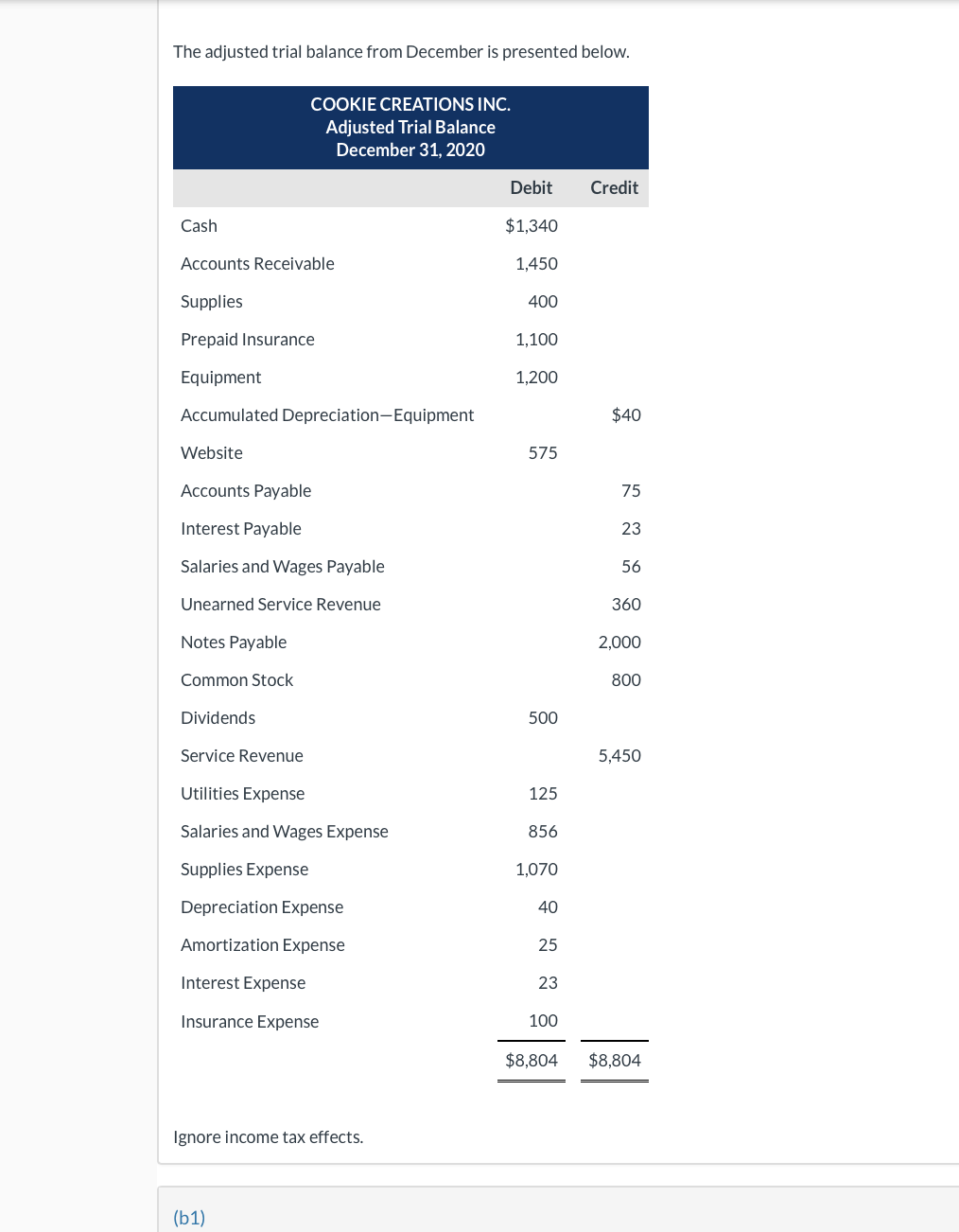

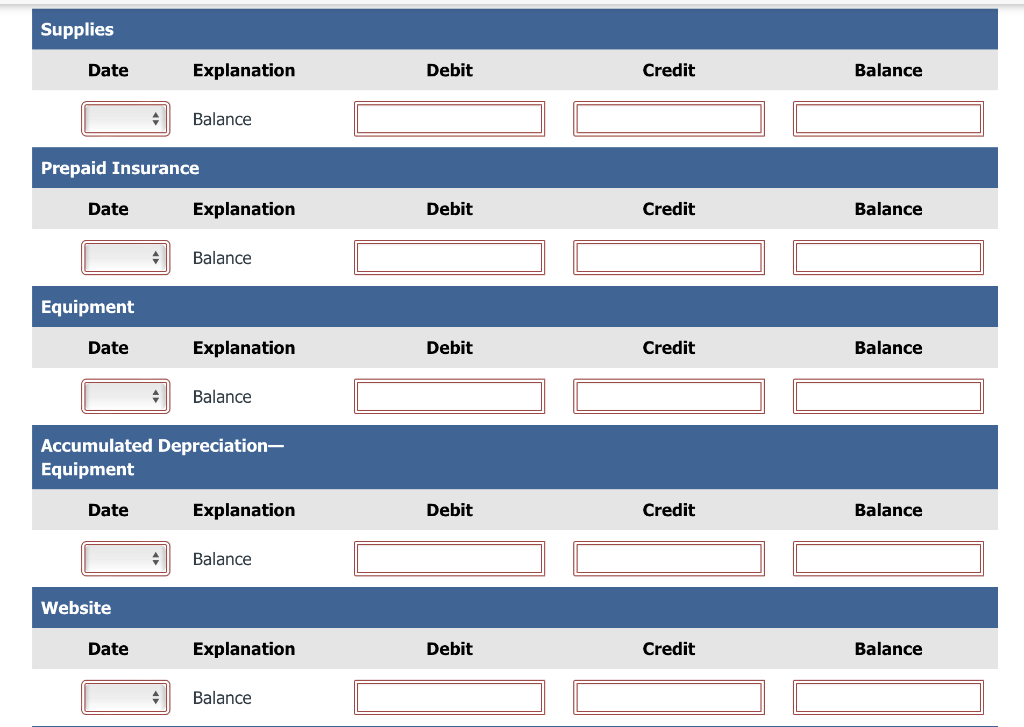

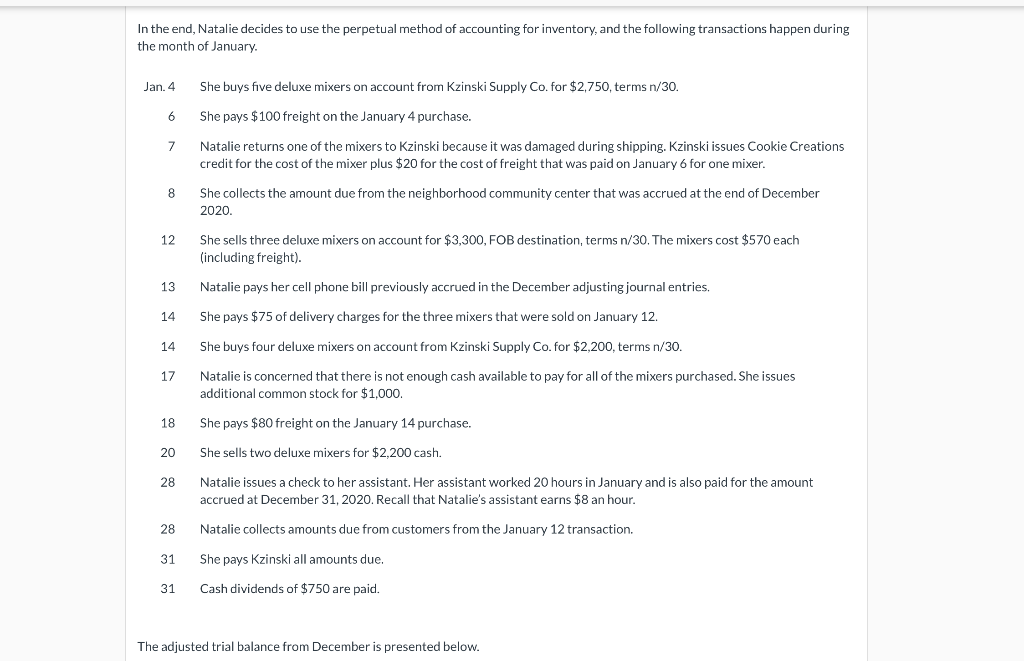

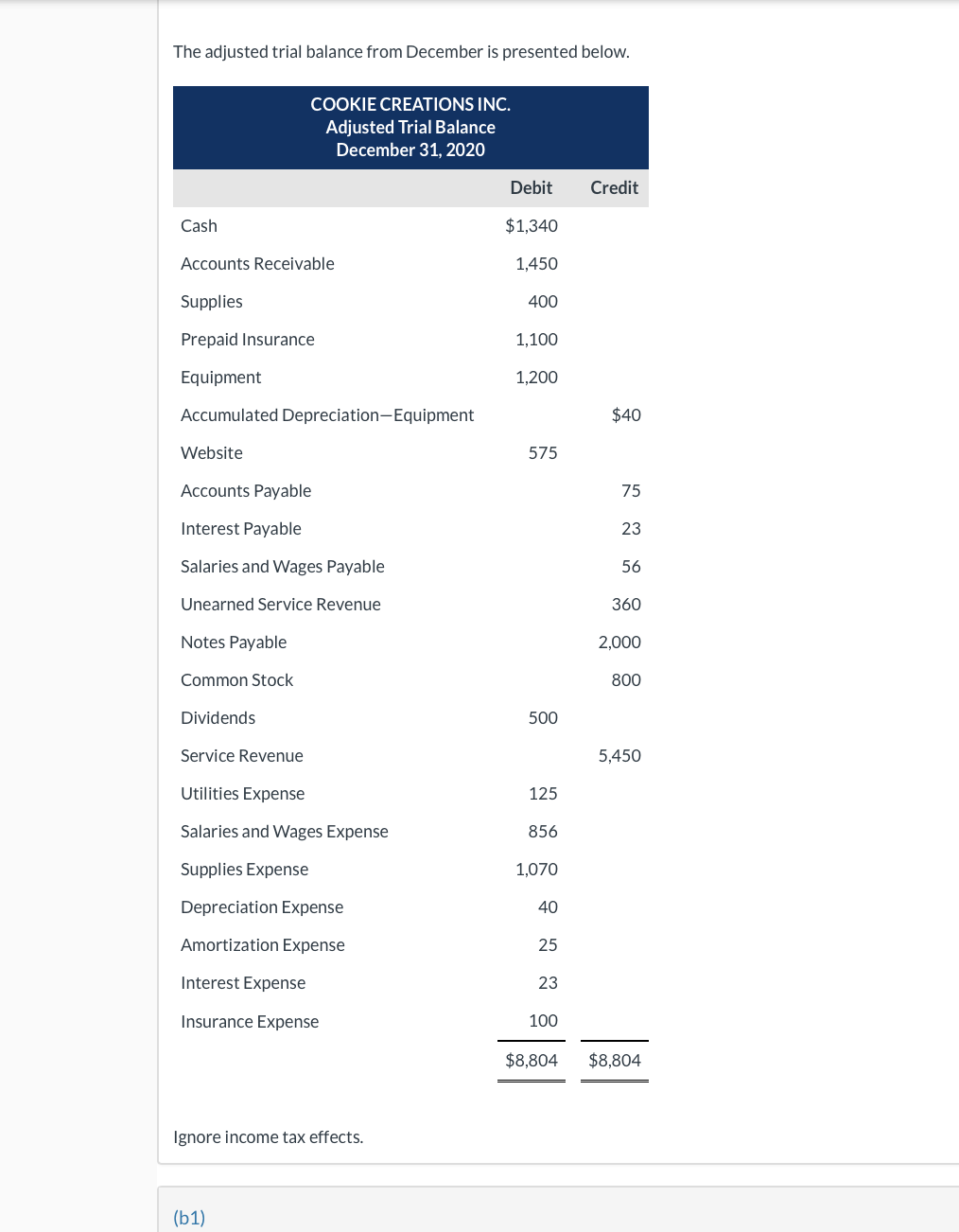

In the end, Natalie decides to use the perpetual method of accounting for inventory, and the following transactions happen durin; the month of January. Jan. 4 She buys five deluxe mixers on account from Kzinski Supply Co. for $2,750, terms n/30. 6 She pays $100 freight on the January 4 purchase. 7 Natalie returns one of the mixers to Kzinski because it was damaged during shipping. Kzinski issues Cookie Creations credit for the cost of the mixer plus $20 for the cost of freight that was paid on January 6 for one mixer. 8 She collects the amount due from the neighborhood community center that was accrued at the end of December 2020. 12 She sells three deluxe mixers on account for $3,300, FOB destination, terms n/30. The mixers cost $570 each (including freight). 13 Natalie pays her cell phone bill previously accrued in the December adjusting journal entries. 14 She pays $75 of delivery charges for the three mixers that were sold on January 12. 14 She buys four deluxe mixers on account from Kzinski Supply Co. for $2,200, terms n/30. 17 Natalie is concerned that there is not enough cash available to pay for all of the mixers purchased. She issues additional common stock for $1,000. 18 She pays $80 freight on the January 14 purchase. 20 She sells two deluxe mixers for $2,200 cash. 28 Natalie issues a check to her assistant. Her assistant worked 20 hours in January and is also paid for the amount accrued at December 31, 2020. Recall that Natalie's assistant earns $8 an hour. 28 Natalie collects amounts due from customers from the January 12 transaction. 31 She pays Kzinski all amounts due. 31 Cash dividends of $750 are paid. The adjusted trial balance from December is presented below. The adjusted trial balance from December is presented below. Supplies \begin{tabular}{lll|} \hline Date & Explanation & Debit \\ \hline & Balance & \\ \hline \end{tabular} Prepaid Insurance Equipment Accumulated Depreciation- Equipment In the end, Natalie decides to use the perpetual method of accounting for inventory, and the following transactions happen durin; the month of January. Jan. 4 She buys five deluxe mixers on account from Kzinski Supply Co. for $2,750, terms n/30. 6 She pays $100 freight on the January 4 purchase. 7 Natalie returns one of the mixers to Kzinski because it was damaged during shipping. Kzinski issues Cookie Creations credit for the cost of the mixer plus $20 for the cost of freight that was paid on January 6 for one mixer. 8 She collects the amount due from the neighborhood community center that was accrued at the end of December 2020. 12 She sells three deluxe mixers on account for $3,300, FOB destination, terms n/30. The mixers cost $570 each (including freight). 13 Natalie pays her cell phone bill previously accrued in the December adjusting journal entries. 14 She pays $75 of delivery charges for the three mixers that were sold on January 12. 14 She buys four deluxe mixers on account from Kzinski Supply Co. for $2,200, terms n/30. 17 Natalie is concerned that there is not enough cash available to pay for all of the mixers purchased. She issues additional common stock for $1,000. 18 She pays $80 freight on the January 14 purchase. 20 She sells two deluxe mixers for $2,200 cash. 28 Natalie issues a check to her assistant. Her assistant worked 20 hours in January and is also paid for the amount accrued at December 31, 2020. Recall that Natalie's assistant earns $8 an hour. 28 Natalie collects amounts due from customers from the January 12 transaction. 31 She pays Kzinski all amounts due. 31 Cash dividends of $750 are paid. The adjusted trial balance from December is presented below. The adjusted trial balance from December is presented below. Supplies \begin{tabular}{lll|} \hline Date & Explanation & Debit \\ \hline & Balance & \\ \hline \end{tabular} Prepaid Insurance Equipment Accumulated Depreciation- Equipment