Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 3: Can We Upgrade? It's now 2020, and El Cap Climbing Company (ECCC) has continued to grow. One of ECCC's major revemue-producing products is

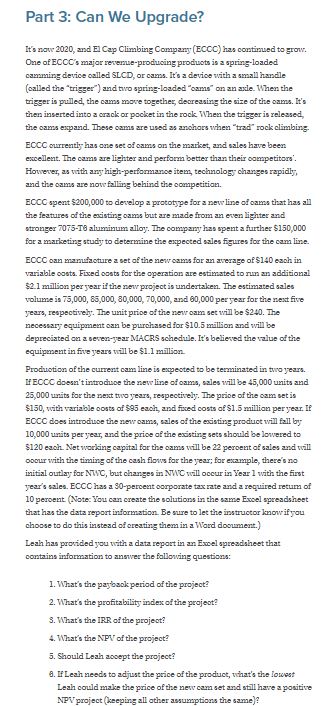

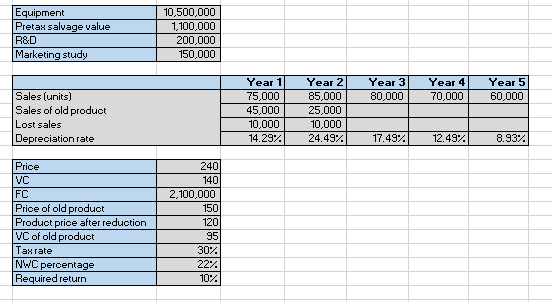

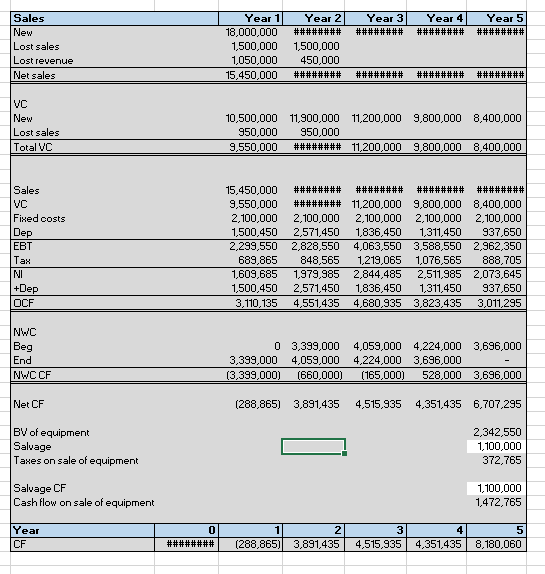

Part 3: Can We Upgrade? It's now 2020, and El Cap Climbing Company (ECCC) has continued to grow. One of ECCC's major revemue-producing products is a spring-losded camming device callod SLCD, or cams. It's a devioe with a small handle (called the "trigger") and two spring-loadod "oms" on an avle. When the trigger is pulled, the cams move together, docreasing the size of the oams. It's then inserted into a crack or pocket in the rock When the trigger is released, the oams expand. These cams are used as anchors when "trad" rock climbing. ECCC eurrently has one set of cams on the maket, and sales have been excelleat. The cams are lighter and perform better than their oampetitors: However, as vith any high-performanoe item, technology changes rapidly, and the oams are now falling behind the competition. ECCC spent $200,000 to develop a prototype for a new line of oams that has all the features of the existing oams but are made from an even lighter and stronger 7075-T6 aluminum alloy. The company has spent a further $150,000 for a marketing study to determine the expected sales figures for the cam line. ECCC oan manufacture a set of the new cams for an awerage of $140 each in variable oosts. Fixed oosts for the operation are estimated to run an additional $2.1 milion per jear if the new project is undertaken. The estimated sales volume is 75,000,86,000,80,000,70,000, and 60,000 per year for the next five years, reopectively. The unit prioe of the nev oam set will be $240. The necessary equipment onn be purchased for $10.5 million and will be depreciated an a seven-year MACRS schedule. It's beliered the vilue of the equipment in five years vill be \$1.1 million. Produotion of the current cam line is expeoted to be teminated in two years. If ECCC doesn't introchoe the new line of oams, sales will be 45,000 units and 25,000 units for the next two years, respectively. The prive of the cam set is $150, with wariable oosts of $95 each, and fived costs of $1.5 millian per year. If ECCC does introduoe the new oams, sales of the existing product will fall by 10,000 units per year, and the prioe af the existing sets should be lowered to $120 each. Net working capital for the cams vill be 22 peroent af sales and twill oocur with the timing of the cash flows for the year; for example, there's no initial outlay for NWC, but changes in NWC will occur in Your 1 with the first year's sales. ECCC has a 90 -percent oorporate tax rate and a required retum of 10 peroent (Note: You can create the solutions in the same Excel spreadsheet that has the data report information. Be sure to let the instruotor know if you choose to do this instead of ereating them in a Word dooument.) Leah has provided you vith a data report in an Exoel spreadsheet that contains information to answer the following questions: 1. What's the payback period of the project? 2. What's the profitability index of the projeot? 3. What's the IRR of the project? 4. What's the NPN of the project? 5. Should Loah aosept the project? 0. If Leah neods to adjust the price of the product, vihat's the lowest Leah could make the price of the new cam set and still have a positive NPV project (keeping all other sesumptions the same)? Part 3: Can We Upgrade? It's now 2020, and El Cap Climbing Company (ECCC) has continued to grow. One of ECCC's major revemue-producing products is a spring-losded camming device callod SLCD, or cams. It's a devioe with a small handle (called the "trigger") and two spring-loadod "oms" on an avle. When the trigger is pulled, the cams move together, docreasing the size of the oams. It's then inserted into a crack or pocket in the rock When the trigger is released, the oams expand. These cams are used as anchors when "trad" rock climbing. ECCC eurrently has one set of cams on the maket, and sales have been excelleat. The cams are lighter and perform better than their oampetitors: However, as vith any high-performanoe item, technology changes rapidly, and the oams are now falling behind the competition. ECCC spent $200,000 to develop a prototype for a new line of oams that has all the features of the existing oams but are made from an even lighter and stronger 7075-T6 aluminum alloy. The company has spent a further $150,000 for a marketing study to determine the expected sales figures for the cam line. ECCC oan manufacture a set of the new cams for an awerage of $140 each in variable oosts. Fixed oosts for the operation are estimated to run an additional $2.1 milion per jear if the new project is undertaken. The estimated sales volume is 75,000,86,000,80,000,70,000, and 60,000 per year for the next five years, reopectively. The unit prioe of the nev oam set will be $240. The necessary equipment onn be purchased for $10.5 million and will be depreciated an a seven-year MACRS schedule. It's beliered the vilue of the equipment in five years vill be \$1.1 million. Produotion of the current cam line is expeoted to be teminated in two years. If ECCC doesn't introchoe the new line of oams, sales will be 45,000 units and 25,000 units for the next two years, respectively. The prive of the cam set is $150, with wariable oosts of $95 each, and fived costs of $1.5 millian per year. If ECCC does introduoe the new oams, sales of the existing product will fall by 10,000 units per year, and the prioe af the existing sets should be lowered to $120 each. Net working capital for the cams vill be 22 peroent af sales and twill oocur with the timing of the cash flows for the year; for example, there's no initial outlay for NWC, but changes in NWC will occur in Your 1 with the first year's sales. ECCC has a 90 -percent oorporate tax rate and a required retum of 10 peroent (Note: You can create the solutions in the same Excel spreadsheet that has the data report information. Be sure to let the instruotor know if you choose to do this instead of ereating them in a Word dooument.) Leah has provided you vith a data report in an Exoel spreadsheet that contains information to answer the following questions: 1. What's the payback period of the project? 2. What's the profitability index of the projeot? 3. What's the IRR of the project? 4. What's the NPN of the project? 5. Should Loah aosept the project? 0. If Leah neods to adjust the price of the product, vihat's the lowest Leah could make the price of the new cam set and still have a positive NPV project (keeping all other sesumptions the same)

Part 3: Can We Upgrade? It's now 2020, and El Cap Climbing Company (ECCC) has continued to grow. One of ECCC's major revemue-producing products is a spring-losded camming device callod SLCD, or cams. It's a devioe with a small handle (called the "trigger") and two spring-loadod "oms" on an avle. When the trigger is pulled, the cams move together, docreasing the size of the oams. It's then inserted into a crack or pocket in the rock When the trigger is released, the oams expand. These cams are used as anchors when "trad" rock climbing. ECCC eurrently has one set of cams on the maket, and sales have been excelleat. The cams are lighter and perform better than their oampetitors: However, as vith any high-performanoe item, technology changes rapidly, and the oams are now falling behind the competition. ECCC spent $200,000 to develop a prototype for a new line of oams that has all the features of the existing oams but are made from an even lighter and stronger 7075-T6 aluminum alloy. The company has spent a further $150,000 for a marketing study to determine the expected sales figures for the cam line. ECCC oan manufacture a set of the new cams for an awerage of $140 each in variable oosts. Fixed oosts for the operation are estimated to run an additional $2.1 milion per jear if the new project is undertaken. The estimated sales volume is 75,000,86,000,80,000,70,000, and 60,000 per year for the next five years, reopectively. The unit prioe of the nev oam set will be $240. The necessary equipment onn be purchased for $10.5 million and will be depreciated an a seven-year MACRS schedule. It's beliered the vilue of the equipment in five years vill be \$1.1 million. Produotion of the current cam line is expeoted to be teminated in two years. If ECCC doesn't introchoe the new line of oams, sales will be 45,000 units and 25,000 units for the next two years, respectively. The prive of the cam set is $150, with wariable oosts of $95 each, and fived costs of $1.5 millian per year. If ECCC does introduoe the new oams, sales of the existing product will fall by 10,000 units per year, and the prioe af the existing sets should be lowered to $120 each. Net working capital for the cams vill be 22 peroent af sales and twill oocur with the timing of the cash flows for the year; for example, there's no initial outlay for NWC, but changes in NWC will occur in Your 1 with the first year's sales. ECCC has a 90 -percent oorporate tax rate and a required retum of 10 peroent (Note: You can create the solutions in the same Excel spreadsheet that has the data report information. Be sure to let the instruotor know if you choose to do this instead of ereating them in a Word dooument.) Leah has provided you vith a data report in an Exoel spreadsheet that contains information to answer the following questions: 1. What's the payback period of the project? 2. What's the profitability index of the projeot? 3. What's the IRR of the project? 4. What's the NPN of the project? 5. Should Loah aosept the project? 0. If Leah neods to adjust the price of the product, vihat's the lowest Leah could make the price of the new cam set and still have a positive NPV project (keeping all other sesumptions the same)? Part 3: Can We Upgrade? It's now 2020, and El Cap Climbing Company (ECCC) has continued to grow. One of ECCC's major revemue-producing products is a spring-losded camming device callod SLCD, or cams. It's a devioe with a small handle (called the "trigger") and two spring-loadod "oms" on an avle. When the trigger is pulled, the cams move together, docreasing the size of the oams. It's then inserted into a crack or pocket in the rock When the trigger is released, the oams expand. These cams are used as anchors when "trad" rock climbing. ECCC eurrently has one set of cams on the maket, and sales have been excelleat. The cams are lighter and perform better than their oampetitors: However, as vith any high-performanoe item, technology changes rapidly, and the oams are now falling behind the competition. ECCC spent $200,000 to develop a prototype for a new line of oams that has all the features of the existing oams but are made from an even lighter and stronger 7075-T6 aluminum alloy. The company has spent a further $150,000 for a marketing study to determine the expected sales figures for the cam line. ECCC oan manufacture a set of the new cams for an awerage of $140 each in variable oosts. Fixed oosts for the operation are estimated to run an additional $2.1 milion per jear if the new project is undertaken. The estimated sales volume is 75,000,86,000,80,000,70,000, and 60,000 per year for the next five years, reopectively. The unit prioe of the nev oam set will be $240. The necessary equipment onn be purchased for $10.5 million and will be depreciated an a seven-year MACRS schedule. It's beliered the vilue of the equipment in five years vill be \$1.1 million. Produotion of the current cam line is expeoted to be teminated in two years. If ECCC doesn't introchoe the new line of oams, sales will be 45,000 units and 25,000 units for the next two years, respectively. The prive of the cam set is $150, with wariable oosts of $95 each, and fived costs of $1.5 millian per year. If ECCC does introduoe the new oams, sales of the existing product will fall by 10,000 units per year, and the prioe af the existing sets should be lowered to $120 each. Net working capital for the cams vill be 22 peroent af sales and twill oocur with the timing of the cash flows for the year; for example, there's no initial outlay for NWC, but changes in NWC will occur in Your 1 with the first year's sales. ECCC has a 90 -percent oorporate tax rate and a required retum of 10 peroent (Note: You can create the solutions in the same Excel spreadsheet that has the data report information. Be sure to let the instruotor know if you choose to do this instead of ereating them in a Word dooument.) Leah has provided you vith a data report in an Exoel spreadsheet that contains information to answer the following questions: 1. What's the payback period of the project? 2. What's the profitability index of the projeot? 3. What's the IRR of the project? 4. What's the NPN of the project? 5. Should Loah aosept the project? 0. If Leah neods to adjust the price of the product, vihat's the lowest Leah could make the price of the new cam set and still have a positive NPV project (keeping all other sesumptions the same) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started