Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 3: Capital Budgeting (14) Calculate internal rate of return for this project. Briefly describe the calculation (1 mark) (15) Calculate profitability index for this

Part 3: Capital Budgeting

(14) Calculate internal rate of return for this project. Briefly describe the calculation (1 mark)

(15) Calculate profitability index for this project. Briefly describe the calculation (1 mark)

SHOW ALL CALCULATIONS IN EXCEL

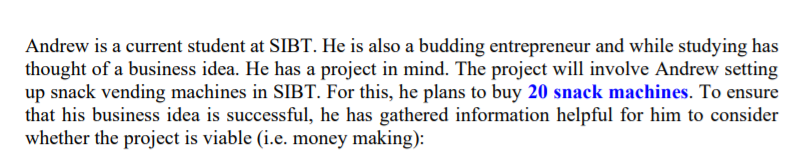

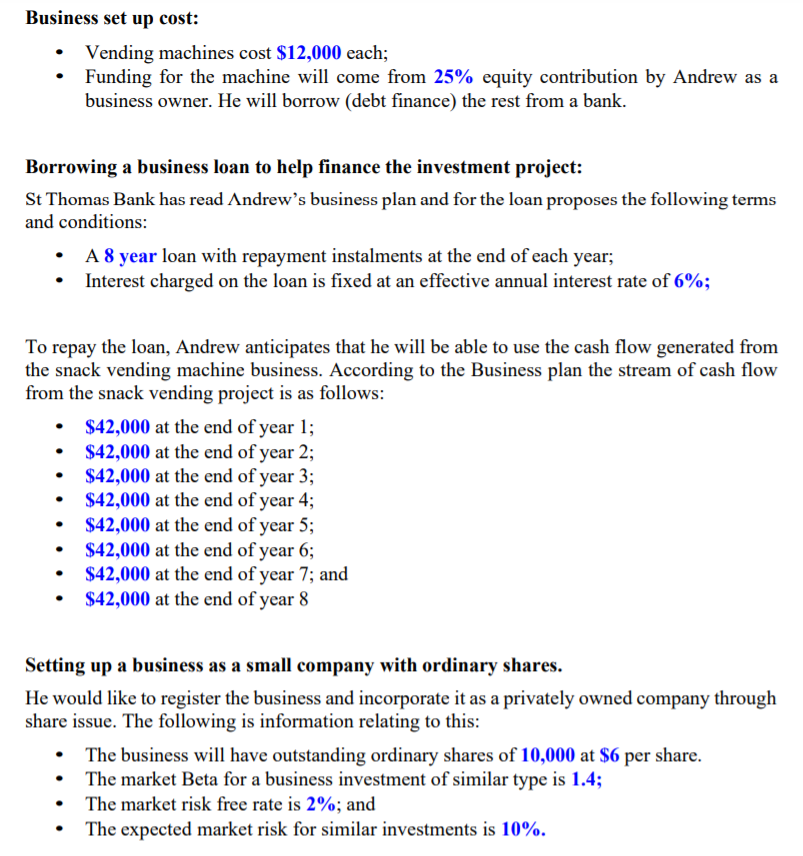

Andrew is a current student at SIBT. He is also a budding entrepreneur and while studying has thought of a business idea. He has a project in mind. The project will involve Andrew setting up snack vending machines in SIBT. For this, he plans to buy 20 snack machines. To ensure that his business idea is successful, he has gathered information helpful for him to consider whether the project is viable (i.e. money making): Business set up cost: Vending machines cost $12,000 each; Funding for the machine will come from 25% equity contribution by Andrew as a business owner. He will borrow (debt finance) the rest from a bank. Borrowing a business loan to help finance the investment project: St Thomas Bank has read Andrew's business plan and for the loan proposes the following terms and conditions: A 8 year loan with repayment instalments at the end of each year; Interest charged on the loan is fixed at an effective annual interest rate of 6%; To repay the loan, Andrew anticipates that he will be able to use the cash flow generated from the snack vending machine business. According to the Business plan the stream of cash flow from the snack vending project is as follows: $42,000 at the end of year 1; $42,000 at the end of year 2; $42,000 at the end of year 3; $42,000 at the end of year 4; $42,000 at the end of year 5; $42,000 at the end of year 6; $42,000 at the end of year 7; and $42,000 at the end of year 8 . Setting up a business as a small company with ordinary shares. He would like to register the business and incorporate it as a privately owned company through share issue. The following is information relating to this: The business will have outstanding ordinary shares of 10,000 at $6 per share. The market Beta for a business investment of similar type is 1.4; The market risk free rate is 2%; and The expected market risk for similar investments is 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started