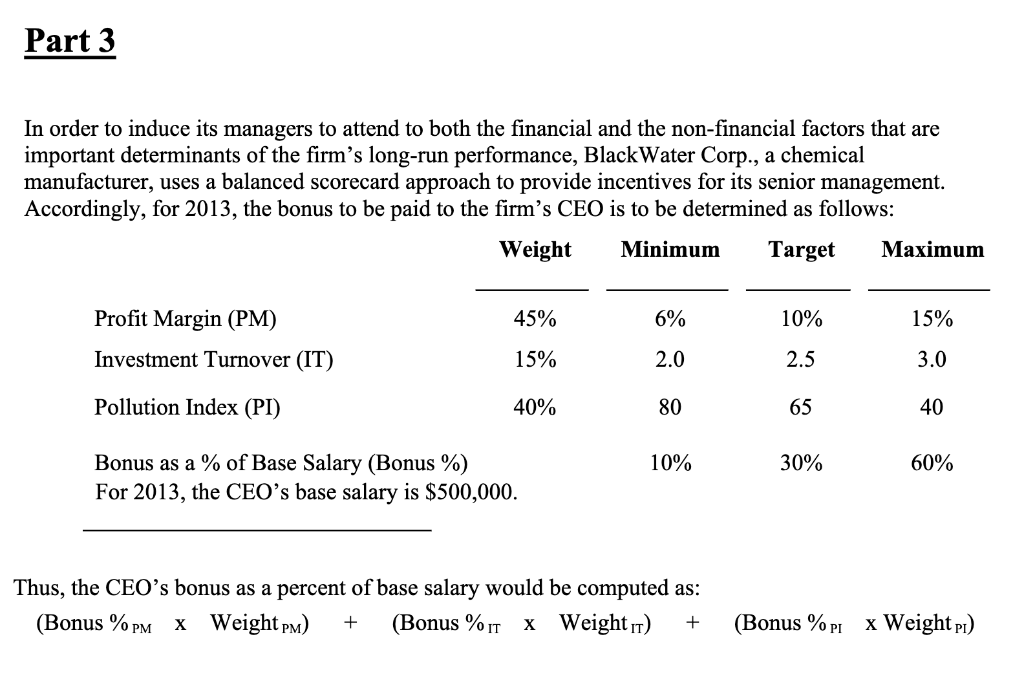

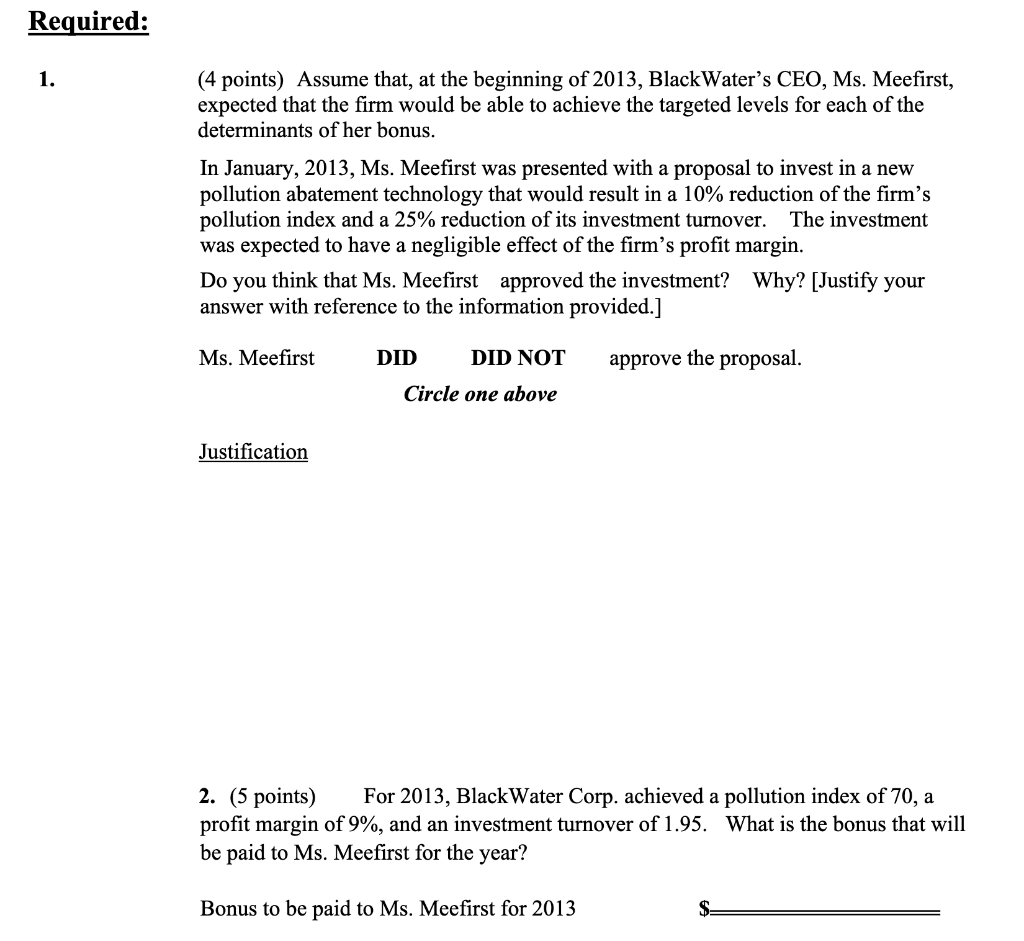

Part 3 In order to induce its managers to attend to both the financial and the non-financial factors that are important determinants of the firm's long-run performance, Black Water Corp., a chemical manufacturer, uses a balanced scorecard approach to provide incentives for its senior management. Accordingly, for 2013, the bonus to be paid to the firm's CEO is to be determined as follows: Weight Minimum Target Maximum 45% 6% 10% 15% Profit Margin (PM) Investment Turnover (IT) 15% 2.0 2.5 3.0 Pollution Index (PI) 40% 80 65 40 10% 30% 60% Bonus as a % Base Salary (Bonus %) For 2013, the CEO's base salary is $500,000. Thus, the CEO's bonus as a percent of base salary would be computed as: (Bonus %pm X Weight pm) (Bonus %it X Weight 11) + + (Bonus %PI x Weight pl) Required: 1. (4 points) Assume that, at the beginning of 2013, BlackWater's CEO, Ms. Meefirst, expected that the firm would be able to achieve the targeted levels for each of the determinants of her bonus. In January, 2013, Ms. Meefirst was presented with a proposal to invest in a new pollution abatement technology that would result in a 10% reduction of the firm's pollution index and a 25% reduction of its investment turnover. The investment was expected to have a negligible effect of the firm's profit margin. Do you think that Ms. Meefirst approved the investment? Why? [Justify your answer with reference to the information provided.] Ms. Meefirst DID DID NOT approve the proposal. Circle one above Justification 2. (5 points) For 2013, BlackWater Corp. achieved a pollution index of 70, a profit margin of 9%, and an investment turnover of 1.95. What is the bonus that will be paid to Ms. Meefirst for the year? Bonus to be paid to Ms. Meefirst for 2013 $ Part 3 In order to induce its managers to attend to both the financial and the non-financial factors that are important determinants of the firm's long-run performance, Black Water Corp., a chemical manufacturer, uses a balanced scorecard approach to provide incentives for its senior management. Accordingly, for 2013, the bonus to be paid to the firm's CEO is to be determined as follows: Weight Minimum Target Maximum 45% 6% 10% 15% Profit Margin (PM) Investment Turnover (IT) 15% 2.0 2.5 3.0 Pollution Index (PI) 40% 80 65 40 10% 30% 60% Bonus as a % Base Salary (Bonus %) For 2013, the CEO's base salary is $500,000. Thus, the CEO's bonus as a percent of base salary would be computed as: (Bonus %pm X Weight pm) (Bonus %it X Weight 11) + + (Bonus %PI x Weight pl) Required: 1. (4 points) Assume that, at the beginning of 2013, BlackWater's CEO, Ms. Meefirst, expected that the firm would be able to achieve the targeted levels for each of the determinants of her bonus. In January, 2013, Ms. Meefirst was presented with a proposal to invest in a new pollution abatement technology that would result in a 10% reduction of the firm's pollution index and a 25% reduction of its investment turnover. The investment was expected to have a negligible effect of the firm's profit margin. Do you think that Ms. Meefirst approved the investment? Why? [Justify your answer with reference to the information provided.] Ms. Meefirst DID DID NOT approve the proposal. Circle one above Justification 2. (5 points) For 2013, BlackWater Corp. achieved a pollution index of 70, a profit margin of 9%, and an investment turnover of 1.95. What is the bonus that will be paid to Ms. Meefirst for the year? Bonus to be paid to Ms. Meefirst for 2013 $