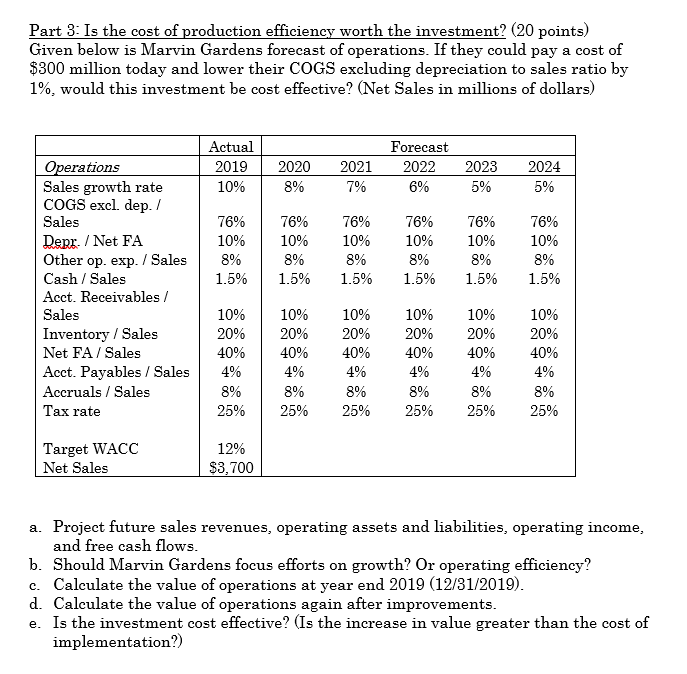

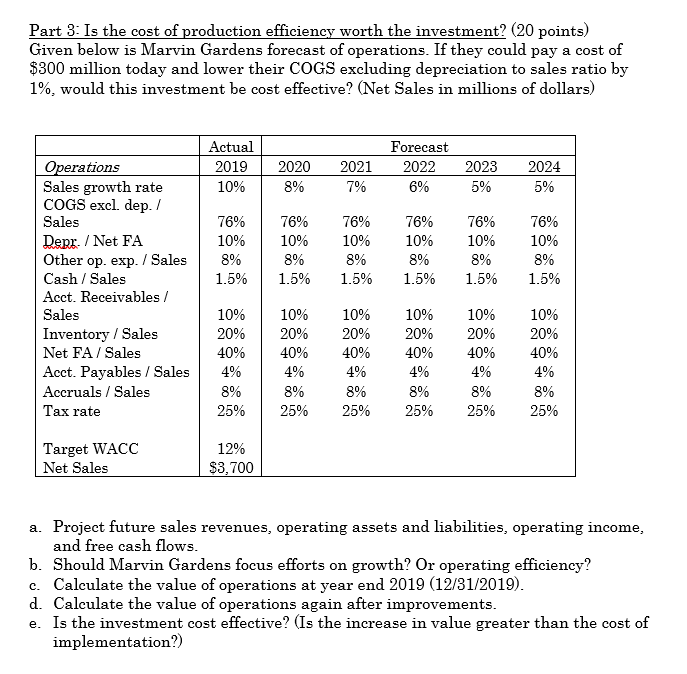

Part 3: Is the cost of production efficiency worth the investment? (20 points) Given below is Marvin Gardens forecast of operations. If they could pay a cost of $300 million today and lower their COGS excluding depreciation to sales ratio by 1%, would this investment be cost effective? (Net Sales in millions of dollars) Actual 2019 10% 2020 8% 2021 7% Forecast 2022 6% 2023 5% 2024 5% 76% 10% 8% 1.5% 76% 10% 8% 1.5% 76% 10% 8% 1.5% 76% 10% 8% 1.5% 76% 10% 8% 1.5% 76% 10% 8% 1.5% Operations Sales growth rate COGS excl. dep./ Sales Derr. / Net FA Other op. exp. / Sales Cash/ Sales Acct. Receivables / Sales Inventory / Sales Net FA/ Sales Acct. Payables / Sales Accruals / Sales Tax rate 10% 20% 40% 4% 8% 25% 10% 20% 40% 4% 8% 25% 10% 20% 40% 4% 8% 25% 10% 20% 40% 4% 8% 25% 10% 20% 40% 4% 8% 25% 10% 20% 40% 4% 8% 25% Target WACC Net Sales 12% $3,700 a. Project future sales revenues, operating assets and liabilities, operating income, and free cash flows. b. Should Marvin Gardens focus efforts on growth? Or operating efficiency? c. Calculate the value of operations at year end 2019 (12/31/2019). d. Calculate the value of operations again after improvements. e. Is the investment cost effective? (Is the increase in value greater than the cost of implementation?) Part 3: Is the cost of production efficiency worth the investment? (20 points) Given below is Marvin Gardens forecast of operations. If they could pay a cost of $300 million today and lower their COGS excluding depreciation to sales ratio by 1%, would this investment be cost effective? (Net Sales in millions of dollars) Actual 2019 10% 2020 8% 2021 7% Forecast 2022 6% 2023 5% 2024 5% 76% 10% 8% 1.5% 76% 10% 8% 1.5% 76% 10% 8% 1.5% 76% 10% 8% 1.5% 76% 10% 8% 1.5% 76% 10% 8% 1.5% Operations Sales growth rate COGS excl. dep./ Sales Derr. / Net FA Other op. exp. / Sales Cash/ Sales Acct. Receivables / Sales Inventory / Sales Net FA/ Sales Acct. Payables / Sales Accruals / Sales Tax rate 10% 20% 40% 4% 8% 25% 10% 20% 40% 4% 8% 25% 10% 20% 40% 4% 8% 25% 10% 20% 40% 4% 8% 25% 10% 20% 40% 4% 8% 25% 10% 20% 40% 4% 8% 25% Target WACC Net Sales 12% $3,700 a. Project future sales revenues, operating assets and liabilities, operating income, and free cash flows. b. Should Marvin Gardens focus efforts on growth? Or operating efficiency? c. Calculate the value of operations at year end 2019 (12/31/2019). d. Calculate the value of operations again after improvements. e. Is the investment cost effective? (Is the increase in value greater than the cost of implementation?)