Answered step by step

Verified Expert Solution

Question

1 Approved Answer

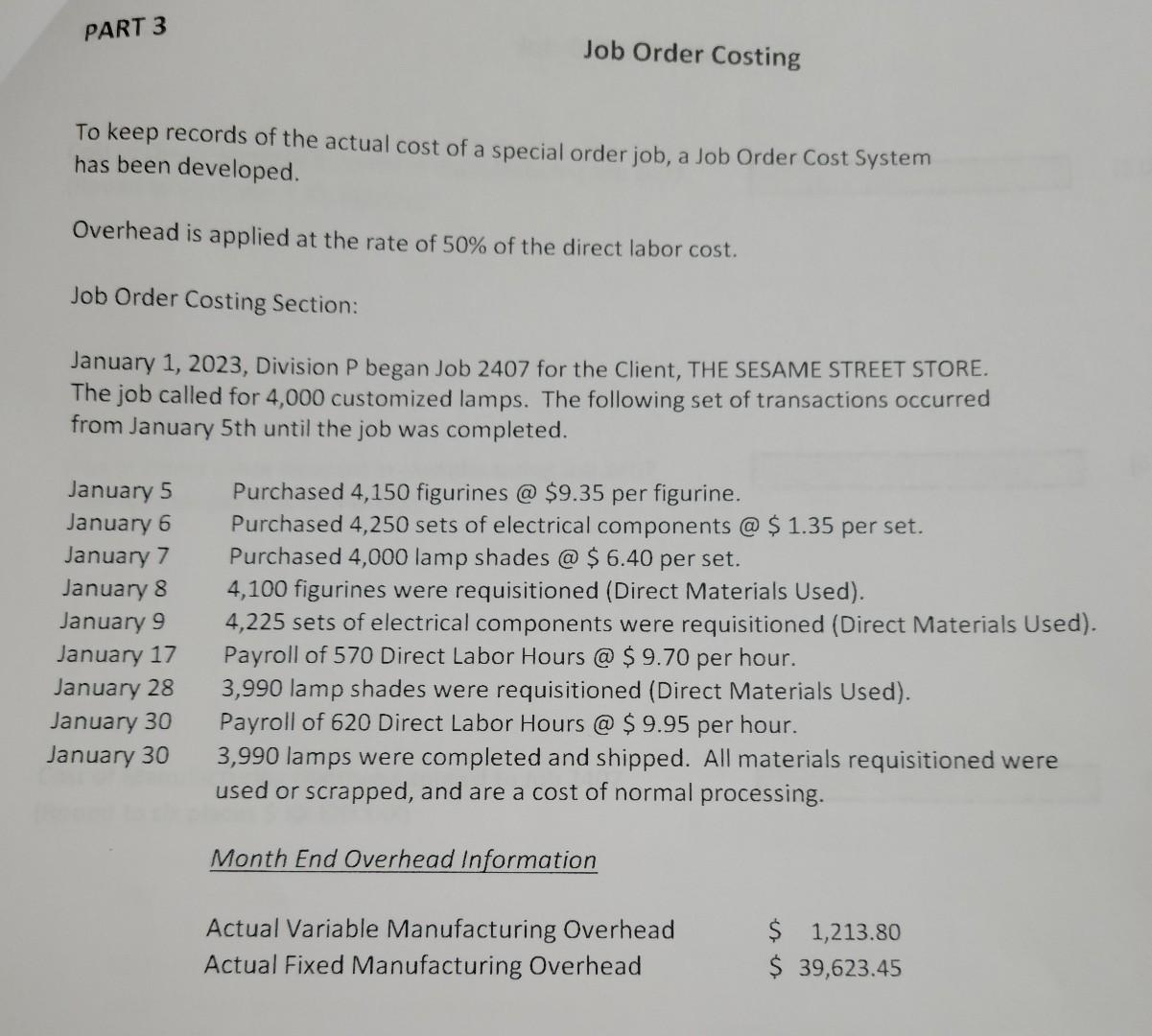

PART 3 Job Order Costing To keep records of the actual cost of a special order job, a Job Order Cost System has been developed.

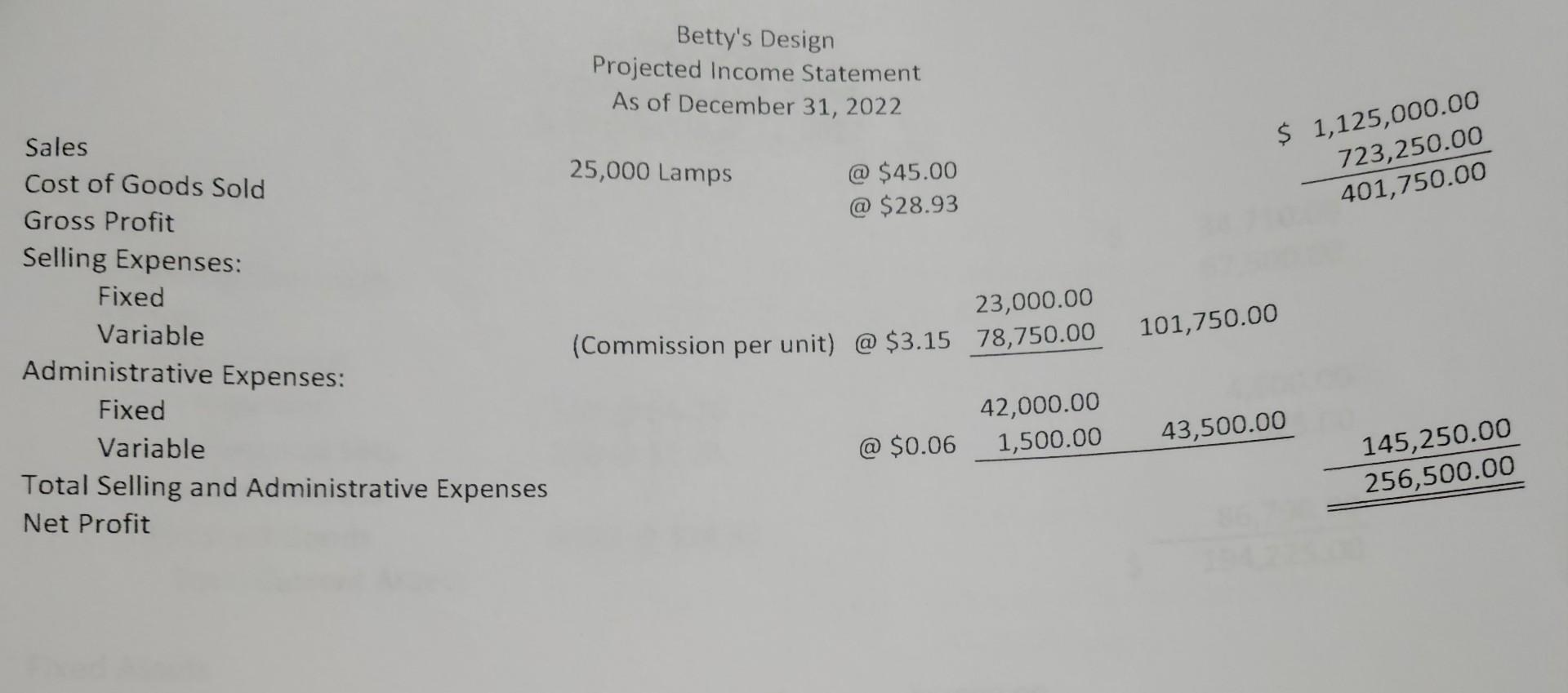

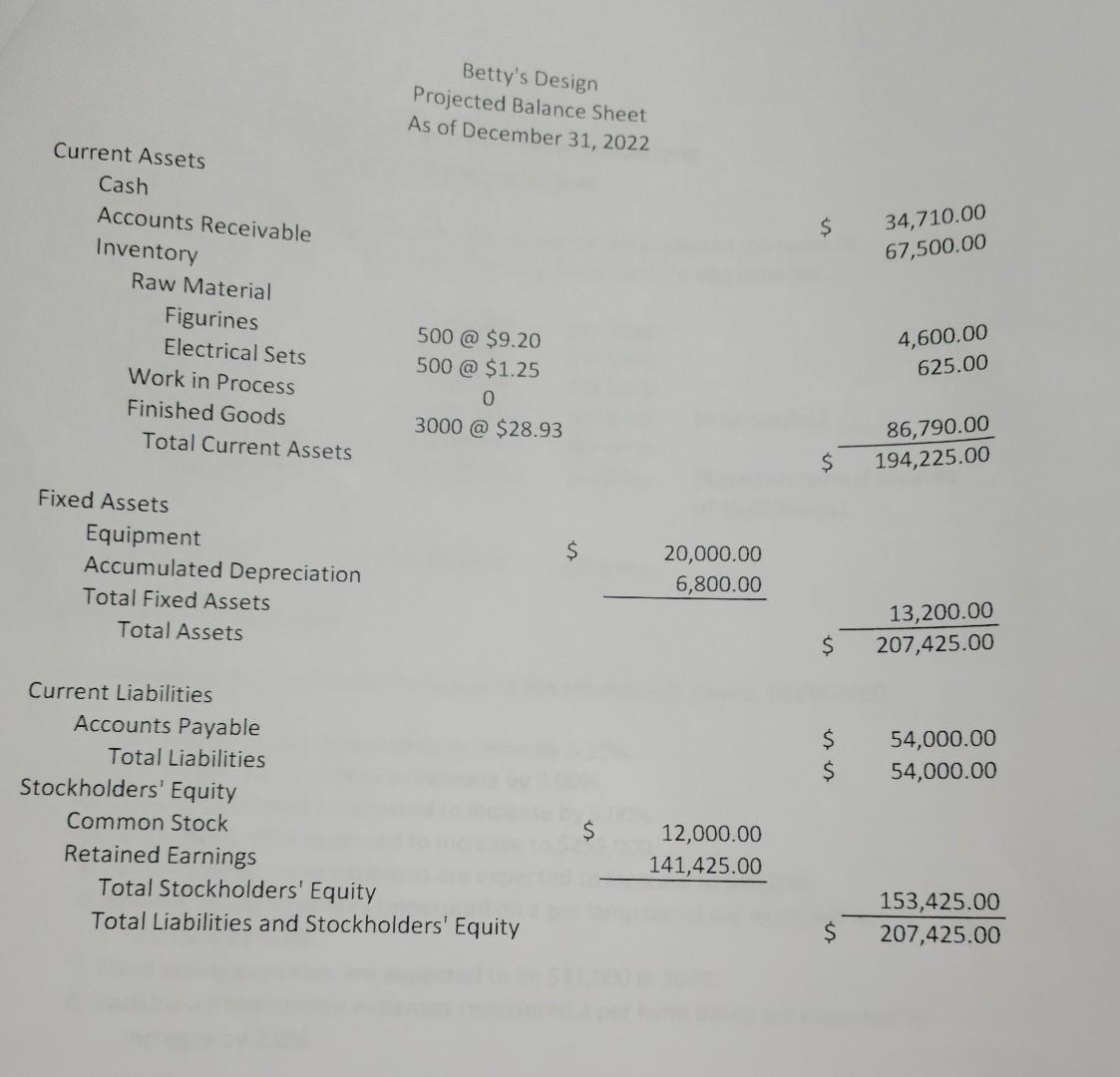

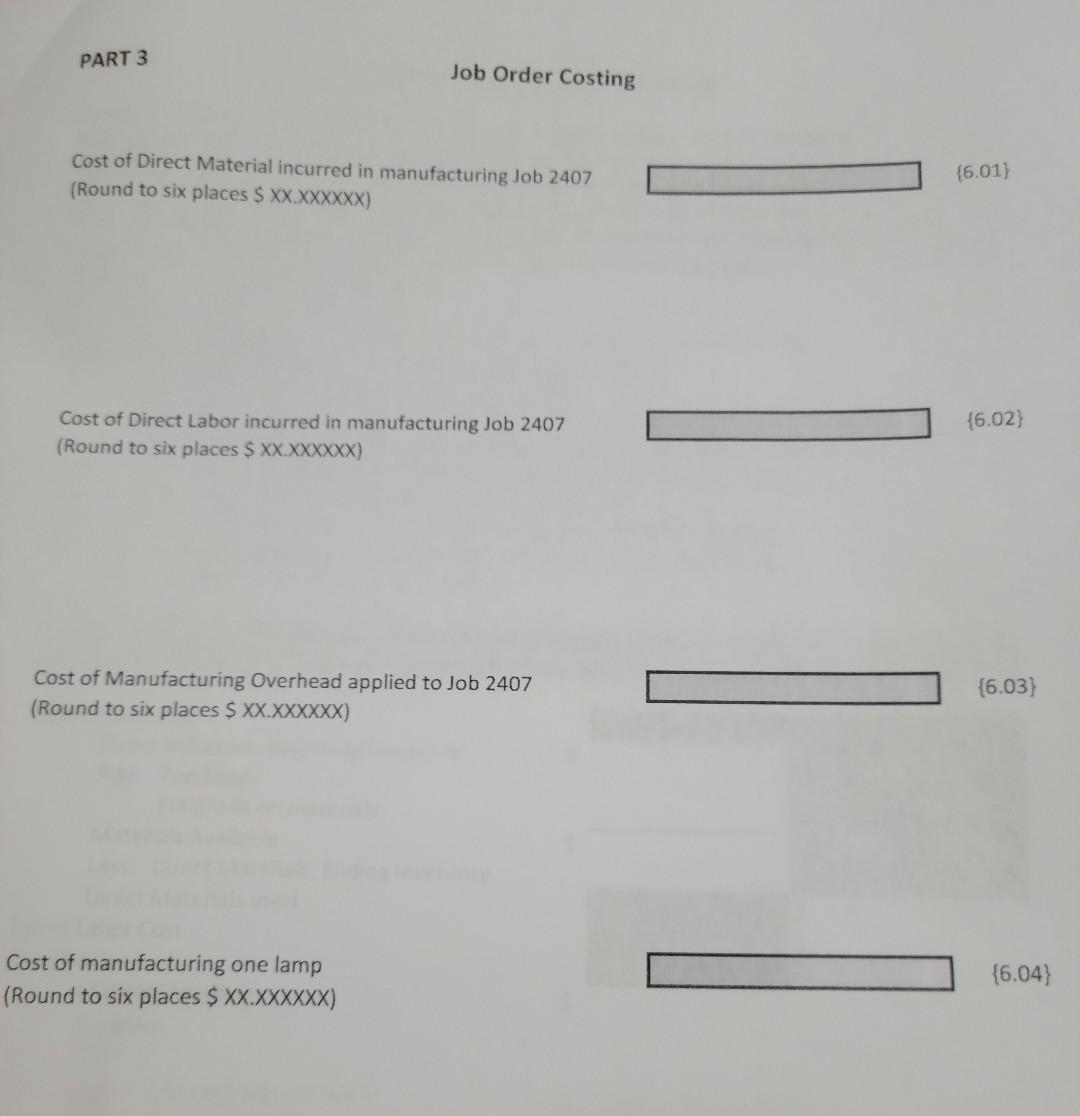

PART 3 Job Order Costing To keep records of the actual cost of a special order job, a Job Order Cost System has been developed. Overhead is applied at the rate of 50% of the direct labor cost. Job Order Costing Section: January 1, 2023, Division P began Job 2407 for the Client, THE SESAME STREET STORE. The job called for 4,000 customized lamps. The following set of transactions occurred from January 5 th until the job was completed. January 5 Purchased 4,150 figurines @ \$9.35 per figurine. January 6 Purchased 4,250 sets of electrical components @ \$ 1.35 per set. January 7 Purchased 4,000 lamp shades@\$ 6.40 per set. January 84,100 figurines were requisitioned (Direct Materials Used). January 94,225 sets of electrical components were requisitioned (Direct Materials Used). January 17 Payroll of 570 Direct Labor Hours @ \$9.70 per hour. January 28 3,990 lamp shades were requisitioned (Direct Materials Used). January 30 Payroll of 620 Direct Labor Hours@ \$9.95 per hour. January 303,990 lamps were completed and shipped. All materials requisitioned were used or scrapped, and are a cost of normal processing. Betty's Design Projected Income Statement As of December 31, 2022 Sales Cost of Goods Sold Gross Profit Selling Expenses: Fixed Variable Administrative Expenses: Fixed Variable 25,000 Lamps @ $45.00 @ \$28.93 \begin{tabular}{rlrr} (Commission per unit) @$3.15 & \begin{tabular}{r} 23,000.00 \\ 78,750.00 \end{tabular} & 101,750.00 \\ & 42,000.00 & \\ & @$0.06 & 1,500.00 & 43,500.00 \\ \hline \end{tabular} Total Selling and Administrative Expenses \$ 1,125,000.00 723,250.00401,750.00 Net Profit \begin{tabular}{r} 145,250.00 \\ \hline 256,500.00 \\ \hline \end{tabular} Betty's Design Projected Balance Sheet As of December 31, 2022 Current Assets Cash Accounts Receivable Inventory Raw Material Figurines Electrical Sets Work in Process Finished Goods Total Current Assets $34,710.00 67,500.00 500@$9.20 500@\$1.25 0 3000 @ \$28.93 Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets Current Liabilities Accounts Payable Total Liabilities Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity \$ 20,000.006,800.00 $207,425.0013,200.00 \begin{tabular}{ll} $ & 54,000.00 \\ $ & 54,000.00 \end{tabular} 12,000.00141,425.00 $153,425.00207,425.00 Cost of Direct Material incurred in manufacturing Job 2407 (Round to six places \$XXX.XXXXXXX) {6.01} Cost of Direct Labor incurred in manufacturing Job 2407 (Round to six places $XX.XXXXXXX ) {6.02} Cost of Manufacturing Overhead applied to Job 2407 (Round to six places $XX.XXXXXX ) {6.03 Cost of manufacturing one lamp (Round to six places $XX.XXXXXX )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started