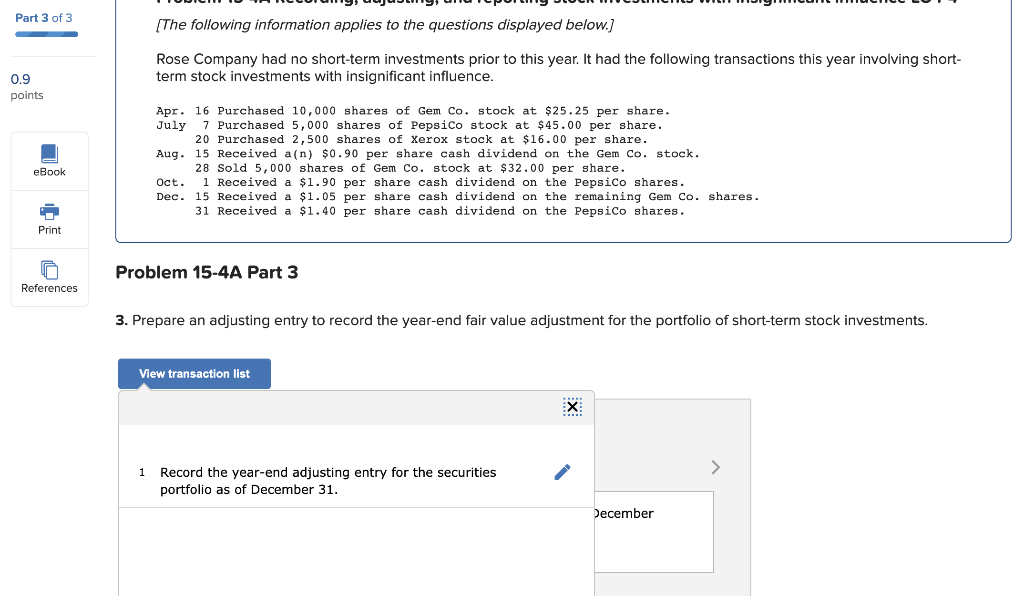

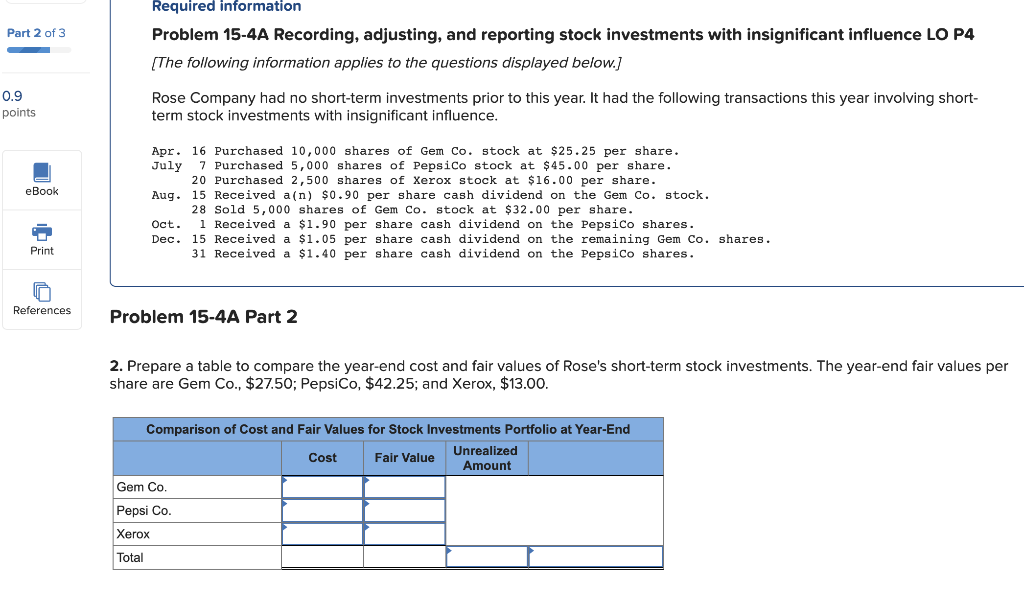

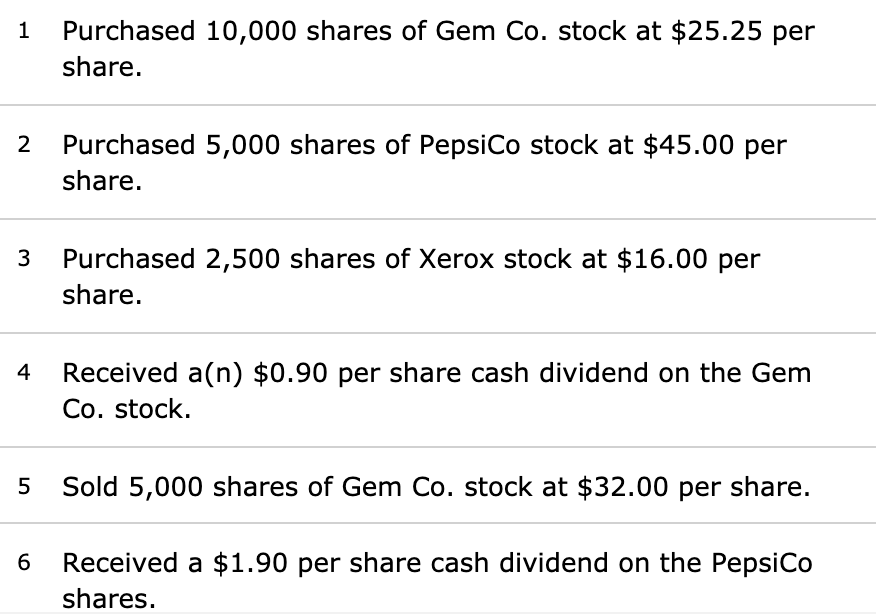

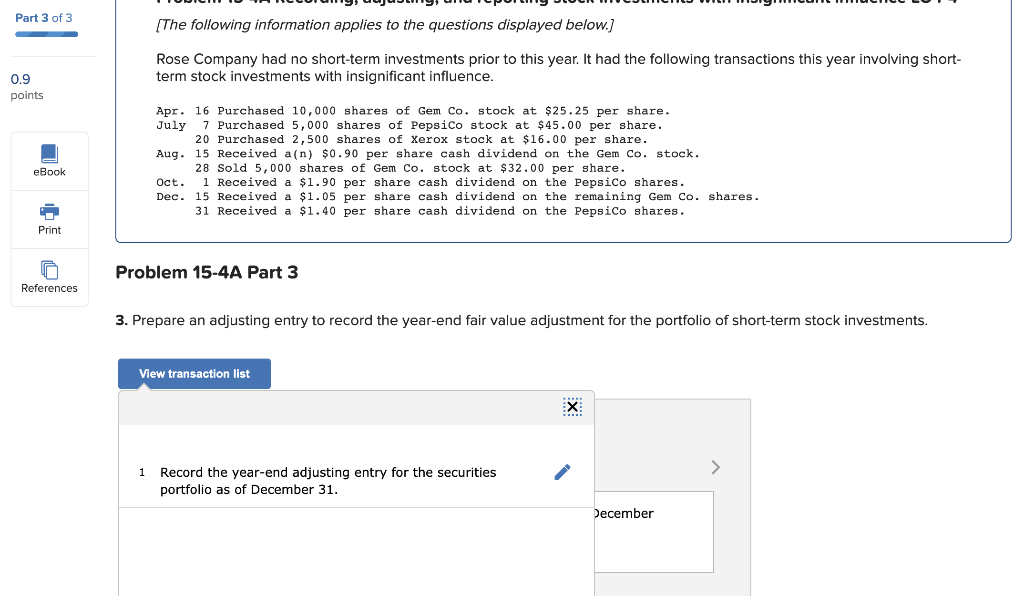

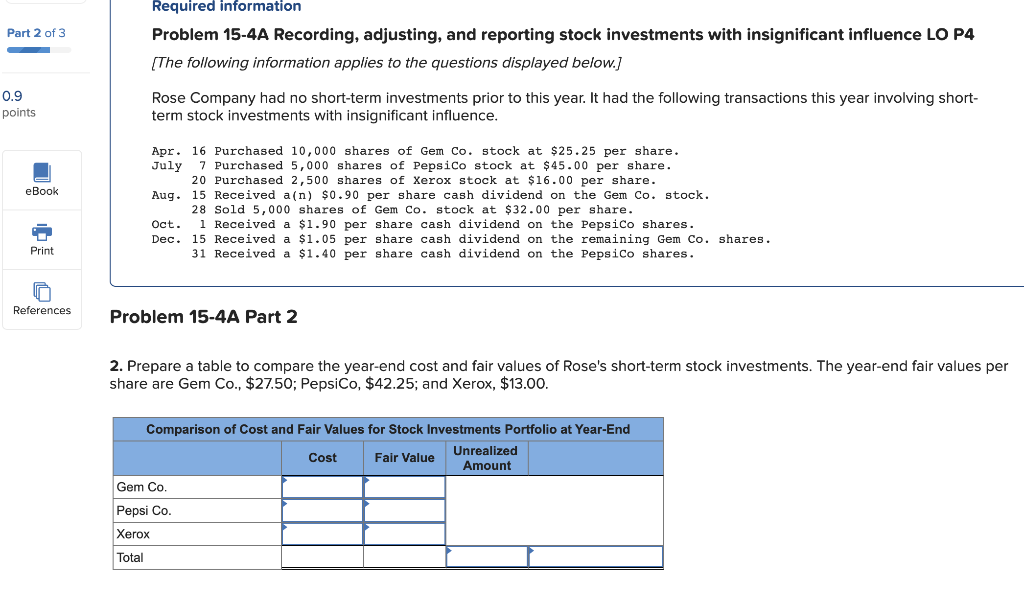

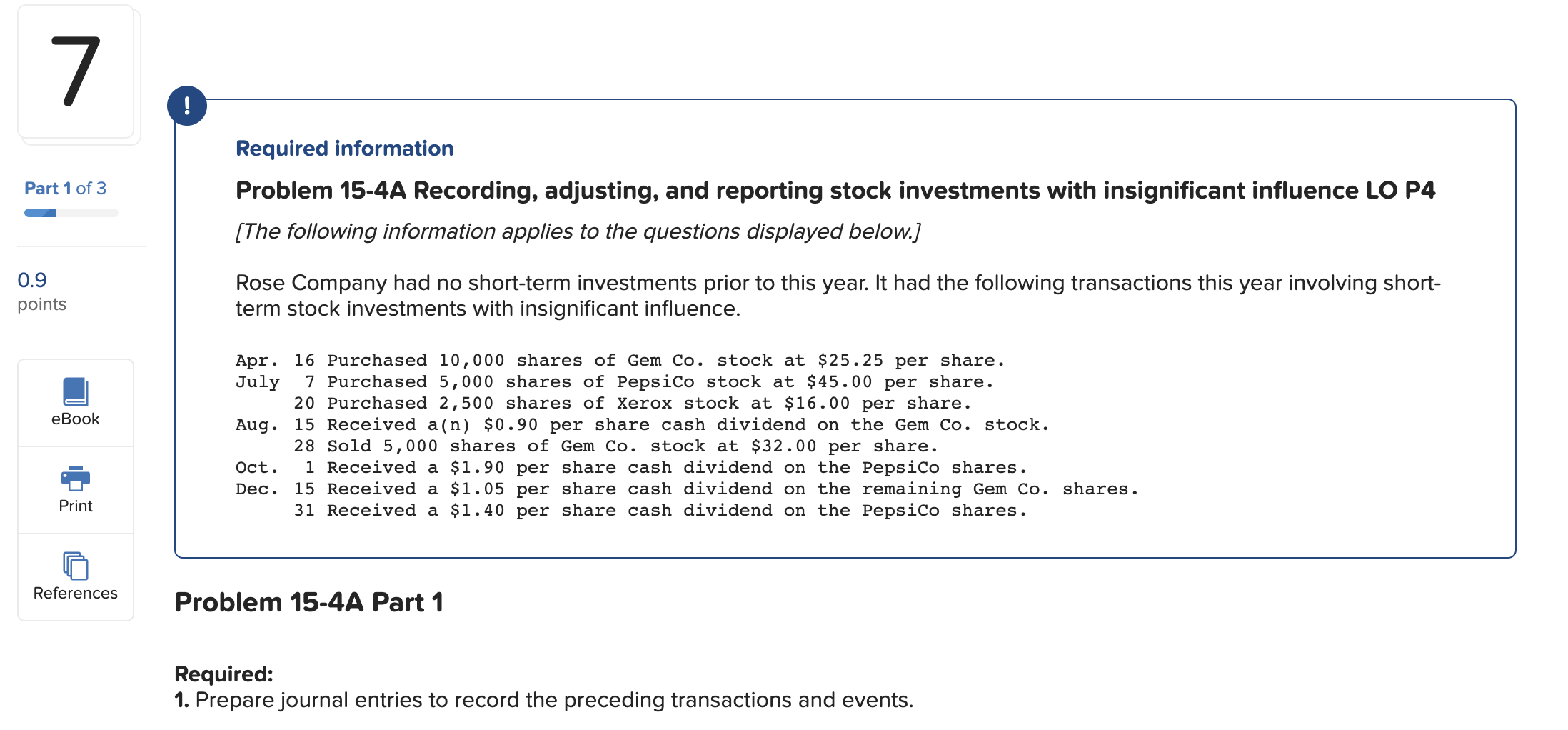

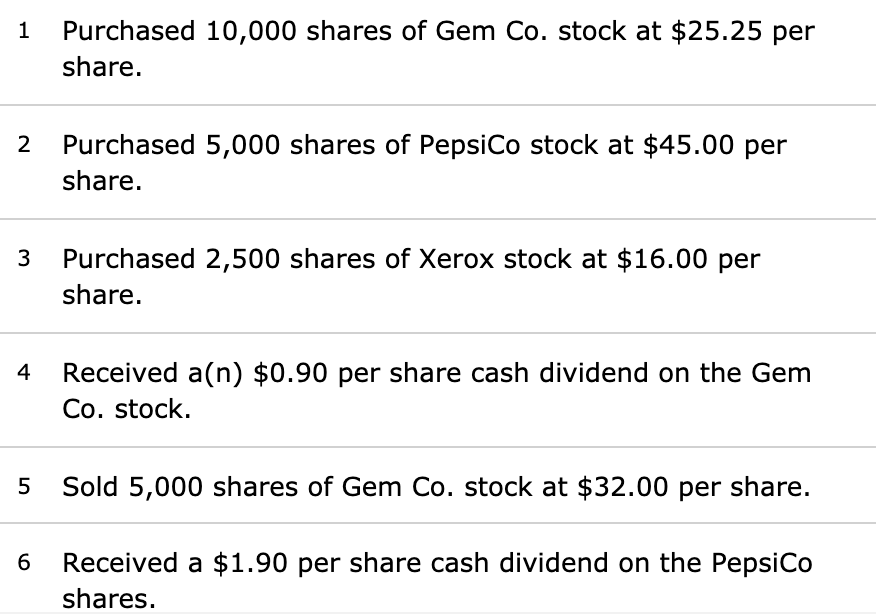

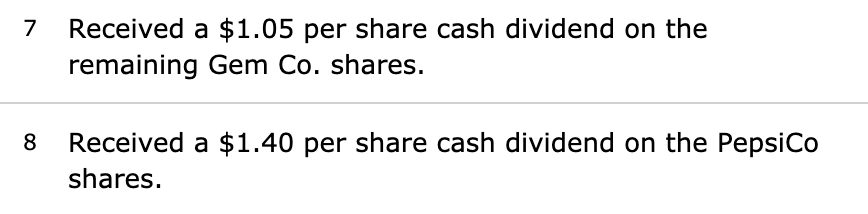

Part 3 of 3 [The following information applies to the questions displayed below.] Rose Company had no short-term investments prior to this year. It had the following transactions this year involving short- term stock investments with insignificant influence. 0.9 points Apr. 16 Purchased 10,000 shares of Gem Co. stock at $25.25 per share. July 7 Purchased 5,000 shares of PepsiCo stock at $45.00 per share. 20 Purchased 2,500 shares of Xerox stock at $16.00 per share. Aug. 15 Received a(n) $0.90 per share cash dividend on the Gem Co. stock. 28 Sold 5,000 shares of Gem Co. stock at $32.00 per share. Oct. 1 Received a $1.90 per share cash dividend on the PepsiCo shares. Dec. 15 Received a $1.05 per share cash dividend on the remaining Gem Co. shares. 31 Received a $1.40 per share cash dividend on the PepsiCo shares. eBook Print Problem 15-4A Part 3 References 3. Prepare an adjusting entry to record the year-end fair value adjustment for the portfolio of short-term stock investments. View transaction list EX 1 Record the year-end adjusting entry for the securities portfolio as of December 31. December Part 2 of 3 Required information Problem 15-4A Recording, adjusting, and reporting stock investments with insignificant influence LO P4 [The following information applies to the questions displayed below.) 0.9 points Rose Company had no short-term investments prior to this year. It had the following transactions this year involving short- term stock investments with insignificant influence. eBook Apr. 16 Purchased 10,000 shares of Gem Co. stock at $25.25 per share. July 7 Purchased 5,000 shares of PepsiCo stock at $45.00 per share. 20 Purchased 2,500 shares of Xerox stock at $16.00 per share. Aug. 15 Received a(n) $0.90 per share cash dividend on the Gem Co. stock. 28 Sold 5,000 shares of Gem Co. stock at $32.00 per share. Oct. 1 Received a $1.90 per share cash dividend on the PepsiCo shares. Dec. 15 Received a $1.05 per share cash dividend on the remaining Gem Co. shares. 31 Received a $1.40 per share cash dividend on the PepsiCo shares. Print References Problem 15-4A Part 2 2. Prepare a table to compare the year-end cost and fair values of Rose's short-term stock investments. The year-end fair values per share are Gem Co., $27.50; PepsiCo, $42.25; and Xerox, $13.00. Comparison of Cost and Fair Values for Stock Investments Portfolio at Year-End Cost Unrealized Fair Value Amount Gem Co. Pepsi Co. Xerox Total 7 Part 1 of 3 Required information Problem 15-4A Recording, adjusting, and reporting stock investments with insignificant influence LO P4 (The following information applies to the questions displayed below.] 0.9 points Rose Company had no short-term investments prior to this year. It had the following transactions this year involving short- term stock investments with insignificant influence. eBook Apr. 16 Purchased 10,000 shares of Gem Co. stock at $25.25 per share. July 7 Purchased 5,000 shares of PepsiCo stock at $45.00 per share. 20 Purchased 2,500 shares of Xerox stock at $16.00 per share. Aug. 15 Received a(n) $0.90 per share cash dividend on the Gem Co. stock. 28 Sold 5,000 shares of Gem Co. stock at $32.00 per share. Oct. 1 Received a $1.90 per share cash dividend on the PepsiCo shares. Dec. 15 Received a $1.05 per share cash dividend on the remaining Gem Co. shares. 31 Received a $1.40 per share cash dividend on the PepsiCo shares. Print References Problem 15-4A Part 1 Required: 1. Prepare journal entries to record the preceding transactions and events. 1 Purchased 10,000 shares of Gem Co. stock at $25.25 per share. 2 Purchased 5,000 shares of PepsiCo stock at $45.00 per share. 3 Purchased 2,500 shares of Xerox stock at $16.00 per share. 4 Received a(n) $0.90 per share cash dividend on the Gem Co. stock. 5 Sold 5,000 shares of Gem Co. stock at $32.00 per share. 6 Received a $1.90 per share cash dividend on the PepsiCo shares. 7 Received a $1.05 per share cash dividend on the remaining Gem Co. shares. 8 Received a $1.40 per share cash dividend on the PepsiCo shares