Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 3: PROBLEM SOLVING 1. (10 points) Assume that you and your brother plan to open a business that will make and sell a

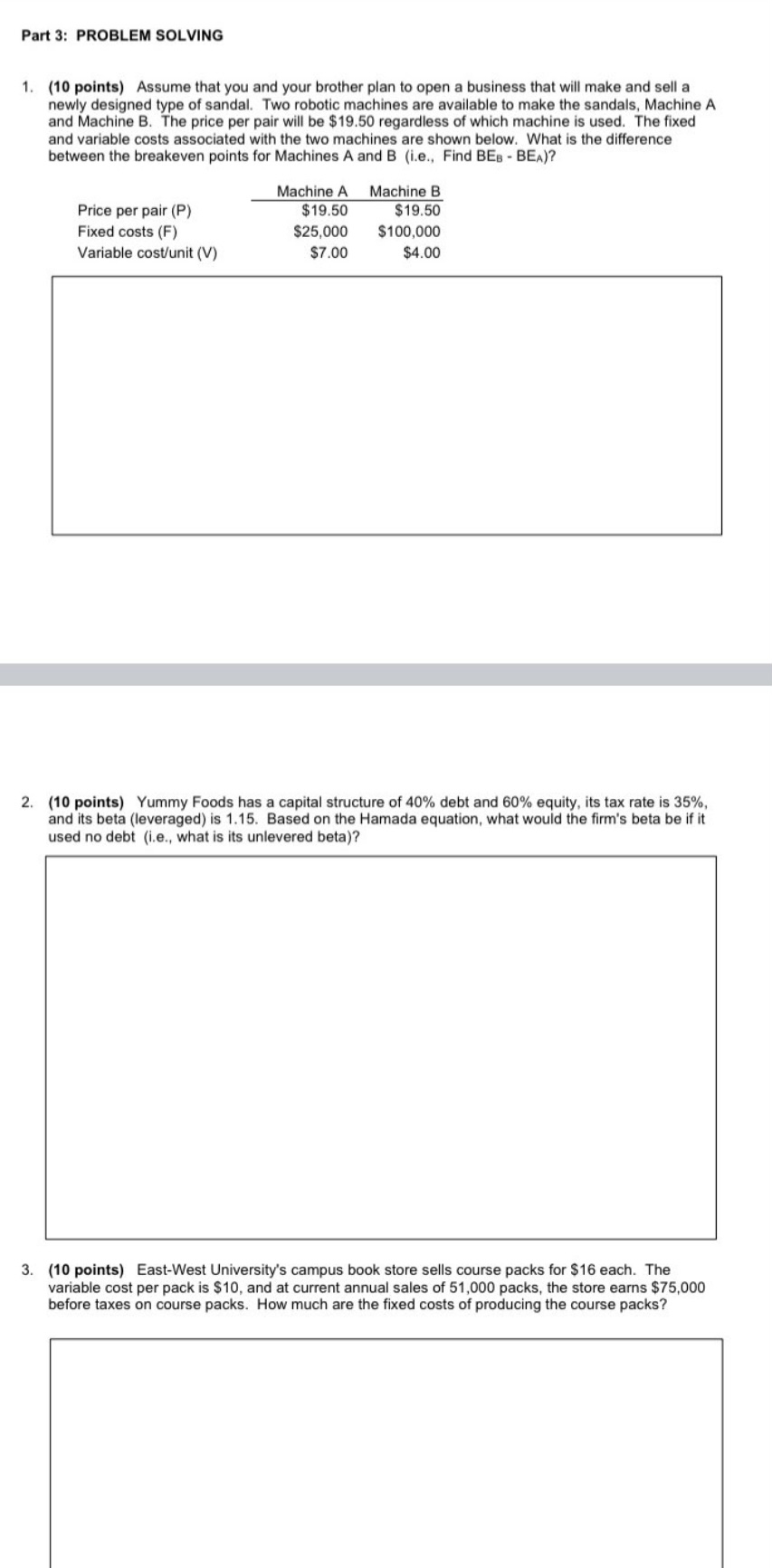

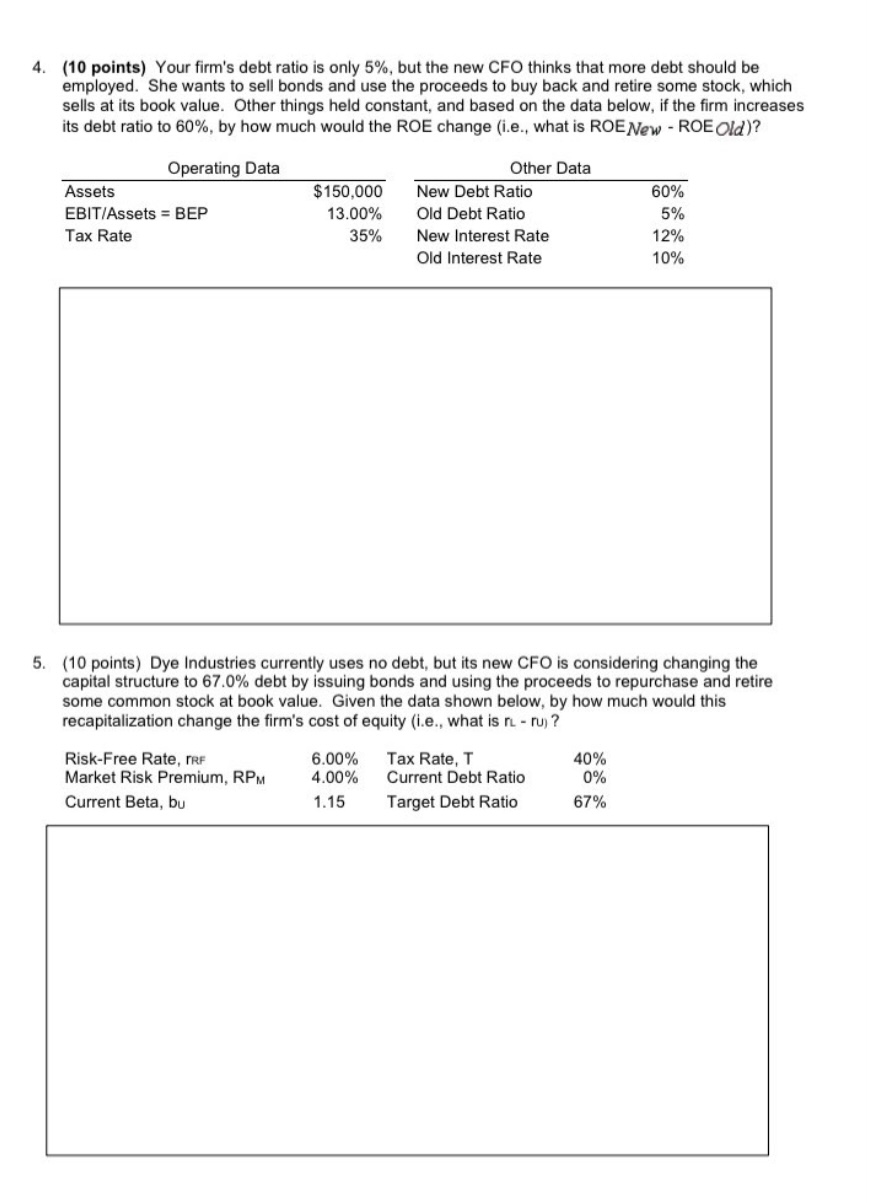

Part 3: PROBLEM SOLVING 1. (10 points) Assume that you and your brother plan to open a business that will make and sell a newly designed type of sandal. Two robotic machines are available to make the sandals, Machine A and Machine B. The price per pair will be $19.50 regardless of which machine is used. The fixed and variable costs associated with the two machines are shown below. What is the difference between the breakeven points for Machines A and B (i.e., Find BEB - BEA)? Machine A Machine B Price per pair (P) Fixed costs (F) $19.50 $19.50 $25,000 $100,000 Variable cost/unit (V) $7.00 $4.00 2. (10 points) Yummy Foods has a capital structure of 40% debt and 60% equity, its tax rate is 35%, and its beta (leveraged) is 1.15. Based on the Hamada equation, what would the firm's beta be if it used no debt (i.e., what is its unlevered beta)? 3. (10 points) East-West University's campus book store sells course packs for $16 each. The variable cost per pack is $10, and at current annual sales of 51,000 packs, the store earns $75,000 before taxes on course packs. How much are the fixed costs of producing the course packs? 4. (10 points) Your firm's debt ratio is only 5%, but the new CFO thinks that more debt should be employed. She wants to sell bonds and use the proceeds to buy back and retire some stock, which sells at its book value. Other things held constant, and based on the data below, if the firm increases its debt ratio to 60%, by how much would the ROE change (i.e., what is ROE New - ROE Old)? Operating Data Other Data Assets EBIT/Assets BEP = $150,000 13.00% New Debt Ratio 60% Old Debt Ratio 5% Tax Rate 35% New Interest Rate 12% Old Interest Rate 10% 5. (10 points) Dye Industries currently uses no debt, but its new CFO is considering changing the capital structure to 67.0% debt by issuing bonds and using the proceeds to repurchase and retire some common stock at book value. Given the data shown below, by how much would this recapitalization change the firm's cost of equity (i.e., what is ru - ru)? Risk-Free Rate, TRF 6.00% Market Risk Premium, RPM 4.00% Tax Rate, T Current Debt Ratio 40% 0% Current Beta, bu 1.15 Target Debt Ratio 67%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started