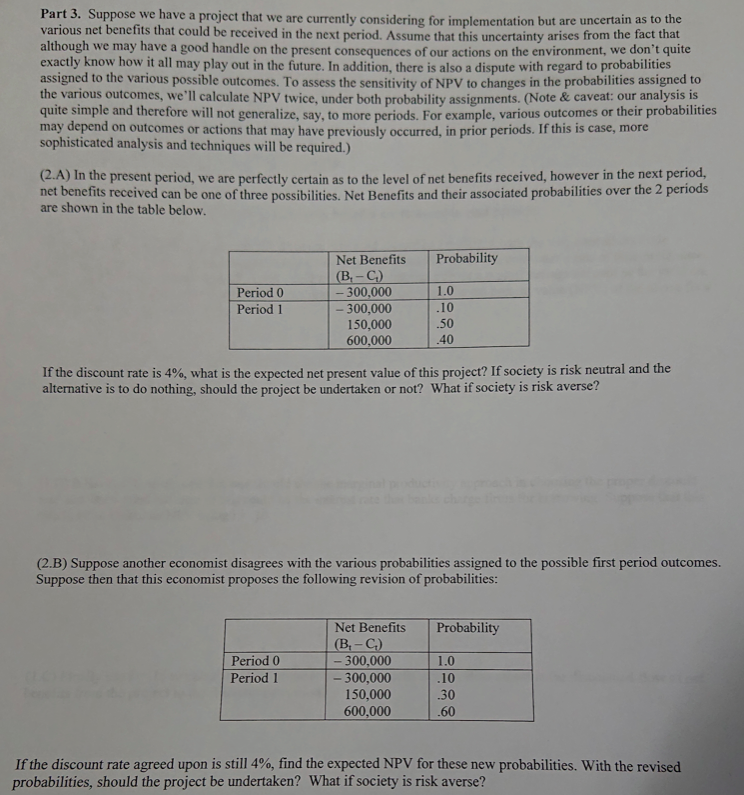

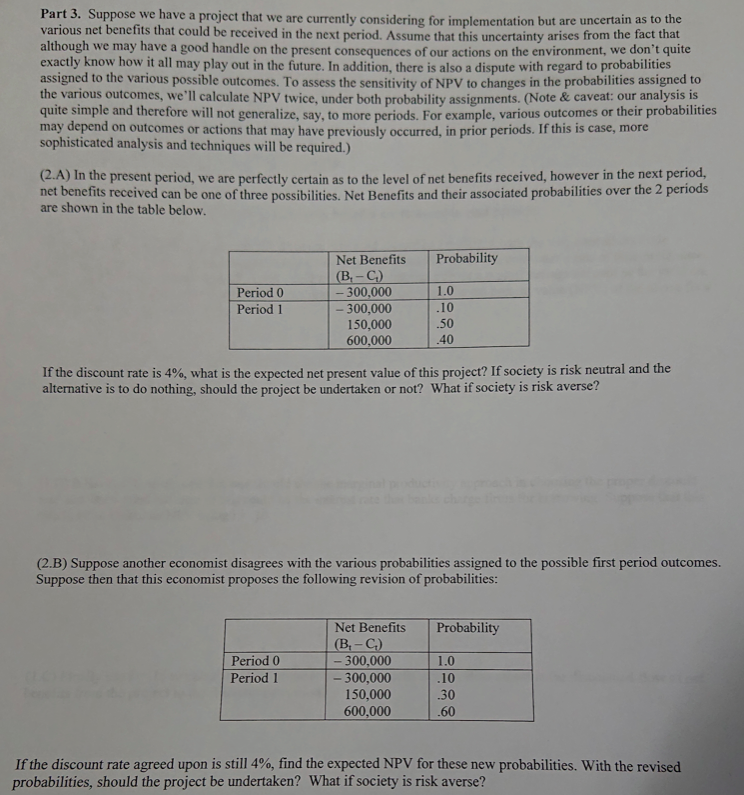

Part 3. Suppose we have a project that we are currently considering for implementation but are uncertain as to the various net benefits that could be received in the next period. Assume that this uncertainty arises from the fact that although we may have a good handle on the present consequences of our actions on the environment, we don t quite exactly know how it all may play out in the future. In addition, there is also a dispute with regard to probabilities assigned to the various possible outcomes. To assess the sens itivity of NPV to changes in the probabilities assigned to the various outcomes, we'll calculate NPV twice, under both probability assignments. (Note& caveat: our analysis is quite simple and therefore will not generalize, say, to more periods. For example, various outcomes or their probabilities may depend on outcomes or actions that may have previously occurred, in prior periods. If this is case, more sophisticated analysis and techniques will be required.) W (2.A) In the present period, we are perfectly certain as to the level of net bene fits received, however in the next period net benefits received can be one of three possibilities. Net Benefits and their associated probabilities over the 2 periods are shown in the table below. Probability Net Benefits (.) -300,000 1.0 Period 0 .10 Period 1 -300,000 150,000 600,000 50 40 If the discount rate is 4%, what is the expected net present value of this project? If society is risk neutral and the alternative is to do nothing, should the project be undertaken or not? What if society is risk averse? (2.B) Suppose another economist disagrees with the various probabilities assigned to the possible first period outcomes. Suppose then that this economist proposes the following revision of probabilities: Net Benefits (, - ) -300,000 - 300,000 150,000 600,000 Probability Period 0 1.0 Period 1 .10 30 60 If the discount rate agreed upon is still 4%, find the expected NPV for these new probabilities. With the revised probabilities, should the project be undertaken? What if society is risk averse