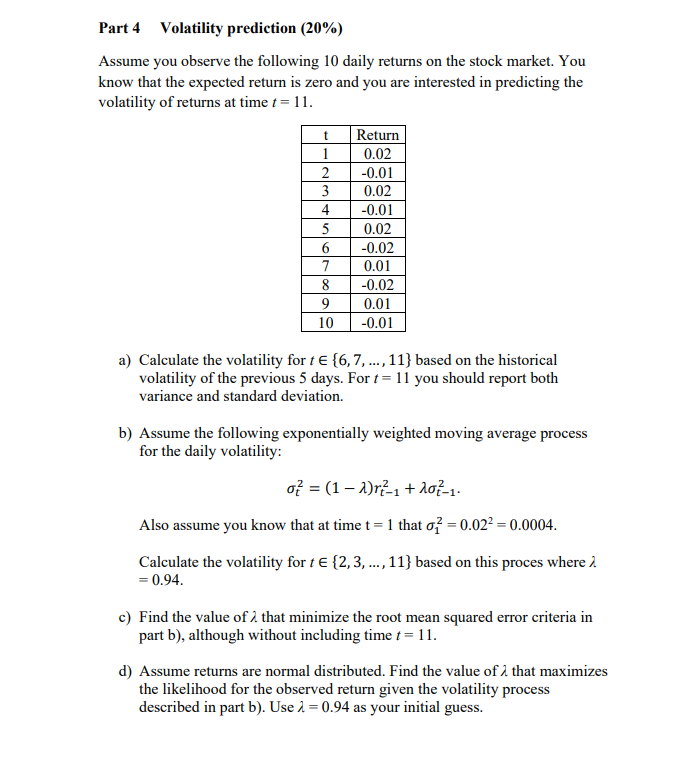

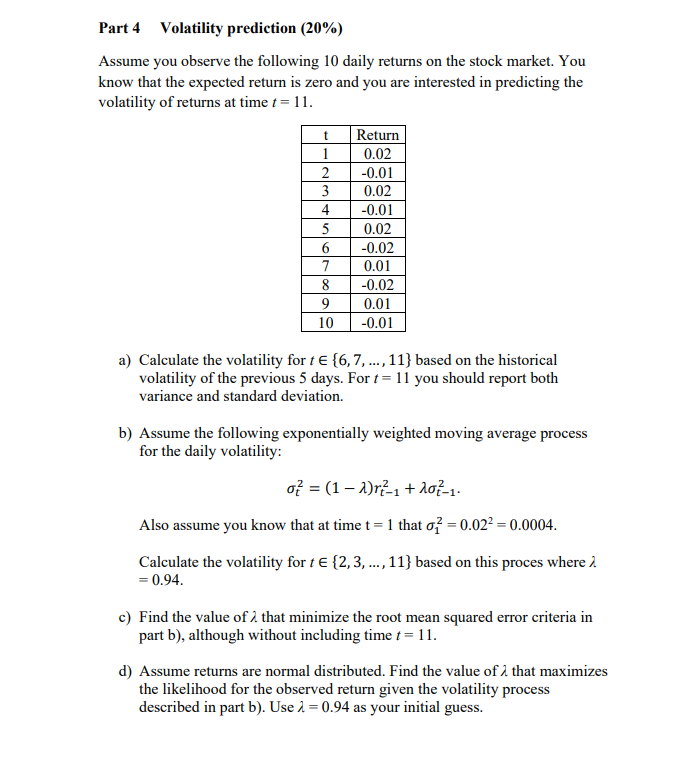

Part 4 Volatility prediction (20%) Assume you observe the following 10 daily returns on the stock market. You know that the expected return is zero and you are interested in predicting the volatility of returns at time t=11. t 1 2 3 4 5 6 7 8 9 10 Return 0.02 -0.01 0.02 -0.01 0.02 -0.02 0.01 -0.02 0.01 -0.01 a) Calculate the volatility for t {6, 7, ..., 11} based on the historical volatility of the previous 5 days. For t= 11 you should report both variance and standard deviation. b) Assume the following exponentially weighted moving average process for the daily volatility: 0} = (1 1972-1 + 107-1. Also assume you know that at time t = 1 that o = 0.022 = 0.0004. = Calculate the volatility for t e {2,3,..., 11} based on this proces where i = 0.94. c) Find the value of 2 that minimize the root mean squared error criteria in part b), although without including time t= 11. d) Assume returns are normal distributed. Find the value of that maximizes the likelihood for the observed return given the volatility process described in part b). Use 1 = 0.94 as your initial guess. Part 4 Volatility prediction (20%) Assume you observe the following 10 daily returns on the stock market. You know that the expected return is zero and you are interested in predicting the volatility of returns at time t=11. t 1 2 3 4 5 6 7 8 9 10 Return 0.02 -0.01 0.02 -0.01 0.02 -0.02 0.01 -0.02 0.01 -0.01 a) Calculate the volatility for t {6, 7, ..., 11} based on the historical volatility of the previous 5 days. For t= 11 you should report both variance and standard deviation. b) Assume the following exponentially weighted moving average process for the daily volatility: 0} = (1 1972-1 + 107-1. Also assume you know that at time t = 1 that o = 0.022 = 0.0004. = Calculate the volatility for t e {2,3,..., 11} based on this proces where i = 0.94. c) Find the value of 2 that minimize the root mean squared error criteria in part b), although without including time t= 11. d) Assume returns are normal distributed. Find the value of that maximizes the likelihood for the observed return given the volatility process described in part b). Use 1 = 0.94 as your initial guess