PART 5 MULTISTAGE ONLY

Please build a decision tree for Part 5 and include formulas, probabilities, decision nodes, calculations etc.

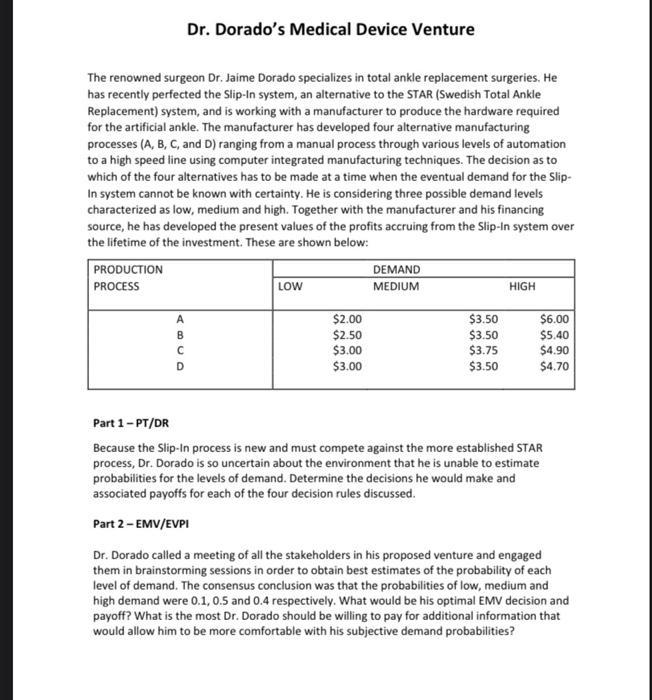

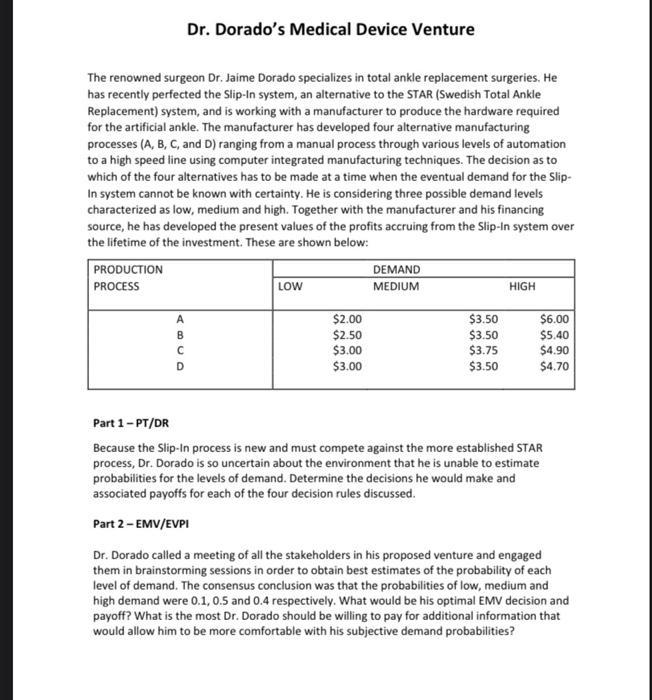

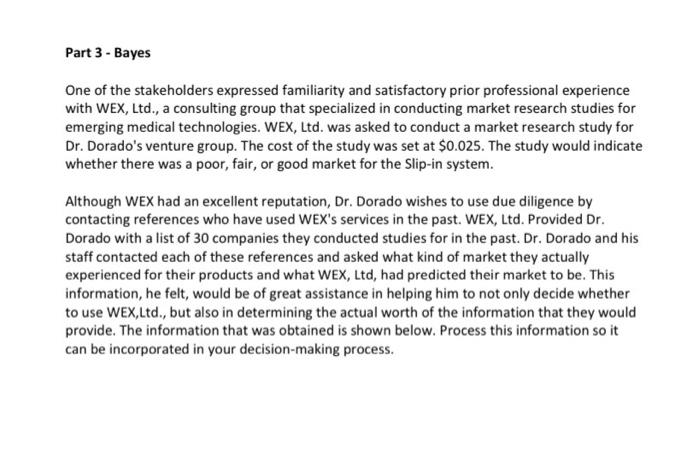

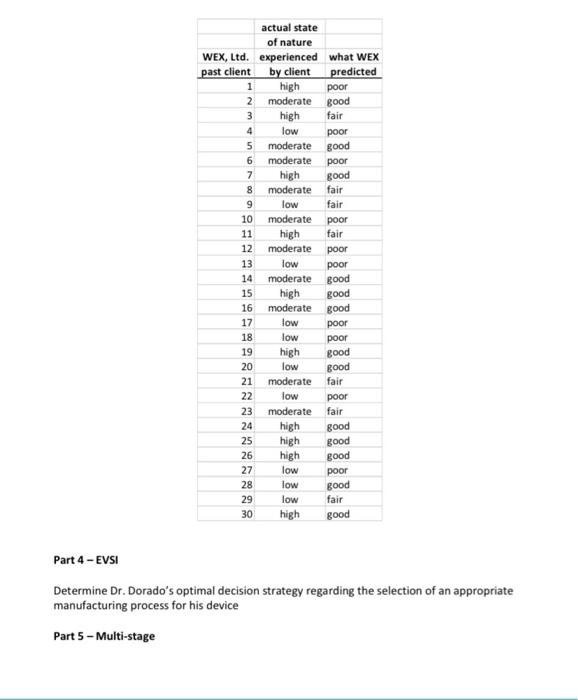

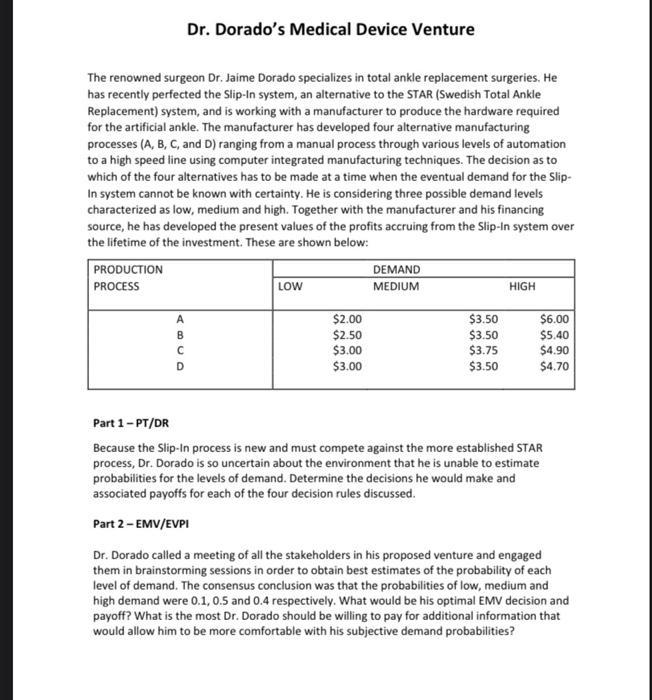

The renowned surgeon Dr. Jaime Dorado specializes in total ankle replacement surgeries. He has recently perfected the Slip-In system, an alternative to the STAR (Swedish Total Ankle Replacement) system, and is working with a manufacturer to produce the hardware required for the artificial ankle. The manufacturer has developed four alternative manufacturing processes (A, B, C, and D) ranging from a manual process through various levels of automation to a high speed line using computer integrated manufacturing techniques. The decision as to which of the four alternatives has to be made at a time when the eventual demand for the SlipIn system cannot be known with certainty. He is considering three possible demand levels characterized as low, medium and high. Together with the manufacturer and his financing source, he has developed the present values of the profits accruing from the Slip-In system over the lifetime of the investment. These are shown below: Part 1 - PT/DR Because the Slip-In process is new and must compete against the more established STAR process, Dr. Dorado is so uncertain about the environment that he is unable to estimate probabilities for the levels of demand. Determine the decisions he would make and associated payoffs for each of the four decision rules discussed. Part 2 - EMV/EVPI Dr. Dorado called a meeting of all the stakeholders in his proposed venture and engaged them in brainstorming sessions in order to obtain best estimates of the probability of each level of demand. The consensus conclusion was that the probabilities of low, medium and high demand were 0.1,0.5 and 0.4 respectively. What would be his optimal EMV decision and payoff? What is the most Dr. Dorado should be willing to pay for additional information that would allow him to be more comfortable with his subjective demand probabilities? One of the stakeholders expressed familiarity and satisfactory prior professional experience with WEX, Ltd., a consulting group that specialized in conducting market research studies for emerging medical technologies. WEX, Ltd. was asked to conduct a market research study for Dr. Dorado's venture group. The cost of the study was set at $0.025. The study would indicate whether there was a poor, fair, or good market for the Slip-in system. Although WEX had an excellent reputation, Dr. Dorado wishes to use due diligence by contacting references who have used WEX's services in the past. WEX, Ltd. Provided Dr. Dorado with a list of 30 companies they conducted studies for in the past. Dr. Dorado and his staff contacted each of these references and asked what kind of market they actually experienced for their products and what WEX, Ltd, had predicted their market to be. This information, he felt, would be of great assistance in helping him to not only decide whether to use WEX,Ltd., but also in determining the actual worth of the information that they would provide. The information that was obtained is shown below. Process this information so it can be incorporated in your decision-making process. Part 4-EVSI Determine Dr. Dorado's optimal decision strategy regarding the selection of an appropriate manufacturing process for his device Part 5-Multi-stage Dr. Dorado has formed a research consortium with scientists and engineers for the USA and Switzerland tasked with taking advantage of rapidly developing advances in biomaterials to develop the next generation Swiss-American Replacement Ankle System (SARAS). While the development of SARAS will take some time, a decision must be made now whether to incorporate plans for the eventual manufacture of SARAS in the current manufacturing process decision. Dr. Dorado realizes that it will only make sense to manufacture the SARAS system if there continues to be a high demand for ankle replacement as reflected by the number of Slip-In system surgeries performed. He is fully aware that since SARAS is still under development there is a risk that it will not work as anticipated, but estimates that the probability of that happening is only 20%. If it performs as anticipated, they expect to get an additional $4.7 in payoff. Otherwise, they will see a decrease of $2 in their payoff. One option available is for him to request (and pay for) an impartial peer review of his team's research on SARAS to see if it can assess whether his team's research has followed sound principles. Published results show that 90% of successful research projects that were peer reviewed at early stages were deemed to be following sound principles. Similarly, 90% of failed research projects that were peer reviewed at early stages were deemed not to be following sound principles. What should Dr. Dorado's decision strategy be for including SARAS in the manufacturing process he will select