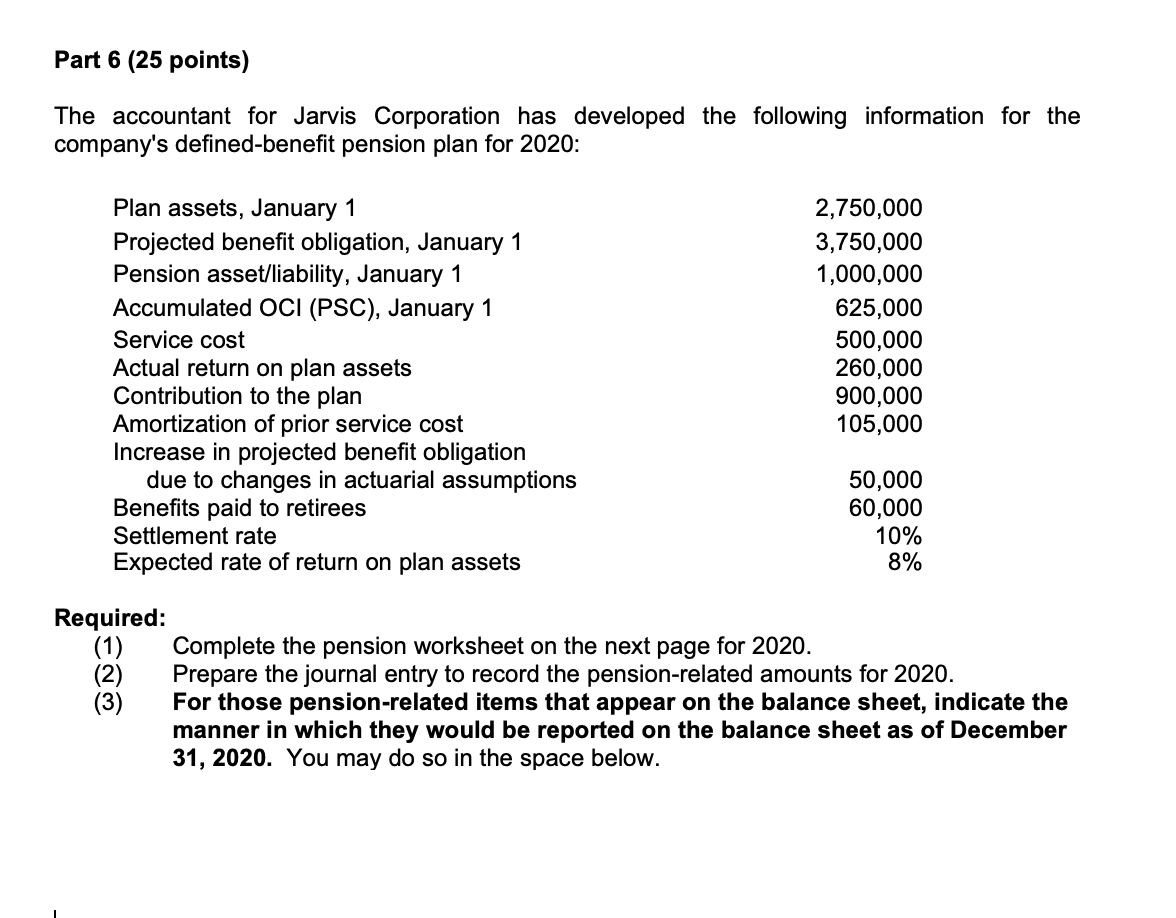

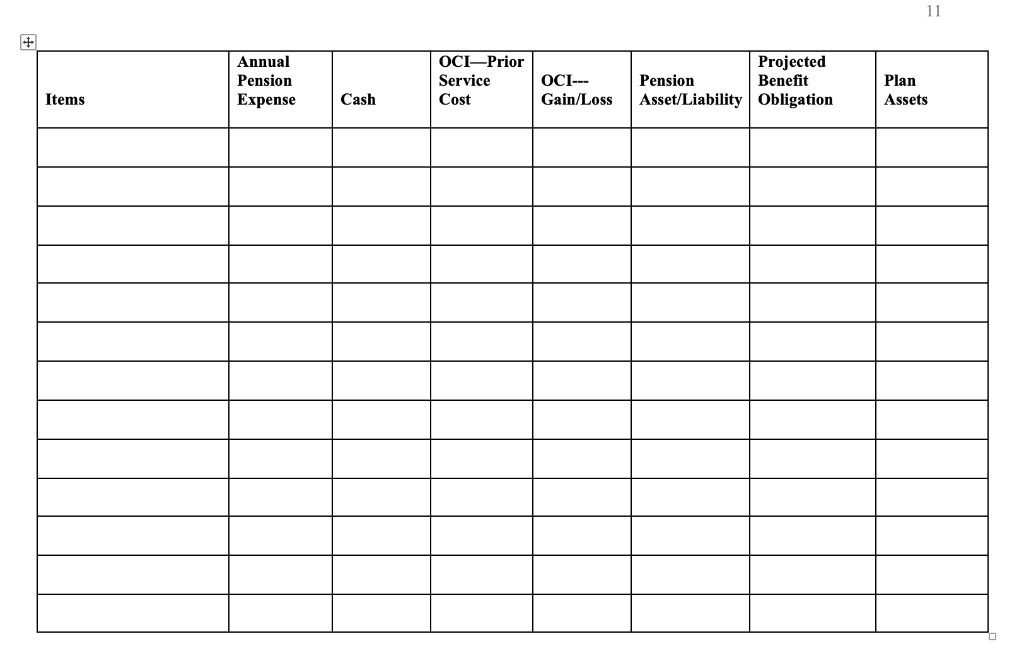

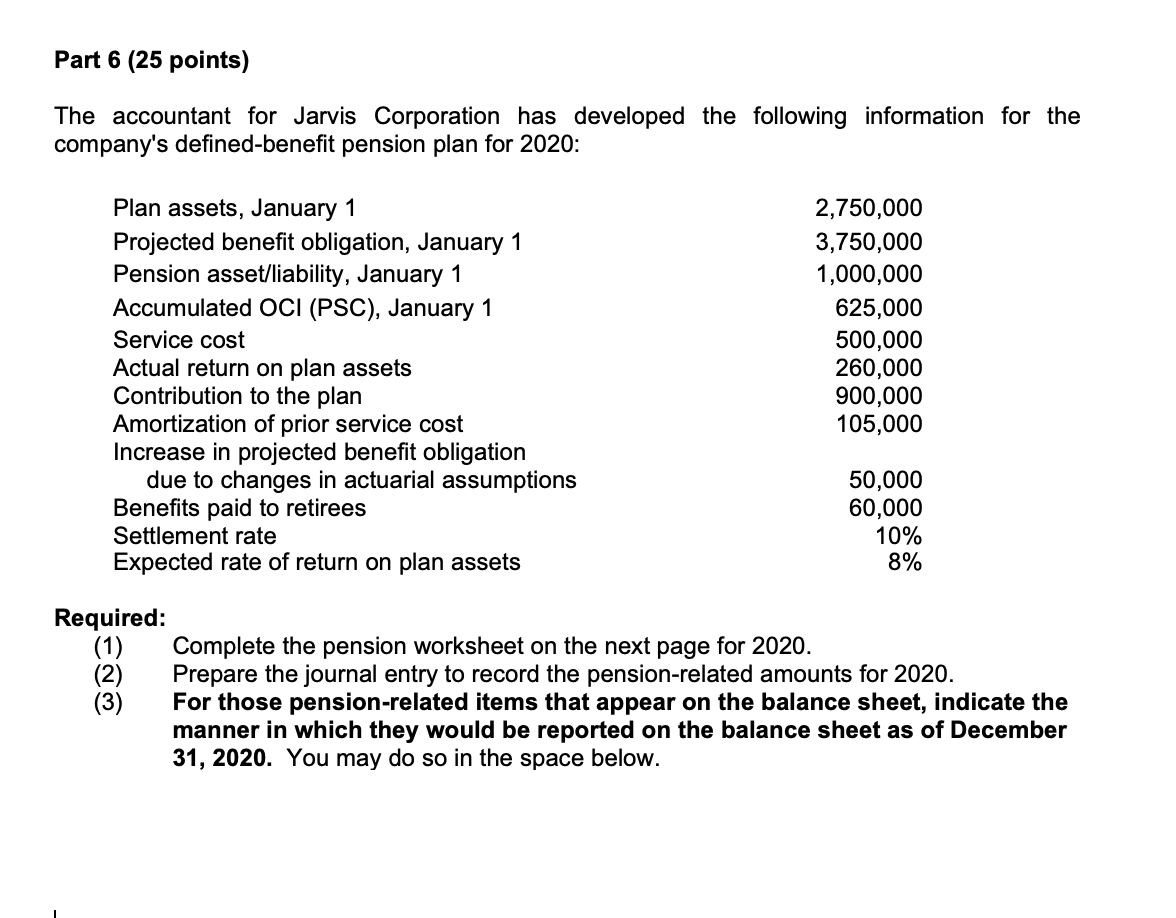

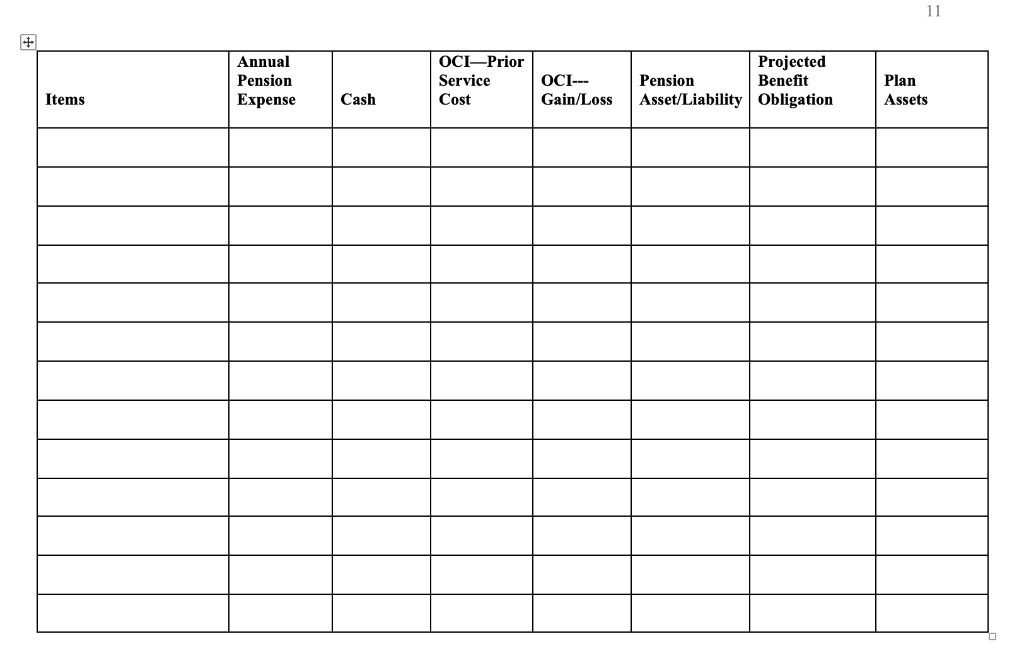

Part 6 (25 points) The accountant for Jarvis Corporation has developed the following information for the company's defined-benefit pension plan for 2020: Plan assets, January 1 Projected benefit obligation, January 1 Pension asset/liability, January 1 Accumulated OCI (PSC), January 1 Service cost Actual return on plan assets Contribution to the plan Amortization of prior service cost Increase in projected benefit obligation due to changes in actuarial assumptions Benefits paid to retirees Settlement rate Expected rate of return on plan assets 2,750,000 3,750,000 1,000,000 625,000 500,000 260,000 900,000 105,000 50,000 60,000 10% 8% Required: (1) Complete the pension worksheet on the next page for 2020. (2) Prepare the journal entry to record the pension-related amounts for 2020. (3) For those pension-related items that appear on the balance sheet, indicate the manner in which they would be reported on the balance sheet as of December 31, 2020. You may do so in the space below. 11 Annual Pension Expense OCI-Prior Service Cost OCI--- Gain/Loss Projected Pension Benefit Asset/Liability Obligation Plan Assets Items Cash Part 6 (25 points) The accountant for Jarvis Corporation has developed the following information for the company's defined-benefit pension plan for 2020: Plan assets, January 1 Projected benefit obligation, January 1 Pension asset/liability, January 1 Accumulated OCI (PSC), January 1 Service cost Actual return on plan assets Contribution to the plan Amortization of prior service cost Increase in projected benefit obligation due to changes in actuarial assumptions Benefits paid to retirees Settlement rate Expected rate of return on plan assets 2,750,000 3,750,000 1,000,000 625,000 500,000 260,000 900,000 105,000 50,000 60,000 10% 8% Required: (1) Complete the pension worksheet on the next page for 2020. (2) Prepare the journal entry to record the pension-related amounts for 2020. (3) For those pension-related items that appear on the balance sheet, indicate the manner in which they would be reported on the balance sheet as of December 31, 2020. You may do so in the space below. 11 Annual Pension Expense OCI-Prior Service Cost OCI--- Gain/Loss Projected Pension Benefit Asset/Liability Obligation Plan Assets Items Cash