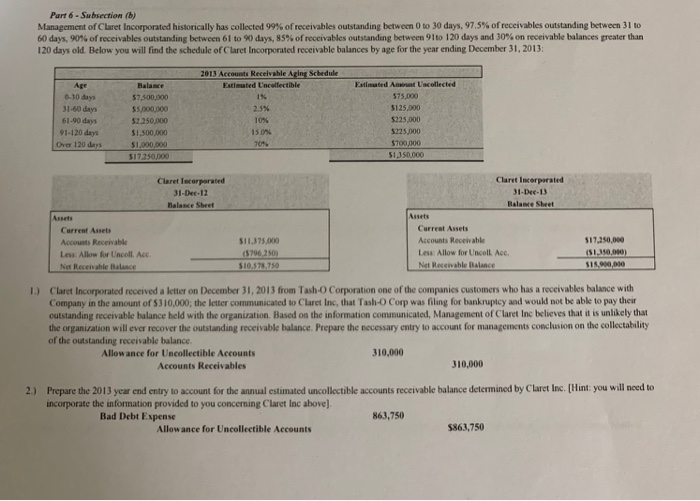

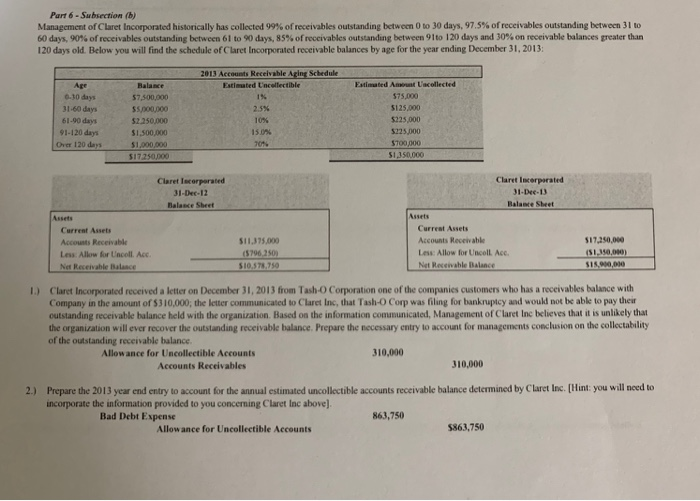

Part 6 - Subsection (b) Management of Claret incorporated historically has collected 99% of receivables outstanding between 0 to 30 days. 97.5% of receivables outstanding between 31 60 days, 90% of receivables outstanding between 61 to 90 days, 85% of receivables outstanding between 9110 120 days and 30% on receivable balances greater than 120 days old. Below you will find the schedule of Claret incorporated receivable balances by age for the year ending December 31, 2013 2013 Acts Receivable Aging Schedule Flated Lincolectible Ap 6-30 days 31-60 days 61.90 days 91-120 days Ore 120 days 57.500.000 $5,000.00 52.250,000 $1.500,000 51.000.000 5173 Estimated Liscollected $75.000 $125.000 $225.000 525.000 $700.000 51 150 000 Claret corporated 31-Dec-12 Balance Sheet Claret Incorporated 31-Dec-13 Balance Sheet Assets Current Assets Accounts Receivable Less Allow for Uncoll. Ace Not Receivable Balance $11,375,000 (57962509 $10.578,750 Curreal Assets Accounts Receivable Las Allow for Uncoll. Ace. Not Receivable Balance 517,250,000 (51,150,000) SI5.000, 00 1) Clare Incorporated received a letter on December 1, 2013 from Tash-o Corporation one of the companies customers who has receivables balance with Company in the amount of $310,000, the letter communicated to Claret Inc, that Tash-oCorp was filing for bankruptcy and would not be able to pay their outstanding receivable balance held with the organization. Based on the information communicated, Management of Claret Inc believes that it is unlikely that the organization will ever recover the outstanding receivable balance. Prepare the necessary entry to account for managements conclusion on the collectability of the outstanding receivable balance Allowance for Uncollectible Accounts 310,000 Accounts Receivables 310,000 2. Prepare the 2013 year end entry to account for the annual estimated uncollectible accounts receivable balance determined by Clare Inc. (Hintyou will need to incorporate the information provided to you concerning Claret Inc above] Bad Debt Expense 86.3.750 Allowance for Uncollectible Accounts $863,750 Part 6 - Subsection (b) Management of Claret incorporated historically has collected 99% of receivables outstanding between 0 to 30 days. 97.5% of receivables outstanding between 31 60 days, 90% of receivables outstanding between 61 to 90 days, 85% of receivables outstanding between 9110 120 days and 30% on receivable balances greater than 120 days old. Below you will find the schedule of Claret incorporated receivable balances by age for the year ending December 31, 2013 2013 Acts Receivable Aging Schedule Flated Lincolectible Ap 6-30 days 31-60 days 61.90 days 91-120 days Ore 120 days 57.500.000 $5,000.00 52.250,000 $1.500,000 51.000.000 5173 Estimated Liscollected $75.000 $125.000 $225.000 525.000 $700.000 51 150 000 Claret corporated 31-Dec-12 Balance Sheet Claret Incorporated 31-Dec-13 Balance Sheet Assets Current Assets Accounts Receivable Less Allow for Uncoll. Ace Not Receivable Balance $11,375,000 (57962509 $10.578,750 Curreal Assets Accounts Receivable Las Allow for Uncoll. Ace. Not Receivable Balance 517,250,000 (51,150,000) SI5.000, 00 1) Clare Incorporated received a letter on December 1, 2013 from Tash-o Corporation one of the companies customers who has receivables balance with Company in the amount of $310,000, the letter communicated to Claret Inc, that Tash-oCorp was filing for bankruptcy and would not be able to pay their outstanding receivable balance held with the organization. Based on the information communicated, Management of Claret Inc believes that it is unlikely that the organization will ever recover the outstanding receivable balance. Prepare the necessary entry to account for managements conclusion on the collectability of the outstanding receivable balance Allowance for Uncollectible Accounts 310,000 Accounts Receivables 310,000 2. Prepare the 2013 year end entry to account for the annual estimated uncollectible accounts receivable balance determined by Clare Inc. (Hintyou will need to incorporate the information provided to you concerning Claret Inc above] Bad Debt Expense 86.3.750 Allowance for Uncollectible Accounts $863,750