Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 8: At point L in Fig. B (Put Option), the Put buyer: (2 marks) Part 9: At higher prices of the underlying than point

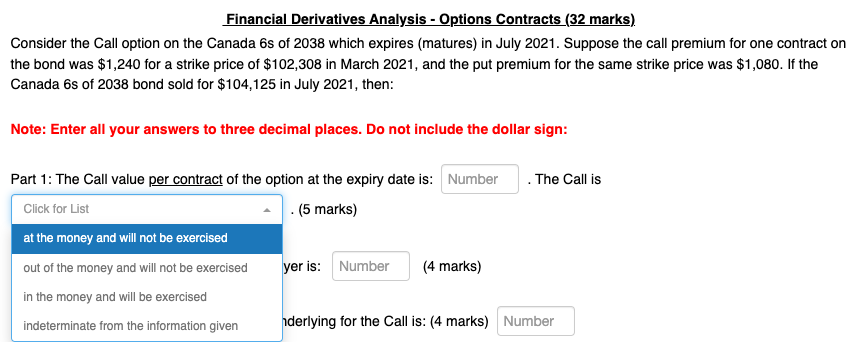

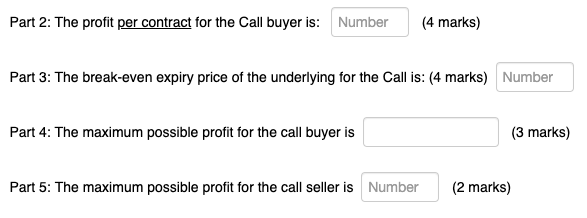

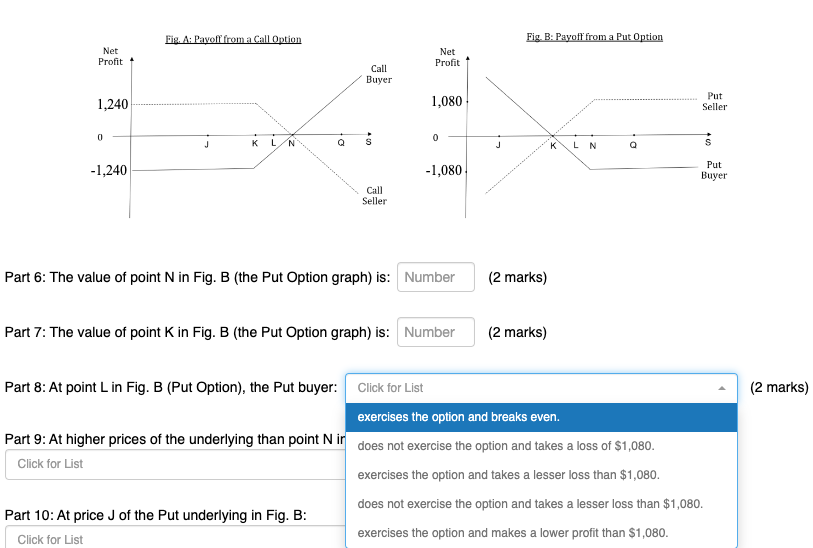

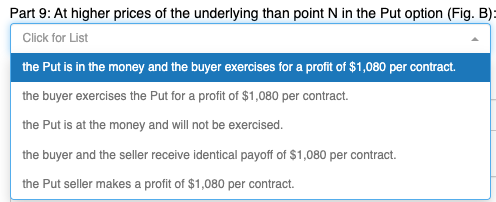

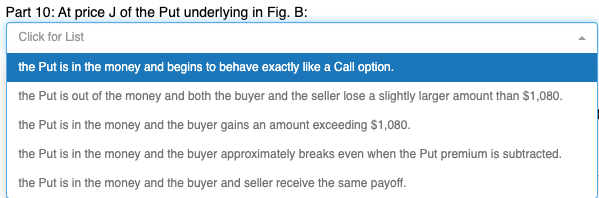

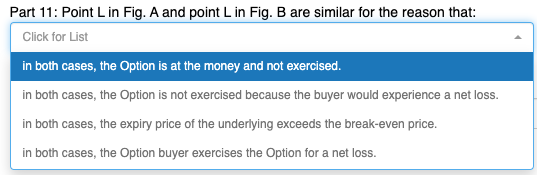

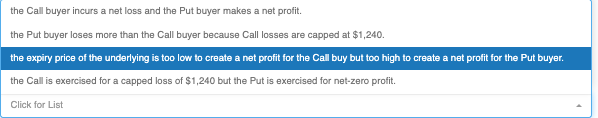

Part 8: At point L in Fig. B (Put Option), the Put buyer: (2 marks) Part 9: At higher prices of the underlying than point N ir Part 10: At price J of the Put underlying in Fig. B: the Call buyer incurs a net loss and the Put buyer makes a net profit. the Put buyer loses more than the Call buyer because Call losses are capped at \$1,240. the expiry price of the underlying is too low to create a net profit for the Call buy but too high to create a net profit for the Put buyer. the Call is exercised for a capped loss of $1,240 but the Put is exercised for net-zero profit. Click for List Part 11: Point L in Fig. A and point L in Fig. B are similar for the reason that: Click for List in both cases, the Option is at the money and not exercised. in both cases, the Option is not exercised because the buyer would experience a net loss. in both cases, the expiry price of the underlying exceeds the break-even price. in both cases, the Option buyer exercises the Option for a net loss. Part 10: At price J of the Put underlying in Fig. B: Click for List the Put is in the money and begins to behave exactly like a Call option. the Put is out of the money and both the buyer and the seller lose a slightly larger amount than $1,080. the Put is in the money and the buyer gains an amount exceeding $1,080. the Put is in the money and the buyer approximately breaks even when the Put premium is subtracted. the Put is in the money and the buyer and seller receive the same payoff. Click for List the Put is in the money and the buyer exercises for a profit of $1,080 per contract. the buyer exercises the Put for a profit of $1,080 per contract. the Put is at the money and will not be exercised. the buyer and the seller receive identical payoff of $1,080 per contract. the Put seller makes a profit of $1,080 per contract. Financial Derivatives Analysis - Options Contracts (32 marks). Consider the Call option on the Canada 6s of 2038 which expires (matures) in July 2021. Suppose the call premium for one contract on the bond was $1,240 for a strike price of $102,308 in March 2021 , and the put premium for the same strike price was $1,080. If the Canada 6 s of 2038 bond sold for $104,125 in July 2021 , then: Note: Enter all your answers to three decimal places. Do not include the dollar sign: Part 1: The Call value per contract of the option at the expiry date is: . (5 marks) yer is: (4 marks) . The Call is . The Call is Iderlying for the Call is: (4 marks) Part 2: The profit per contract for the Call buyer is: (4 marks) Part 3: The break-even expiry price of the underlying for the Call is: (4 marks) Part 4: The maximum possible profit for the call buyer is (3 marks) Part 5: The maximum possible profit for the call seller is (2 marks) Part 12: Point J in Fig. A and point J in Fig. B differ for the reason that: Click for List

Part 8: At point L in Fig. B (Put Option), the Put buyer: (2 marks) Part 9: At higher prices of the underlying than point N ir Part 10: At price J of the Put underlying in Fig. B: the Call buyer incurs a net loss and the Put buyer makes a net profit. the Put buyer loses more than the Call buyer because Call losses are capped at \$1,240. the expiry price of the underlying is too low to create a net profit for the Call buy but too high to create a net profit for the Put buyer. the Call is exercised for a capped loss of $1,240 but the Put is exercised for net-zero profit. Click for List Part 11: Point L in Fig. A and point L in Fig. B are similar for the reason that: Click for List in both cases, the Option is at the money and not exercised. in both cases, the Option is not exercised because the buyer would experience a net loss. in both cases, the expiry price of the underlying exceeds the break-even price. in both cases, the Option buyer exercises the Option for a net loss. Part 10: At price J of the Put underlying in Fig. B: Click for List the Put is in the money and begins to behave exactly like a Call option. the Put is out of the money and both the buyer and the seller lose a slightly larger amount than $1,080. the Put is in the money and the buyer gains an amount exceeding $1,080. the Put is in the money and the buyer approximately breaks even when the Put premium is subtracted. the Put is in the money and the buyer and seller receive the same payoff. Click for List the Put is in the money and the buyer exercises for a profit of $1,080 per contract. the buyer exercises the Put for a profit of $1,080 per contract. the Put is at the money and will not be exercised. the buyer and the seller receive identical payoff of $1,080 per contract. the Put seller makes a profit of $1,080 per contract. Financial Derivatives Analysis - Options Contracts (32 marks). Consider the Call option on the Canada 6s of 2038 which expires (matures) in July 2021. Suppose the call premium for one contract on the bond was $1,240 for a strike price of $102,308 in March 2021 , and the put premium for the same strike price was $1,080. If the Canada 6 s of 2038 bond sold for $104,125 in July 2021 , then: Note: Enter all your answers to three decimal places. Do not include the dollar sign: Part 1: The Call value per contract of the option at the expiry date is: . (5 marks) yer is: (4 marks) . The Call is . The Call is Iderlying for the Call is: (4 marks) Part 2: The profit per contract for the Call buyer is: (4 marks) Part 3: The break-even expiry price of the underlying for the Call is: (4 marks) Part 4: The maximum possible profit for the call buyer is (3 marks) Part 5: The maximum possible profit for the call seller is (2 marks) Part 12: Point J in Fig. A and point J in Fig. B differ for the reason that: Click for List Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started