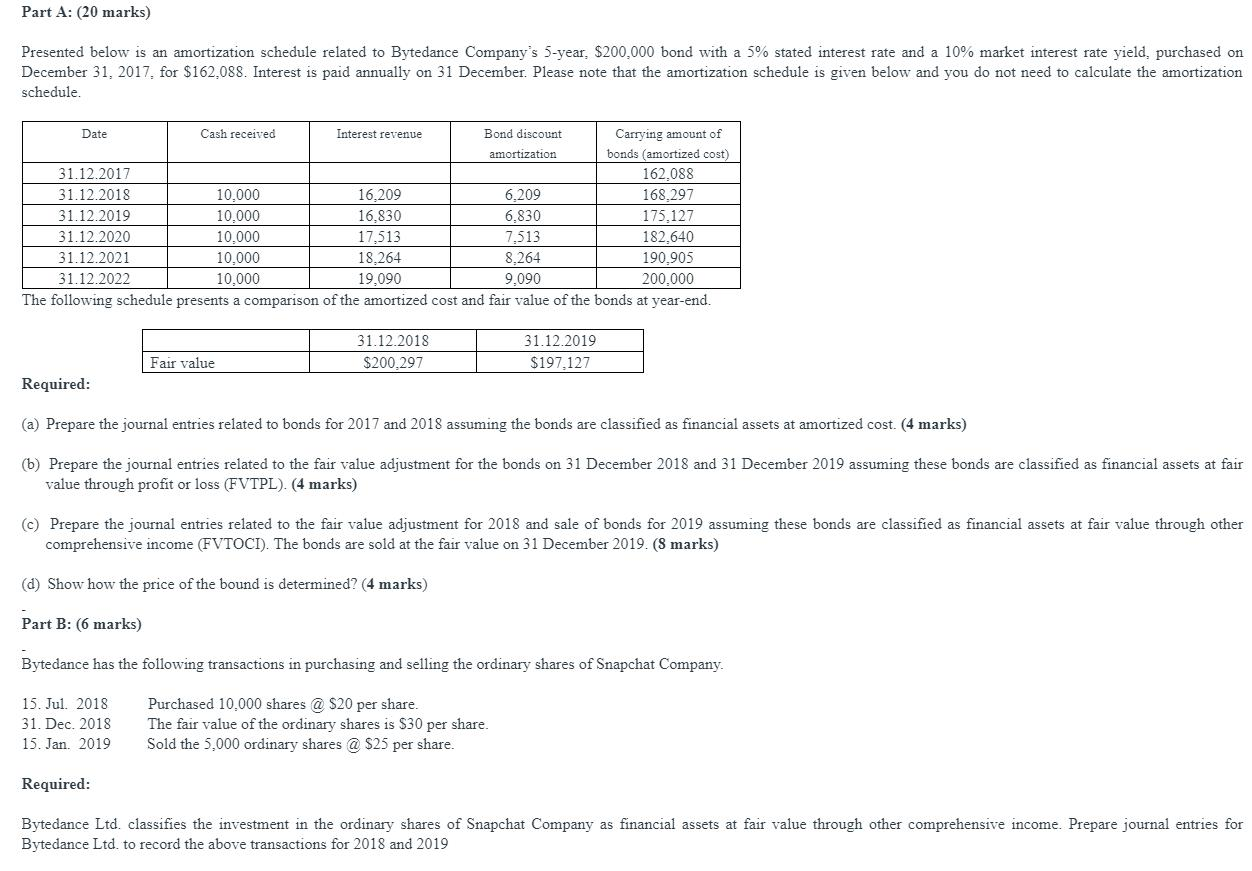

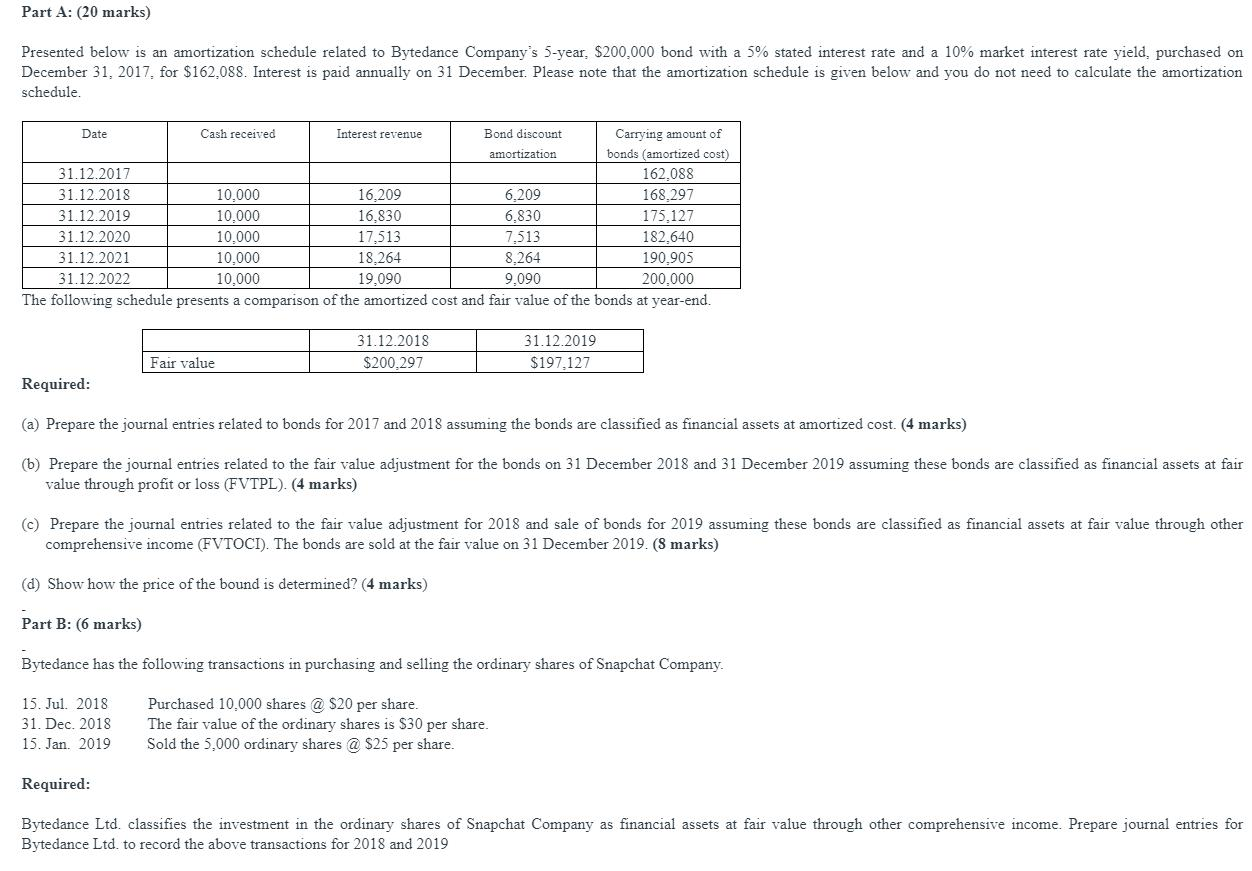

Part A: (20 marks) Presented below is an amortization schedule related to Bytedance Company's 5-year. $200,000 bond with a 5% stated interest rate and a 10% market interest rate yield, purchased on December 31, 2017. for $162,088. Interest is paid annually on 31 December. Please note that the amortization schedule is given below and you do not need to calculate the amortization schedule. Date Cash received Interest revenue Bond discount Carrying amount of amortization bonds (amortized cost) 31.12.2017 162.088 31.12.2018 10.000 16,209 6.209 168.297 31.12.2019 10.000 16.830 6.830 175.127 31.12.2020 10,000 17,513 7.513 182.640 31.12.2021 10,000 18.264 8.264 190.905 31.12.2022 10,000 19,090 9,090 200.000 The following schedule presents a comparison of the amortized cost and fair value of the bonds at year-end. 31.12.2018 $200.297 31.12.2019 $197.127 Fair value Required: a) Prepare the journal entries related to bonds for 2017 and 2018 assuming the bonds are classified as financial assets at amortized cost. (4 marks) (b) Prepare the journal entries related to the fair value adjustment for the bonds on 31 December 2018 and 31 December 2019 assuming these bonds are classified as financial assets at fair value through profit or loss (FVTPL). (4 marks) (c) Prepare the journal entries related to the fair value adjustment for 2018 and sale of bonds for 2019 assuming these bonds are classified as financial assets at fair value through other comprehensive income (FVTOCI). The bonds are sold at the fair value on 31 December 2019. (8 marks) (d) Show how the price of the bound is determined? (4 marks) Part B: 6 marks) Bytedance has the following transactions in purchasing and selling the ordinary shares of Snapchat Company 15. Jul. 2018 31. Dec. 2018 15. Jan. 2019 Purchased 10,000 shares @ $20 per share. The fair value of the ordinary shares is $30 per share Sold the 5,000 ordinary shares @ $25 per share. Required: Bytedance Ltd. classifies the investment in the ordinary shares of Snapchat Company as financial assets at fair value through other comprehensive income. Prepare journal entries for Bytedance Ltd. to record the above transactions for 2018 and 2019