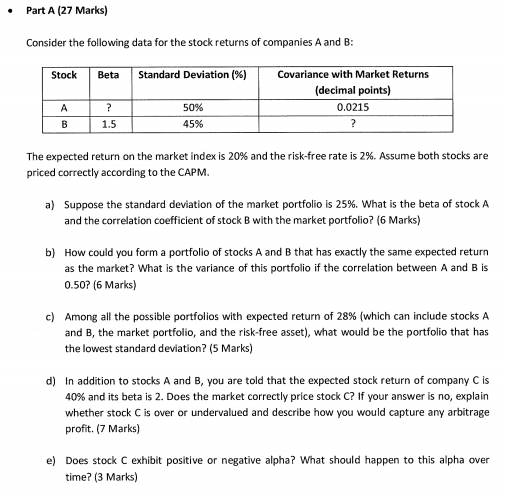

Part A (27 Marks) Consider the following data for the stock returns of companies A and B: Stock | Beta Standard Deviation (%) Covariance with Market Returns (decimal points) 0.0215 50% 45% 1.5 The expected return on the market index is 20% and the risk-free rate is 2%. Assume both stocks are priced correctly according to the CAPM. a) Suppose the standard deviation of the market portfolio is 25%. What is the beta of stock A and the correlation coefficient of stock B with the market portfolio? (6 Marks) b) How could you form a portfolio of stocks A and B that has exactly the same expected return as the market? What is the variance of this portfolio if the correlation between A and B is 0.50? (6 Marks) c) Among all the possible portfolios with expected return of 28% (which can include stocks A and B, the market portfolio, and the risk-free asset), what would be the portfolio that has the lowest standard deviation? (5 Marks) d) in addition to stocks A and B, you are told that the expected stock return of company Cis 40% and its beta is 2. Does the market correctly price stock C? If your answer is no, explain whether stock C is over or undervalued and describe how you would capture any arbitrage profit. (7 Marks) e) Does stock C exhibit positive or negative alpha? What should happen to this alpha over time? (3 Marks) Part A (27 Marks) Consider the following data for the stock returns of companies A and B: Stock | Beta Standard Deviation (%) Covariance with Market Returns (decimal points) 0.0215 50% 45% 1.5 The expected return on the market index is 20% and the risk-free rate is 2%. Assume both stocks are priced correctly according to the CAPM. a) Suppose the standard deviation of the market portfolio is 25%. What is the beta of stock A and the correlation coefficient of stock B with the market portfolio? (6 Marks) b) How could you form a portfolio of stocks A and B that has exactly the same expected return as the market? What is the variance of this portfolio if the correlation between A and B is 0.50? (6 Marks) c) Among all the possible portfolios with expected return of 28% (which can include stocks A and B, the market portfolio, and the risk-free asset), what would be the portfolio that has the lowest standard deviation? (5 Marks) d) in addition to stocks A and B, you are told that the expected stock return of company Cis 40% and its beta is 2. Does the market correctly price stock C? If your answer is no, explain whether stock C is over or undervalued and describe how you would capture any arbitrage profit. (7 Marks) e) Does stock C exhibit positive or negative alpha? What should happen to this alpha over time