Answered step by step

Verified Expert Solution

Question

1 Approved Answer

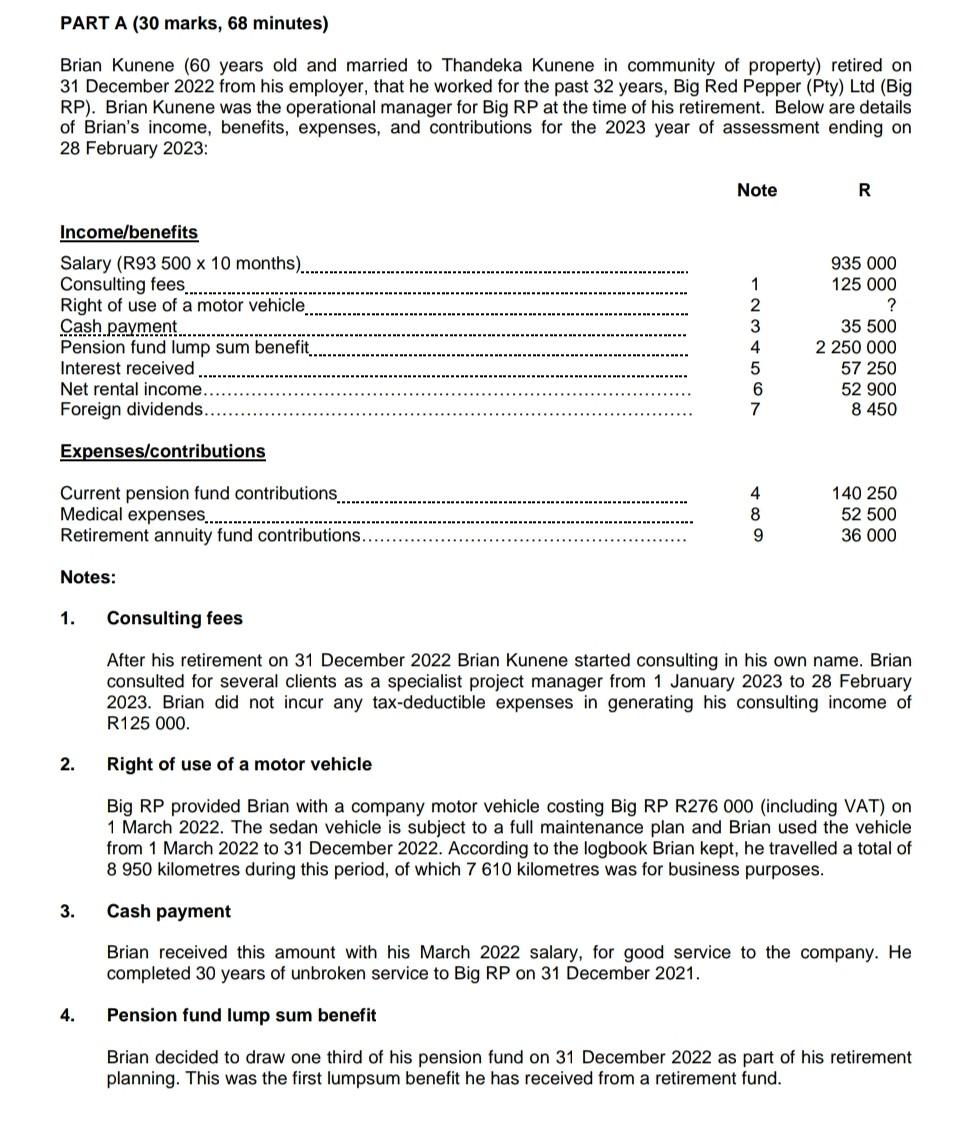

PART A (30 marks, 68 minutes) Brian Kunene (60 years old and married to Thandeka Kunene in community of property) retired on 31 December 2022

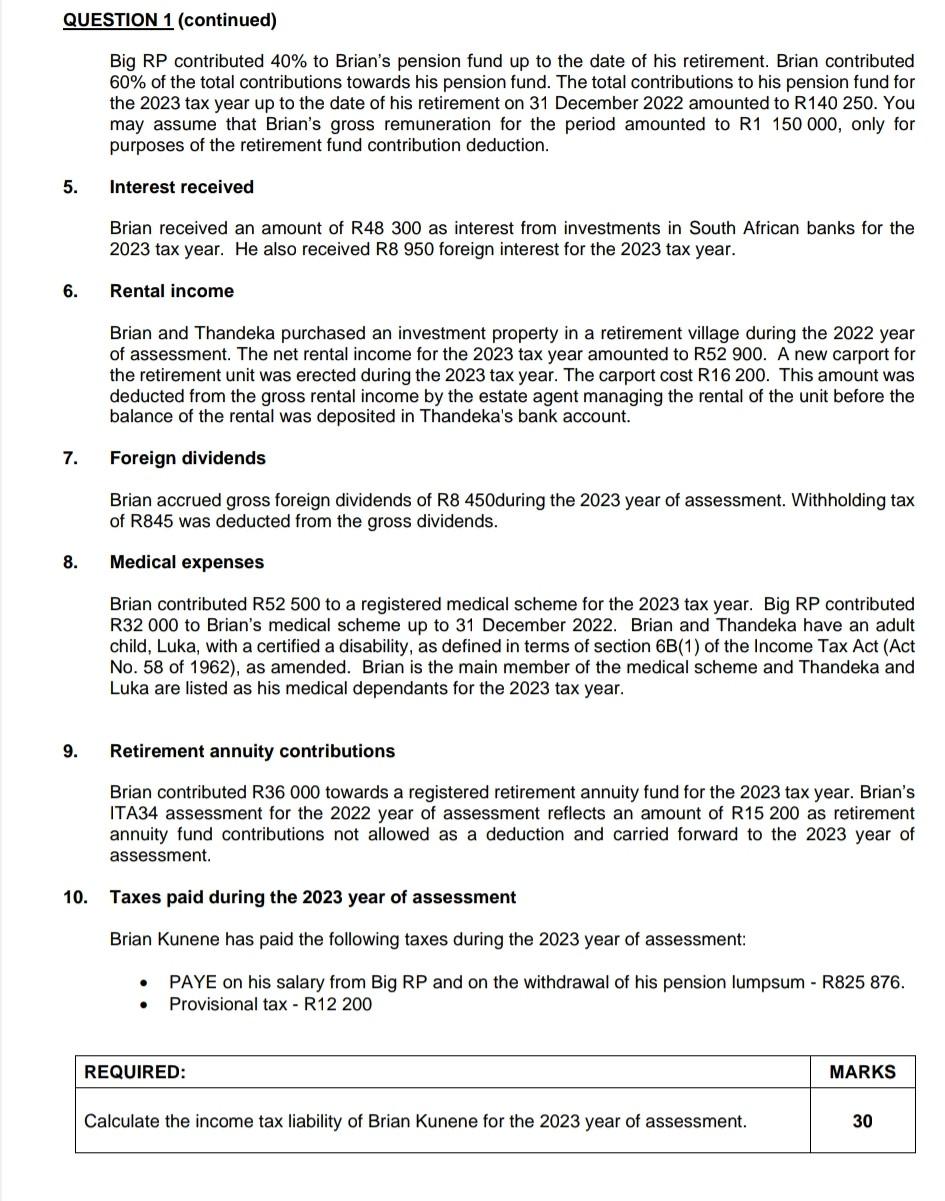

PART A (30 marks, 68 minutes) Brian Kunene (60 years old and married to Thandeka Kunene in community of property) retired on 31 December 2022 from his employer, that he worked for the past 32 years, Big Red Pepper (Pty) Ltd (Big RP). Brian Kunene was the operational manager for Big RP at the time of his retirement. Below are details of Brian's income, benefits, expenses, and contributions for the 2023 year of assessment ending on 28 February 2023: Notes: 1. Consulting fees After his retirement on 31 December 2022 Brian Kunene started consulting in his own name. Brian consulted for several clients as a specialist project manager from 1 January 2023 to 28 February 2023. Brian did not incur any tax-deductible expenses in generating his consulting income of R125 000 . 2. Right of use of a motor vehicle Big RP provided Brian with a company motor vehicle costing Big RP R276 000 (including VAT) on 1 March 2022. The sedan vehicle is subject to a full maintenance plan and Brian used the vehicle from 1 March 2022 to 31 December 2022. According to the logbook Brian kept, he travelled a total of 8950 kilometres during this period, of which 7610 kilometres was for business purposes. 3. Cash payment Brian received this amount with his March 2022 salary, for good service to the company. He completed 30 years of unbroken service to Big RP on 31 December 2021. 4. Pension fund lump sum benefit Brian decided to draw one third of his pension fund on 31 December 2022 as part of his retirement planning. This was the first lumpsum benefit he has received from a retirement fund. QUESTION 1 (continued) Big RP contributed 40% to Brian's pension fund up to the date of his retirement. Brian contributed 60% of the total contributions towards his pension fund. The total contributions to his pension fund for the 2023 tax year up to the date of his retirement on 31 December 2022 amounted to R140 250. You may assume that Brian's gross remuneration for the period amounted to R1 150000 , only for purposes of the retirement fund contribution deduction. 5. Interest received Brian received an amount of R48 300 as interest from investments in South African banks for the 2023 tax year. He also received R8 950 foreign interest for the 2023 tax year. 6. Rental income Brian and Thandeka purchased an investment property in a retirement village during the 2022 year of assessment. The net rental income for the 2023 tax year amounted to R52 900 . A new carport for the retirement unit was erected during the 2023 tax year. The carport cost R16 200. This amount was deducted from the gross rental income by the estate agent managing the rental of the unit before the balance of the rental was deposited in Thandeka's bank account. 7. Foreign dividends Brian accrued gross foreign dividends of R8 450during the 2023 year of assessment. Withholding tax of R845 was deducted from the gross dividends. 8. Medical expenses Brian contributed R52 500 to a registered medical scheme for the 2023 tax year. Big RP contributed R32 000 to Brian's medical scheme up to 31 December 2022. Brian and Thandeka have an adult child, Luka, with a certified a disability, as defined in terms of section 6B(1) of the Income Tax Act (Act No. 58 of 1962), as amended. Brian is the main member of the medical scheme and Thandeka and Luka are listed as his medical dependants for the 2023 tax year. 9. Retirement annuity contributions Brian contributed R36 000 towards a registered retirement annuity fund for the 2023 tax year. Brian's ITA34 assessment for the 2022 year of assessment reflects an amount of R15 200 as retirement annuity fund contributions not allowed as a deduction and carried forward to the 2023 year of assessment. 10. Taxes paid during the 2023 year of assessment Brian Kunene has paid the following taxes during the 2023 year of assessment: - PAYE on his salary from Big RP and on the withdrawal of his pension lumpsum - R825 876. - Provisional tax - R12 200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started