Answered step by step

Verified Expert Solution

Question

1 Approved Answer

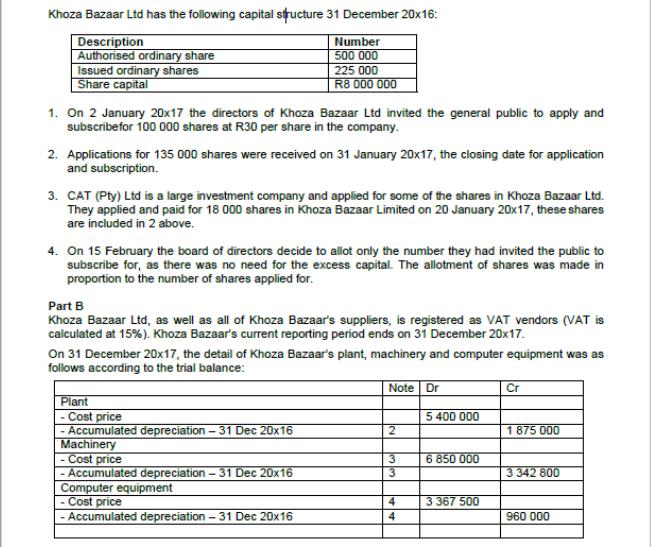

Part A Khoza Bazaar Ltd has the following capital structure 31 December 20x16: Description Authorised ordinary share Issued ordinary shares Share capital 1. On

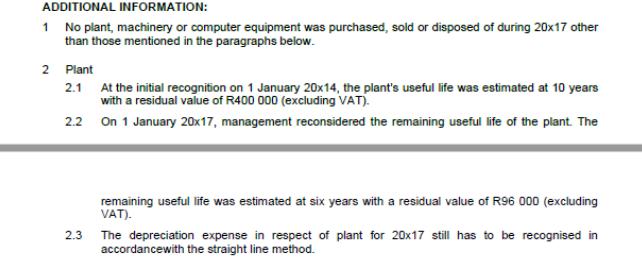

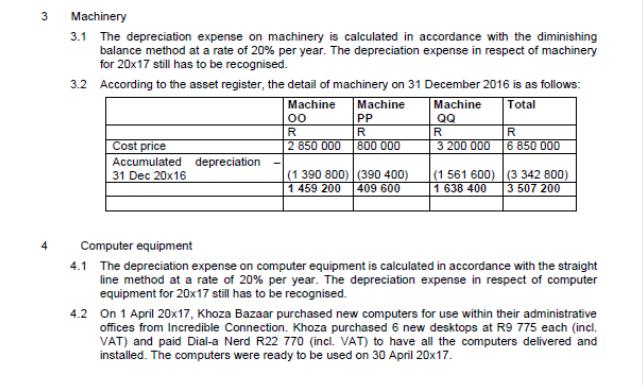

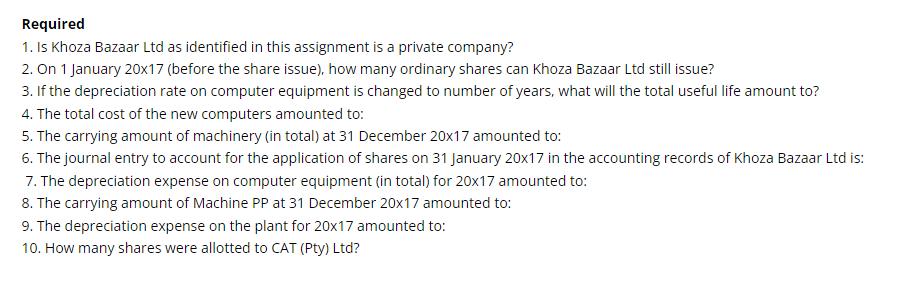

Part A Khoza Bazaar Ltd has the following capital structure 31 December 20x16: Description Authorised ordinary share Issued ordinary shares Share capital 1. On 2 January 20x17 the directors of Khoza Bazaar Ltd invited the general public to apply and subscribe for 100 000 shares at R30 per share in the company. Number 500 000 225 000 R8 000 000 2. Applications for 135 000 shares were received on 31 January 20x17, the closing date for application and subscription. 3. CAT (Pty) Ltd is a large investment company and applied for some of the shares in Khoza Bazaar Ltd. They applied and paid for 18 000 shares in Khoza Bazaar Limited on 20 January 20x17, these shares are included in 2 above. 4. On 15 February the board of directors decide to allot only the number they had invited the public to subscribe for, as there was no need for the excess capital. The allotment of shares was made in proportion to the number of shares applied for. Part B Khoza Bazaar Ltd, as well as all of Khoza Bazaar's suppliers, is registered as VAT vendors (VAT is calculated at 15%). Khoza Bazaar's current reporting period ends on 31 December 20x17. On 31 December 20x17, the detail of Khoza Bazaar's plant, machinery and computer equipment was as follows according to the trial balance: Plant - Cost price - Accumulated depreciation - 31 Dec 20x16 Machinery - Cost price - Accumulated depreciation - 31 Dec 20x16 Computer equipment - Cost price - Accumulated depreciation - 31 Dec 20x16 Note Dr 2 3 3 4 4 5 400 000 6 850 000 3 367 500 Cr 1 875 000 3 342 800 960 000 ADDITIONAL INFORMATION: 1 No plant, machinery or computer equipment was purchased, sold or disposed of during 20x17 other than those mentioned in the paragraphs below. 2 Plant 2.1 2.2 2.3 At the initial recognition on 1 January 20x14, the plant's useful life was estimated at 10 years with a residual value of R400 000 (excluding VAT). On 1 January 20x17, management reconsidered the remaining useful life of the plant. The remaining useful life was estimated at six years with a residual value of R96 000 (excluding VAT). The depreciation expense in respect of plant for 20x17 still has to be recognised in accordance with the straight line method. 3 Machinery 3.1 The depreciation expense on machinery is calculated in accordance with the diminishing balance method at a rate of 20% per year. The depreciation expense in respect of machinery for 20x17 still has to be recognised. 3.2 According to the asset register, the detail of machinery on 31 December 2016 is as follows: Total Cost price Accumulated depreciation 31 Dec 20x16 Machine 00 R 2 850 000 Machine PP R 800 000 (1 390 800) (390 400) 1 459 200 409 600 Machine QQ R R 3 200 000 6 850 000 (1 561 600) 1 638 400 (3 342 800) 3 507 200 Computer equipment 4.1 The depreciation expense on computer equipment is calculated in accordance with the straight line method at a rate of 20% per year. The depreciation expense in respect of computer equipment for 20x17 still has to be recognised. 4.2 On 1 April 20x17, Khoza Bazaar purchased new computers for use within their administrative offices from Incredible Connection. Khoza purchased 6 new desktops at R9 775 each (incl. VAT) and paid Dial-a Nerd R22 770 (incl. VAT) to have all the computers delivered and installed. The computers were ready to be used on 30 April 20x17. Required 1. Is Khoza Bazaar Ltd as identified in this assignment is a private company? 2. On 1 January 20x17 (before the share issue), how many ordinary shares can Khoza Bazaar Ltd still issue? 3. If the depreciation rate on computer equipment is changed to number of years, what will the total useful life amount to? 4. The total cost of the new computers amounted to: 5. The carrying amount of machinery (in total) at 31 December 20x17 amounted to: 6. The journal entry to account for the application of shares on 31 January 20x17 in the accounting records of Khoza Bazaar Ltd is: 7. The depreciation expense on computer equipment (in total) for 20x17 amounted to: 8. The carrying amount of Machine PP at 31 December 20x17 amounted to: 9. The depreciation expense on the plant for 20x17 amounted to: 10. How many shares were allotted to CAT (Pty) Ltd?

Step by Step Solution

★★★★★

3.37 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 4 1 Khoza Bazaar Ltd as identified in this assignment is a private company Answer False In the name of a Private Company the suffix Pvt Ltd is used in its name whereas in the name of a Publi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started