Question

Part A: a) Budget = $2,300,000; MARR = 10%. b) Use the NPW decision criterion to determine the best feasible bundle of independent projects. c)

Part A:

Part A:

a) Budget = $2,300,000; MARR = 10%. b) Use the NPW decision criterion to determine the best feasible bundle of independent projects. c) Projects B, D, E and G must be included in the best bundle. d) A maximum of five (5) projects can be selected.

1. The best investment bundle consists of projects is

A.BDEFG B.ABDEG C.BDEGH D.BCDEG 2. The NPW ($) of the best investment bundle is

A.560,000 B.570,000 C.565,000 D.585,000 3. The total first cost ($) of the best investment bundle is

A.2,130,000 B.1,950.000 C.2,150,000 D.2,050,000

Part B:

a) Budget = $2,500,000; MARR = 10%. b) Use the NPW decision criterion to determine the best feasible bundle of projects. c) Projects A and B are duplicative (select at most one project). d) Projects C and H must be excluded from the best bundle. e) Select at most 3 projects.

1. The best investment bundle consists of projects is

A.ADF B.BDF C.AEG D.BDE 2. The NPW ($) of the best investment bundle is

A.385,000 B.365,500 C.375,700 D.415,000 3. The total first cost ($) of the best investment bundle is

A.1,450,000 B.1,400,000 C.1,300,000 D.1,550,000

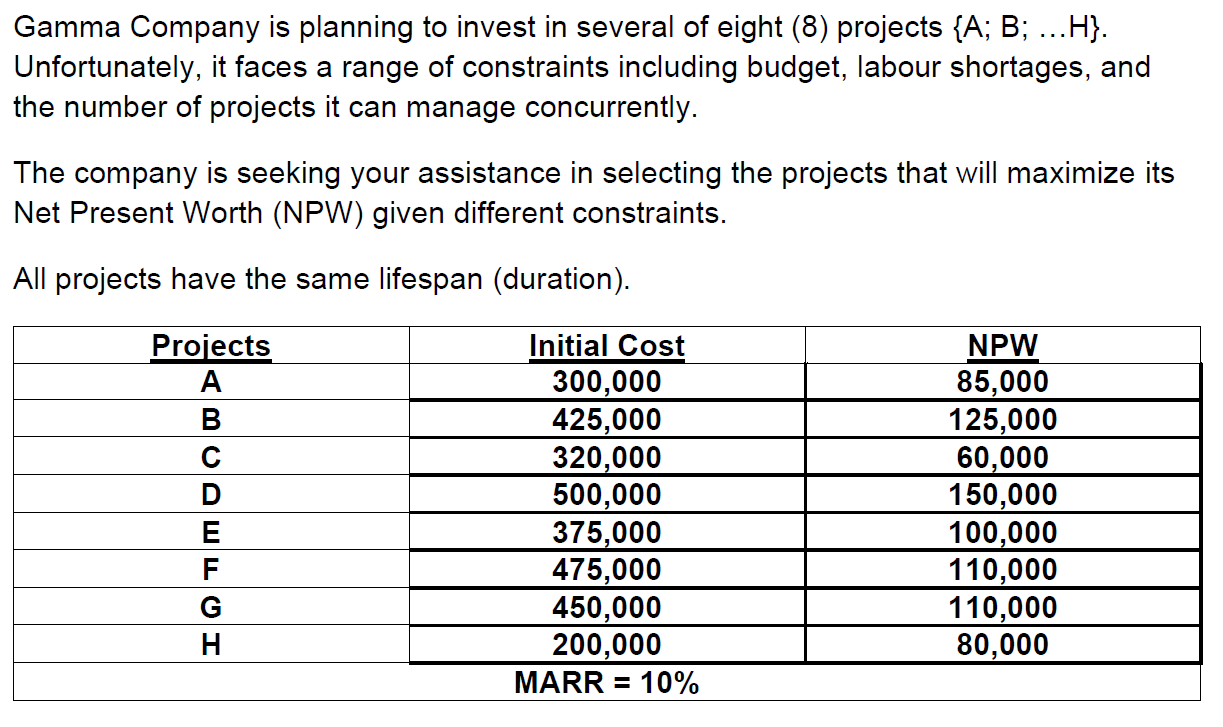

Gamma Company is planning to invest in several of eight (8) projects {A; B; ...H}. Unfortunately, it faces a range of constraints including budget, labour shortages, and the number of projects it can manage concurrently. The company is seeking your assistance in selecting the projects that will maximize its Net Present Worth (NPW) given different constraints. All projects have the same lifespan (duration). Projects A B D E F G H me UI Initial Cost 300,000 425,000 320,000 500,000 375,000 475,000 450,000 200,000 MARR = 10% NPW 85,000 125,000 60,000 150,000 100,000 110,000 110,000 80,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started