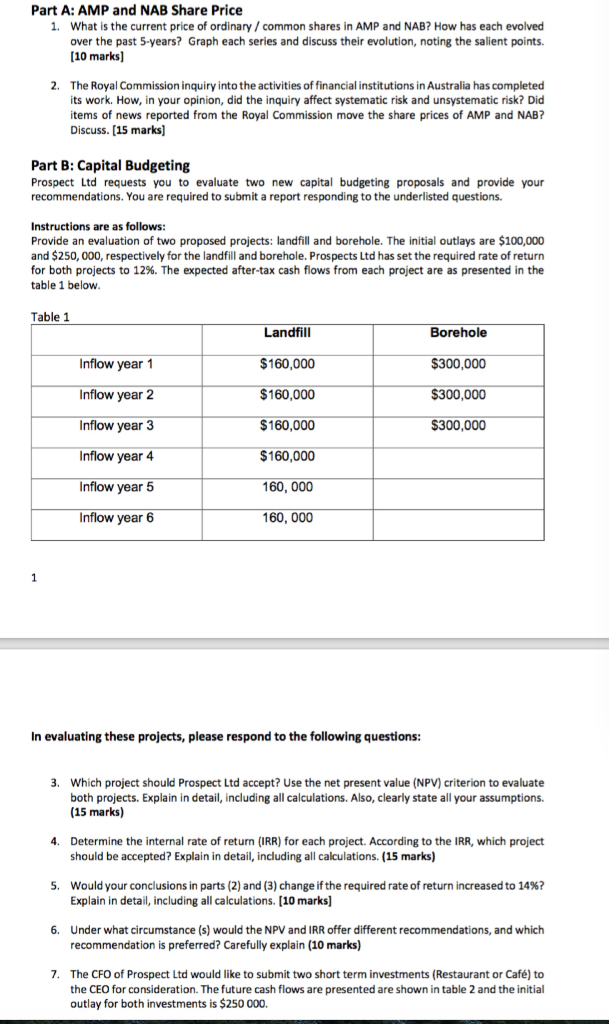

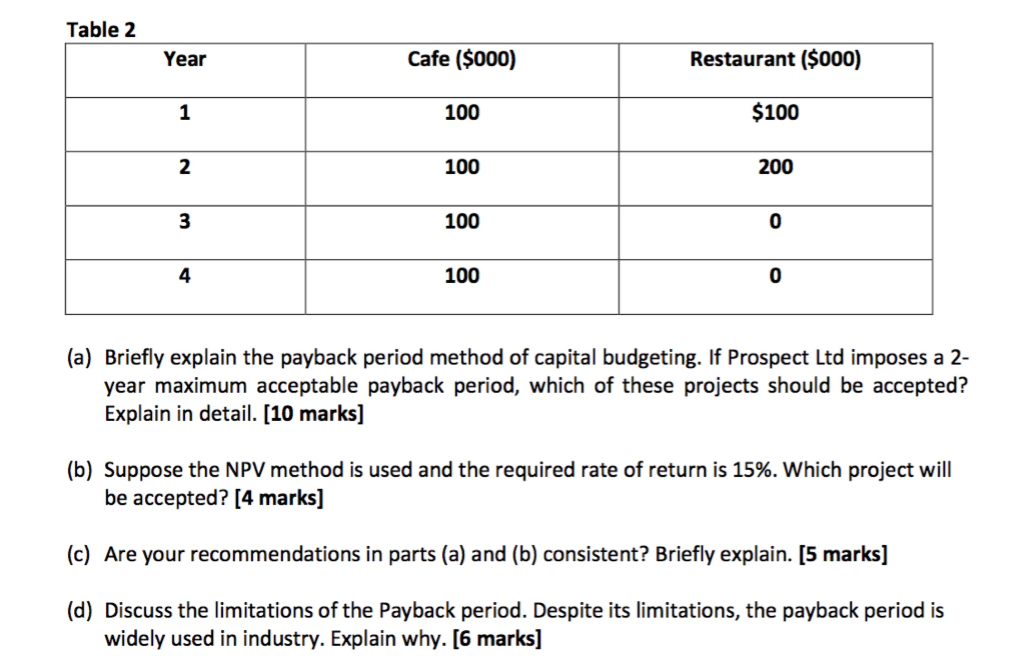

Part A: AMP and NAB Share Price What is the current price of ordinary/common shares in AMP and NAB? How has each evolved over the past 5-years? Graph each series and discuss their evolution, noting the salient points [10 marks] 1. 2. The Royal Commission inquiry into the activities of financial institutions in Australia has completed its work. How, in your opinion, did the inquiry affect systematic risk and unsystematic risk? Did items of news reported from the Royal Commission move the share prices of AMP and NAB? Discuss. [15 marks] Part B: Capital Budgeting Prospect Ltd requests you to evaluate two new capital budgeting proposals and provide your recommendations. You are required to submit a report responding to the underlisted questions. Instructions are as follows: Provide an evaluation of two proposed projects: landfill and borehole. The initial outlays are $100,000 and $250, 000, respectively for the landfill and borehole. Prospects Ltd has set the required rate of return for both projects to 12%. The expected after-tax cash flows from each project are as presented in the table 1 below Table 1 Landfill $160,000 $160,000 $160,000 $160,000 160, 000 160, 000 Borehole $300,000 300,000 $300,000 Inflow year 1 Inflow year 2 Inflow year 3 Inflow year 4 Inflow year 5 Inflow year6 In evaluating these projects, please respond to the following questions: Which project should Prospect Ltd accept? Use the net present value (NPV) criterion to evaluate both projects. Explain in detail, including all calculations. Also, clearly state all your assumptions. (15 marks) 4. Determine the internal rate of return (IRR) for each project. According to the IRR, which project should be accepted? Explain in detail, including all calculations. (15 marks) 5, would your conclusions in parts (2) and (3) change if the required rate of return increased to 14%? Explain in detail, including all calculations. [10 marks 6. Under what circumstance (s) would the NPV and IRR offer different recommendations, and which recommendation is preferred? Carefully explain (10 marks) 7. The CFO of Prospect Ltd would like to submit two short term investments(Restaurant or Caf) to the CEO for consideration. The future cash flows are presented are shown in table 2 and the initial outlay for both investments is $250 000. Table 2 Cafe ($000) 100 100 100 100 Restaurant ($000) $100 200 Year 1 2 0 (a) Briefly explain the payback period method of capital budgeting. If Prospect Ltd imposes a 2- year maximum acceptable payback period, which of these projects should be accepted? Explain in detail. [10 marks] (b) Suppose the NPV method is used and the required rate of return is 15%. which project will be accepted? [4 marks] (c) Are your recommendations in parts (a) and (b) consistent? Briefly explain. [5 marks] (d) Discuss the limitations of the Payback period. Despite its limitations, the payback period is widely used in industry. Explain why. [6 marks] Part A: AMP and NAB Share Price What is the current price of ordinary/common shares in AMP and NAB? How has each evolved over the past 5-years? Graph each series and discuss their evolution, noting the salient points [10 marks] 1. 2. The Royal Commission inquiry into the activities of financial institutions in Australia has completed its work. How, in your opinion, did the inquiry affect systematic risk and unsystematic risk? Did items of news reported from the Royal Commission move the share prices of AMP and NAB? Discuss. [15 marks] Part B: Capital Budgeting Prospect Ltd requests you to evaluate two new capital budgeting proposals and provide your recommendations. You are required to submit a report responding to the underlisted questions. Instructions are as follows: Provide an evaluation of two proposed projects: landfill and borehole. The initial outlays are $100,000 and $250, 000, respectively for the landfill and borehole. Prospects Ltd has set the required rate of return for both projects to 12%. The expected after-tax cash flows from each project are as presented in the table 1 below Table 1 Landfill $160,000 $160,000 $160,000 $160,000 160, 000 160, 000 Borehole $300,000 300,000 $300,000 Inflow year 1 Inflow year 2 Inflow year 3 Inflow year 4 Inflow year 5 Inflow year6 In evaluating these projects, please respond to the following questions: Which project should Prospect Ltd accept? Use the net present value (NPV) criterion to evaluate both projects. Explain in detail, including all calculations. Also, clearly state all your assumptions. (15 marks) 4. Determine the internal rate of return (IRR) for each project. According to the IRR, which project should be accepted? Explain in detail, including all calculations. (15 marks) 5, would your conclusions in parts (2) and (3) change if the required rate of return increased to 14%? Explain in detail, including all calculations. [10 marks 6. Under what circumstance (s) would the NPV and IRR offer different recommendations, and which recommendation is preferred? Carefully explain (10 marks) 7. The CFO of Prospect Ltd would like to submit two short term investments(Restaurant or Caf) to the CEO for consideration. The future cash flows are presented are shown in table 2 and the initial outlay for both investments is $250 000. Table 2 Cafe ($000) 100 100 100 100 Restaurant ($000) $100 200 Year 1 2 0 (a) Briefly explain the payback period method of capital budgeting. If Prospect Ltd imposes a 2- year maximum acceptable payback period, which of these projects should be accepted? Explain in detail. [10 marks] (b) Suppose the NPV method is used and the required rate of return is 15%. which project will be accepted? [4 marks] (c) Are your recommendations in parts (a) and (b) consistent? Briefly explain. [5 marks] (d) Discuss the limitations of the Payback period. Despite its limitations, the payback period is widely used in industry. Explain why. [6 marks]