Answered step by step

Verified Expert Solution

Question

1 Approved Answer

part a and b please P23-5B Bonita Labs performs steroid testing services to high schools, colleges, and uni- versities. Because the company deals solely with

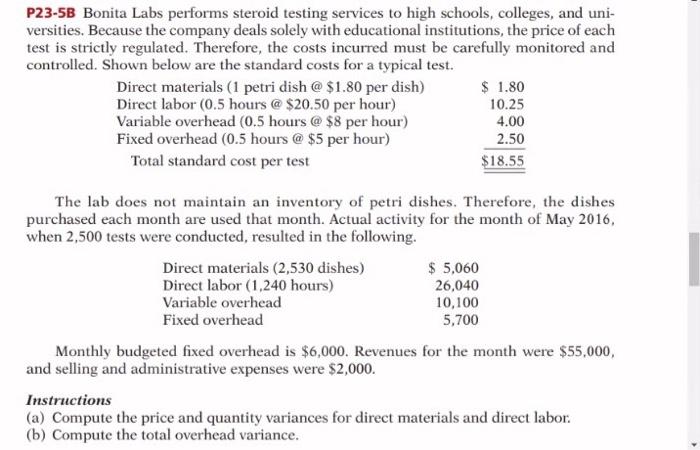

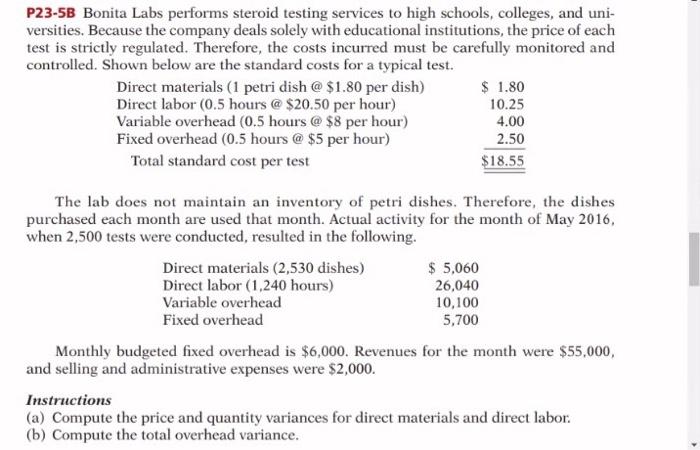

part a and b please  P23-5B Bonita Labs performs steroid testing services to high schools, colleges, and uni- versities. Because the company deals solely with educational institutions, the price of each test is strictly regulated. Therefore, the costs incurred must be carefully monitored and controlled. Shown below are the standard costs for a typical test. Direct materials (1 petri dish @ $1.80 per dish) $ 1.80 Direct labor (0.5 hours @ $20.50 per hour) 10.25 Variable overhead (0.5 hours @ $8 per hour) 4.00 Fixed overhead (0.5 hours @ $5 per hour) 2.50 Total standard cost per test $18.55 The lab does not maintain an inventory of petri dishes. Therefore, the dishes purchased each month are used that month. Actual activity for the month of May 2016, when 2,500 tests were conducted, resulted in the following. Direct materials (2,530 dishes) $ 5,060 Direct labor (1,240 hours) 26,040 Variable overhead 10,100 Fixed overhead 5,700 Monthly budgeted fixed overhead is $6,000. Revenues for the month were $55,000, and selling and administrative expenses were $2,000. Instructions (a) Compute the price and quantity variances for direct materials and direct labor. (b) Compute the total overhead variance

P23-5B Bonita Labs performs steroid testing services to high schools, colleges, and uni- versities. Because the company deals solely with educational institutions, the price of each test is strictly regulated. Therefore, the costs incurred must be carefully monitored and controlled. Shown below are the standard costs for a typical test. Direct materials (1 petri dish @ $1.80 per dish) $ 1.80 Direct labor (0.5 hours @ $20.50 per hour) 10.25 Variable overhead (0.5 hours @ $8 per hour) 4.00 Fixed overhead (0.5 hours @ $5 per hour) 2.50 Total standard cost per test $18.55 The lab does not maintain an inventory of petri dishes. Therefore, the dishes purchased each month are used that month. Actual activity for the month of May 2016, when 2,500 tests were conducted, resulted in the following. Direct materials (2,530 dishes) $ 5,060 Direct labor (1,240 hours) 26,040 Variable overhead 10,100 Fixed overhead 5,700 Monthly budgeted fixed overhead is $6,000. Revenues for the month were $55,000, and selling and administrative expenses were $2,000. Instructions (a) Compute the price and quantity variances for direct materials and direct labor. (b) Compute the total overhead variance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started