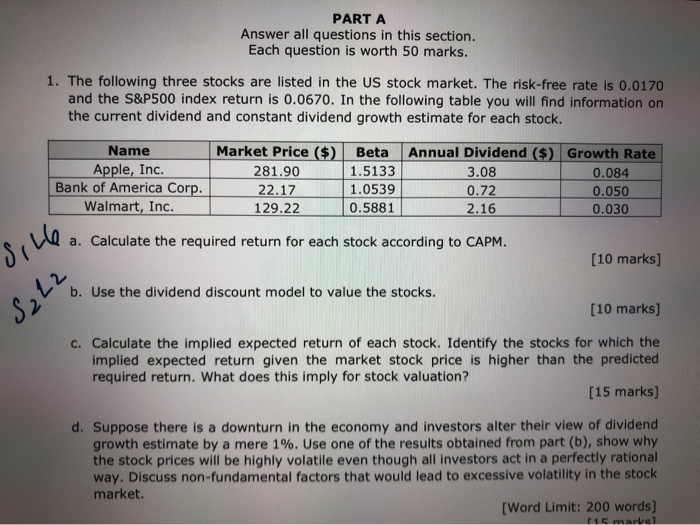

PART A Answer all questions in this section. Each question is worth 50 marks. 1. The following three stocks are listed in the US stock market. The risk-free rate is 0.0170 and the S&P500 index return is 0.0670. In the following table you will find information on the current dividend and constant dividend growth estimate for each stock. Name Apple, Inc. Bank of America Corp. Walmart, Inc. Market Price ($) 281.90 22.17 129.22 Beta 1.5133 1.0539 0.5881 Annual Dividend ($) Growth Rate 3.08 0.084 0.72 0.050 2.16 0.030 a. Calculate the required return for each stock according to CAPM. [10 marks] b. Use the dividend discount model to value the stocks. [10 marks] c. Calculate the implied expected return of each stock. Identify the stocks for which the implied expected return given the market stock price is higher than the predicted required return. What does this imply for stock valuation? [15 marks] d. Suppose there is a downturn in the economy and investors alter their view of dividend growth estimate by a mere 1%. Use one of the results obtained from part (b), show why the stock prices will be highly volatile even though all investors act in a perfectly rational way. Discuss non-fundamental factors that would lead to excessive volatility in the stock market. [Word Limit: 200 words] 15 marvel PART A Answer all questions in this section. Each question is worth 50 marks. 1. The following three stocks are listed in the US stock market. The risk-free rate is 0.0170 and the S&P500 index return is 0.0670. In the following table you will find information on the current dividend and constant dividend growth estimate for each stock. Name Apple, Inc. Bank of America Corp. Walmart, Inc. Market Price ($) 281.90 22.17 129.22 Beta 1.5133 1.0539 0.5881 Annual Dividend ($) Growth Rate 3.08 0.084 0.72 0.050 2.16 0.030 a. Calculate the required return for each stock according to CAPM. [10 marks] b. Use the dividend discount model to value the stocks. [10 marks] c. Calculate the implied expected return of each stock. Identify the stocks for which the implied expected return given the market stock price is higher than the predicted required return. What does this imply for stock valuation? [15 marks] d. Suppose there is a downturn in the economy and investors alter their view of dividend growth estimate by a mere 1%. Use one of the results obtained from part (b), show why the stock prices will be highly volatile even though all investors act in a perfectly rational way. Discuss non-fundamental factors that would lead to excessive volatility in the stock market. [Word Limit: 200 words] 15 marvel