Answered step by step

Verified Expert Solution

Question

1 Approved Answer

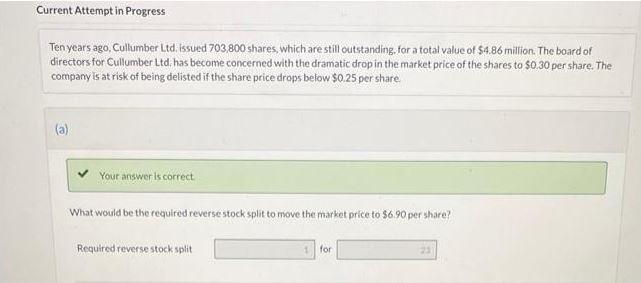

Part a answer is 1 for 23 Answer 158.82 is wrong. Ten years ago, Cullumber Ltd: issued 703,800 shares, which are still outstanding. for a

Part a answer is 1 for 23

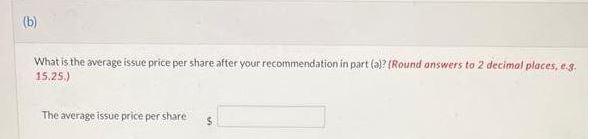

Answer 158.82 is wrong.

Ten years ago, Cullumber Ltd: issued 703,800 shares, which are still outstanding. for a total value of 54.86 million. The board of directors for Cullumber Ltd. has become concerned with the dramatic drop in the market price of the shares to 50.30 per share. The company is at risk of being delisted if the share price drops below $0.25 per share. (a) What would be the required reverse stock split to move the market price to $6.90 per share? Required reverse stock split for What is the average issue price per share after your recommendation in part (a)? \{Round onswers to 2 decimol places, e.8. 15.25. The average issue price per shape \$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started