Question

Part A Assume Pine owns 100% of Spruce and uses the equity method to record its investment in Spruce. Calculate the following figures: 1. Consolidated

Part A

Assume Pine owns 100% of Spruce and uses the equity method to record its investment

in Spruce. Calculate the following figures:

1. Consolidated net income, 2021: ________________

2. Consolidated dividends declared, 2021: _____________

3. Consolidated sales revenue, 2021: _______________

4. Investment in subsidiary at 12/31/21 (as reported by Pine): ______________

Part B

(Ignore Part A.) Assume Pine owns 100% of Spruce and uses the cost method to

record the investment. Based on the original data, calculate the following figures:

1. Consolidated net income, 2021: ____________

2. Consolidated total shareholders equity at 12/31/21: _______________

Part C

Assume Pine only owns 75% of Spruce and uses the equity method. Based on the original data, calculate the follow figures:

1. Pines own operating income, 2021: ___________

2. Consolidated net income, 2021: ______________

3. Controlling interest (CI) in consolidated net income, 2021: ______________

4. NCI in consolidated net assets at 12/31/21: _____________

5. Sales revenue (consolidated), 2021: ______________

6. Total shareholders equity (consolidated), at 12/31/21: ______________

7. Investment in subsidiary, at 12/31/21 (as reported by Pine): _____________

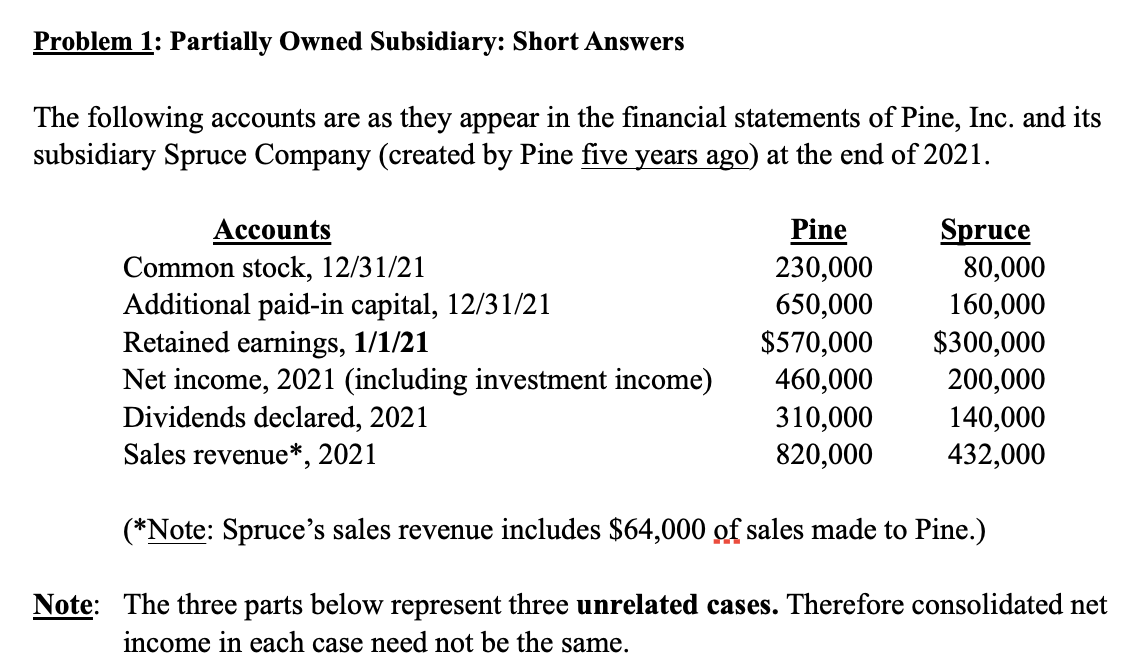

The following accounts are as they appear in the financial statements of Pine, Inc. and its subsidiary Spruce Company (created by Pine five years ago) at the end of 2021. (*Note: Spruce's sales revenue includes $64,000 of sales made to Pine.) Note: The three parts below represent three unrelated cases. Therefore consolidated net income in each case need not be the same. The following accounts are as they appear in the financial statements of Pine, Inc. and its subsidiary Spruce Company (created by Pine five years ago) at the end of 2021. (*Note: Spruce's sales revenue includes $64,000 of sales made to Pine.) Note: The three parts below represent three unrelated cases. Therefore consolidated net income in each case need not be the sameStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started