Answered step by step

Verified Expert Solution

Question

1 Approved Answer

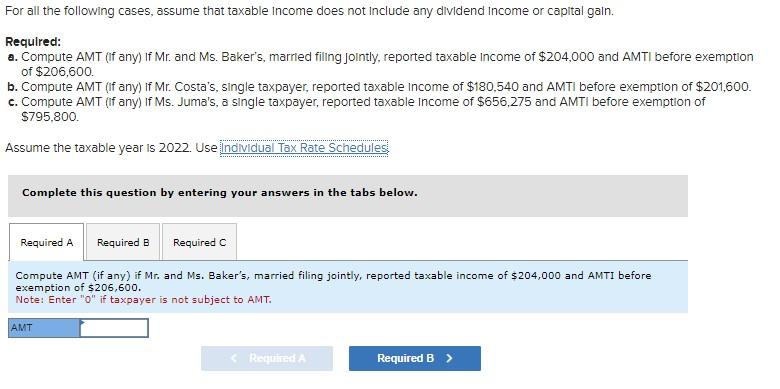

PART A B C For all the following cases, assume that taxable income does not include any dividend Income or capital gain. Required: a. Compute

PART A B C

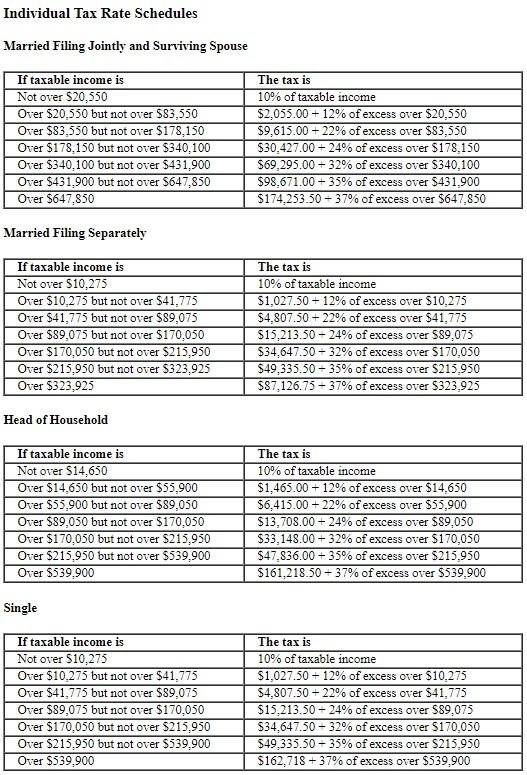

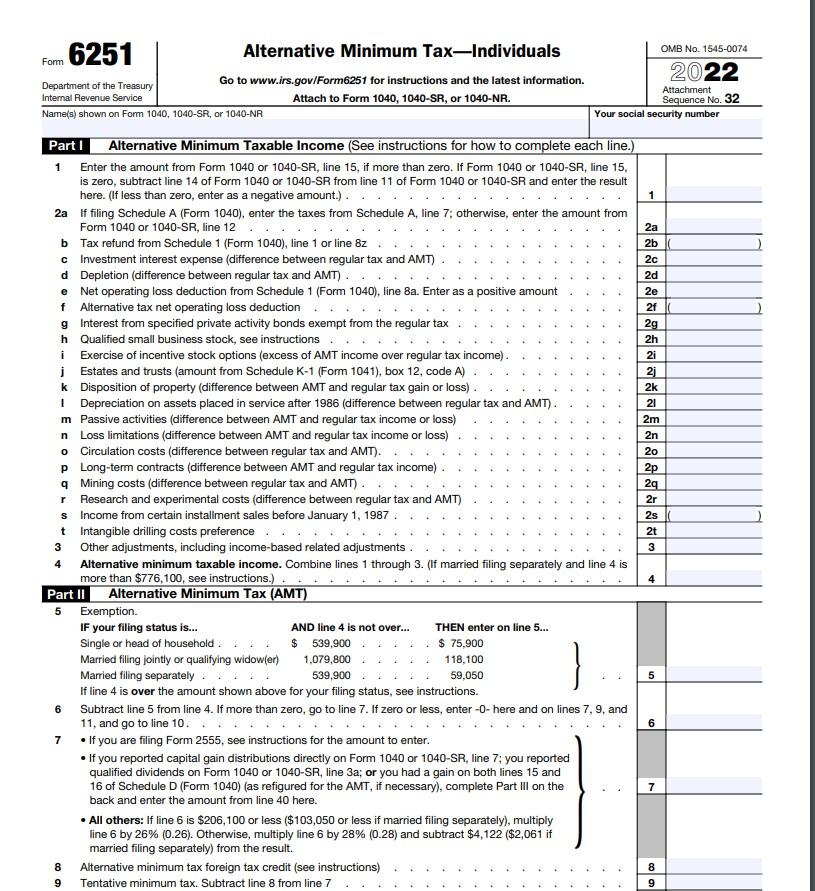

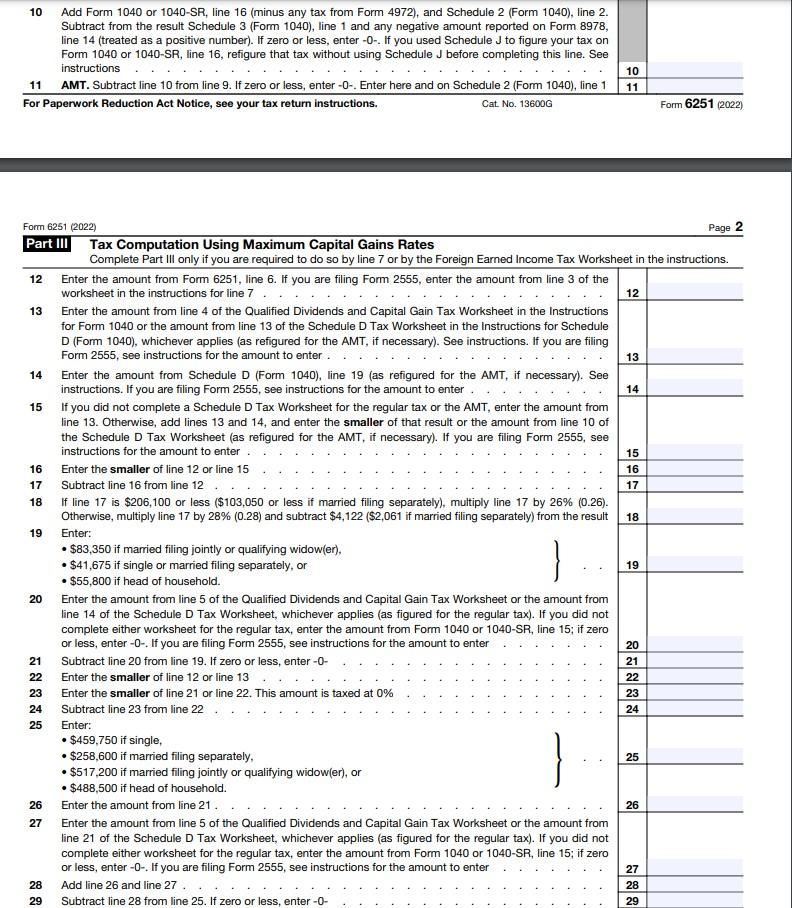

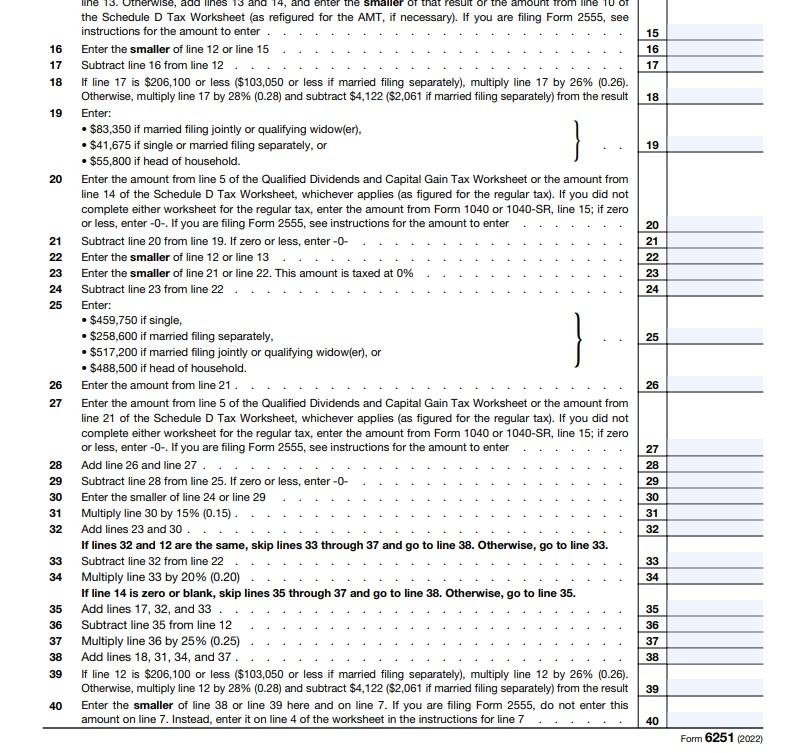

For all the following cases, assume that taxable income does not include any dividend Income or capital gain. Required: a. Compute AMT (If any) If Mr. and Ms. Baker's, marrled filing Jointly, reported taxable income of $204,000 and AMTI before exemption of $206,600. b. Compute AMT (If any) If Mr. Costa's, single taxpayer, reported taxable income of $180,540 and AMTI before exemption of $201,600. c. Compute AMT (If any) If Ms. Juma's, a single taxpayer, reported taxable income of $656,275 and AMTI before exemption of $795,800 Assume the taxable year is 2022 . Use Complete this question by entering your answers in the tabs below. Compute AMT (if any) if Mr. and Ms. Baker's, married filing jointly, reported taxable income of $204,000 and AMTI before exemption of $206,600. Note: Enter "0" if taxpayer is not subject to AMT. Individual Tax Rate Schedules of 641 Alternative Minimum Tax-Individuals 7 - If you are filing Form 2555, see instructions for the amount to enter. - If you reported capital gain distributions directly on Form 1040 or 1040-SR, line 7; you reported qualified dividends on Form 1040 or 1040-SR, line 3a; or you had a gain on both lines 15 and 16 of Schedule D (Form 1040) (as refigured for the AMT, if necessary), complete Part III on the back and enter the amount from line 40 here. - All others: If line 6 is $206,100 or less ($103,050 or less if married filing separately), multiply line 6 by 26%(0.26). Otherwise, multiply line 6 by 28%(0.28) and subtract $4,122($2,061 if married filing separately) from the result. 8 Alternative minimum tax foreign tax credit (see instructions) . . . . . . . . . . . . . . . . . . . 10 Add Form 1040 or 1040-SR, line 16 (minus any tax from Form 4972), and Schedule 2 (Form 1040), line 2. Subtract from the result Schedule 3 (Form 1040), line 1 and any negative amount reported on Form 8978 , line 14 (treated as a positive number). If zero or less, enter 0 - If you used Schedule J to figure your tax on Form 1040 or 1040-SR, line 16, refigure that tax without using Schedule J before completing this line. See instructions 11 AMT. Subtract line 10 from line 9. If zero or less, enter -0-. Enter here and on Schedule 2 (Form 1040), line 1 For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 13600G Form 6251(2022) Form 6251 (2022) Page 2 Part III Tax Computation Using Maximum Capital Gains Rates Complete Part III only if you are required to do so by line 7 or by the Foreign Earned Income Tax Worksheet in the instructions. 12 Enter the amount from Form 6251 , line 6 . If you are filing Form 2555 , enter the amount from line 3 of the worksheet in the instructions for line 7 13 Enter the amount from line 4 of the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Form 1040 or the amount from line 13 of the Schedule D Tax Worksheet in the Instructions for Schedule D (Form 1040), whichever applies (as refigured for the AMT, if necessary). See instructions. If you are filing Form 2555, see instructions for the amount to enter. 14 Enter the amount from Schedule D (Form 1040), line 19 (as refigured for the AMT, if necessary). See instructions. If you are filing Form 2555 , see instructions for the amount to enter . 15 If you did not complete a Schedule D Tax Worksheet for the regular tax or the AMT, enter the amount from line 13. Otherwise, add lines 13 and 14 , and enter the smaller of that result or the amount from line 10 of the Schedule D Tax Worksheet (as refigured for the AMT, if necessary). If you are filing Form 2555 , see instructions for the amount to enter . 16 Enter the smaller of line 12 or line 15 17 Subtract line 16 from line 12 18 If line 17 is $206,100 or less ( $103,050 or less if married filing separately), multiply line 17 by 26% (0.26). Otherwise, multiply line 17 by 28%(0.28) and subtract $4,122 ( $2,061 if married filing separately) from the result 19 Enter: - $83,350 if married filing jointly or qualifying widow(er), - $41,675 if single or married filing separately, or - $55,800 if head of household. 20 Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 14 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15; if zero or less, enter 0-. If you are filing Form 2555 , see instructions for the amount to enter 21 Subtract line 20 from line 19. If zero or less, enter 0 22 Enter the smaller of line 12 or line 13 23 Enter the smaller of line 21 or line 22 . This amount is taxed at 0% 24 Subtract line 23 from line 22 25 Enter: - $459,750 if single, - $258,600 if married filing separately, - $517,200 if married filing jointly or qualifying widow(er), or - $488,500 if head of household. 26 Enter the amount from line 21. 27 Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 21 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15; if zero or less, enter 0-. If you are filing Form 2555 , see instructions for the amount to enter 28 Add line 26 and line 27 . 29 Subtract line 28 from line 25 . If zero or less, enter 0 - the Schedule D Tax Worksheet (as refigured for the AMT, if necessary). If you are filing Form 2555, see instructions for the amount to enter . 16 Enter the smaller of line 12 or line 15 17 Subtract line 16 from line 12 18 If line 17 is $206,100 or less ( $103,050 or less if married filing separately), multiply line 17 by 26%(0.26). Otherwise, multiply line 17 by 28%(0.28) and subtract $4,122 ( $2,061 if married filing separately) from the result 19 Enter: - $83,350 if married filing jointly or qualifying widow(er), - $41,675 if single or married filing separately, or - $55,800 if head of household. 20 Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 14 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15; if zero or less, enter - 0 -. If you are filing Form 2555 , see instructions for the amount to enter 21 Subtract line 20 from line 19 . If zero or less, enter 0 - 22 Enter the smaller of line 12 or line 13 23 Enter the smaller of line 21 or line 22. This amount is taxed at 0% 24 Subtract line 23 from line 22 25 Enter: - $459,750 if single, - $258,600 if married filing separately, - $517,200 if married filing jointly or qualifying widow(er), or - $488,500 if head of household. 26 Enter the amount from line 21. 27 Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 21 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15; if zero or less, enter 0-. If you are filing Form 2555 , see instructions for the amount to enter 28 Add line 26 and line 27. 29 Subtract line 28 from line 25 . If zero or less, enter -0- 30 Enter the smaller of line 24 or line 29 31 Multiply line 30 by 15%(0.15). 32 Add lines 23 and 30 . If lines 32 and 12 are the same, skip lines 33 through 37 and go to line 38 . Otherwise, go to line 33. 33 Subtract line 32 from line 22 34 Multiply line 33 by 20%(0.20) If line 14 is zero or blank, skip lines 35 through 37 and go to line 38 . Otherwise, go to line 35 . 35 Add lines 17, 32, and 33 . Subtract line 35 from line 12 Multiply line 36 by 25%(0.25) Add lines 18, 31, 34, and 37 . If line 12 is $206,100 or less ( $103,050 or less if married filing separately), multiply line 12 by 26%(0.26). Otherwise, multiply line 12 by 28%(0.28) and subtract $4,122 ( $2,061 if married filing separately) from the result 40 Enter the smaller of line 38 or line 39 here and on line 7. If you are filing Form 2555, do not enter this amount on line 7 . Instead, enter it on line 4 of the worksheet in the instructions for line 7 For all the following cases, assume that taxable income does not include any dividend Income or capital gain. Required: a. Compute AMT (If any) If Mr. and Ms. Baker's, marrled filing Jointly, reported taxable income of $204,000 and AMTI before exemption of $206,600. b. Compute AMT (If any) If Mr. Costa's, single taxpayer, reported taxable income of $180,540 and AMTI before exemption of $201,600. c. Compute AMT (If any) If Ms. Juma's, a single taxpayer, reported taxable income of $656,275 and AMTI before exemption of $795,800 Assume the taxable year is 2022 . Use Complete this question by entering your answers in the tabs below. Compute AMT (if any) if Mr. and Ms. Baker's, married filing jointly, reported taxable income of $204,000 and AMTI before exemption of $206,600. Note: Enter "0" if taxpayer is not subject to AMT. Individual Tax Rate Schedules of 641 Alternative Minimum Tax-Individuals 7 - If you are filing Form 2555, see instructions for the amount to enter. - If you reported capital gain distributions directly on Form 1040 or 1040-SR, line 7; you reported qualified dividends on Form 1040 or 1040-SR, line 3a; or you had a gain on both lines 15 and 16 of Schedule D (Form 1040) (as refigured for the AMT, if necessary), complete Part III on the back and enter the amount from line 40 here. - All others: If line 6 is $206,100 or less ($103,050 or less if married filing separately), multiply line 6 by 26%(0.26). Otherwise, multiply line 6 by 28%(0.28) and subtract $4,122($2,061 if married filing separately) from the result. 8 Alternative minimum tax foreign tax credit (see instructions) . . . . . . . . . . . . . . . . . . . 10 Add Form 1040 or 1040-SR, line 16 (minus any tax from Form 4972), and Schedule 2 (Form 1040), line 2. Subtract from the result Schedule 3 (Form 1040), line 1 and any negative amount reported on Form 8978 , line 14 (treated as a positive number). If zero or less, enter 0 - If you used Schedule J to figure your tax on Form 1040 or 1040-SR, line 16, refigure that tax without using Schedule J before completing this line. See instructions 11 AMT. Subtract line 10 from line 9. If zero or less, enter -0-. Enter here and on Schedule 2 (Form 1040), line 1 For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 13600G Form 6251(2022) Form 6251 (2022) Page 2 Part III Tax Computation Using Maximum Capital Gains Rates Complete Part III only if you are required to do so by line 7 or by the Foreign Earned Income Tax Worksheet in the instructions. 12 Enter the amount from Form 6251 , line 6 . If you are filing Form 2555 , enter the amount from line 3 of the worksheet in the instructions for line 7 13 Enter the amount from line 4 of the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Form 1040 or the amount from line 13 of the Schedule D Tax Worksheet in the Instructions for Schedule D (Form 1040), whichever applies (as refigured for the AMT, if necessary). See instructions. If you are filing Form 2555, see instructions for the amount to enter. 14 Enter the amount from Schedule D (Form 1040), line 19 (as refigured for the AMT, if necessary). See instructions. If you are filing Form 2555 , see instructions for the amount to enter . 15 If you did not complete a Schedule D Tax Worksheet for the regular tax or the AMT, enter the amount from line 13. Otherwise, add lines 13 and 14 , and enter the smaller of that result or the amount from line 10 of the Schedule D Tax Worksheet (as refigured for the AMT, if necessary). If you are filing Form 2555 , see instructions for the amount to enter . 16 Enter the smaller of line 12 or line 15 17 Subtract line 16 from line 12 18 If line 17 is $206,100 or less ( $103,050 or less if married filing separately), multiply line 17 by 26% (0.26). Otherwise, multiply line 17 by 28%(0.28) and subtract $4,122 ( $2,061 if married filing separately) from the result 19 Enter: - $83,350 if married filing jointly or qualifying widow(er), - $41,675 if single or married filing separately, or - $55,800 if head of household. 20 Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 14 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15; if zero or less, enter 0-. If you are filing Form 2555 , see instructions for the amount to enter 21 Subtract line 20 from line 19. If zero or less, enter 0 22 Enter the smaller of line 12 or line 13 23 Enter the smaller of line 21 or line 22 . This amount is taxed at 0% 24 Subtract line 23 from line 22 25 Enter: - $459,750 if single, - $258,600 if married filing separately, - $517,200 if married filing jointly or qualifying widow(er), or - $488,500 if head of household. 26 Enter the amount from line 21. 27 Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 21 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15; if zero or less, enter 0-. If you are filing Form 2555 , see instructions for the amount to enter 28 Add line 26 and line 27 . 29 Subtract line 28 from line 25 . If zero or less, enter 0 - the Schedule D Tax Worksheet (as refigured for the AMT, if necessary). If you are filing Form 2555, see instructions for the amount to enter . 16 Enter the smaller of line 12 or line 15 17 Subtract line 16 from line 12 18 If line 17 is $206,100 or less ( $103,050 or less if married filing separately), multiply line 17 by 26%(0.26). Otherwise, multiply line 17 by 28%(0.28) and subtract $4,122 ( $2,061 if married filing separately) from the result 19 Enter: - $83,350 if married filing jointly or qualifying widow(er), - $41,675 if single or married filing separately, or - $55,800 if head of household. 20 Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 14 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15; if zero or less, enter - 0 -. If you are filing Form 2555 , see instructions for the amount to enter 21 Subtract line 20 from line 19 . If zero or less, enter 0 - 22 Enter the smaller of line 12 or line 13 23 Enter the smaller of line 21 or line 22. This amount is taxed at 0% 24 Subtract line 23 from line 22 25 Enter: - $459,750 if single, - $258,600 if married filing separately, - $517,200 if married filing jointly or qualifying widow(er), or - $488,500 if head of household. 26 Enter the amount from line 21. 27 Enter the amount from line 5 of the Qualified Dividends and Capital Gain Tax Worksheet or the amount from line 21 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040 or 1040-SR, line 15; if zero or less, enter 0-. If you are filing Form 2555 , see instructions for the amount to enter 28 Add line 26 and line 27. 29 Subtract line 28 from line 25 . If zero or less, enter -0- 30 Enter the smaller of line 24 or line 29 31 Multiply line 30 by 15%(0.15). 32 Add lines 23 and 30 . If lines 32 and 12 are the same, skip lines 33 through 37 and go to line 38 . Otherwise, go to line 33. 33 Subtract line 32 from line 22 34 Multiply line 33 by 20%(0.20) If line 14 is zero or blank, skip lines 35 through 37 and go to line 38 . Otherwise, go to line 35 . 35 Add lines 17, 32, and 33 . Subtract line 35 from line 12 Multiply line 36 by 25%(0.25) Add lines 18, 31, 34, and 37 . If line 12 is $206,100 or less ( $103,050 or less if married filing separately), multiply line 12 by 26%(0.26). Otherwise, multiply line 12 by 28%(0.28) and subtract $4,122 ( $2,061 if married filing separately) from the result 40 Enter the smaller of line 38 or line 39 here and on line 7. If you are filing Form 2555, do not enter this amount on line 7 . Instead, enter it on line 4 of the worksheet in the instructions for line 7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started