Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part A Brenda Jones worked for Cool Corner Store for straight-time earnings of $ 15.00 per hour with time and a half for hours

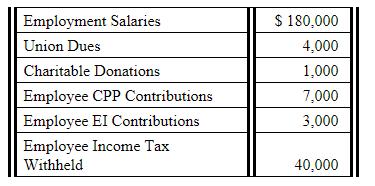

Part A Brenda Jones worked for Cool Corner Store for straight-time earnings of $ 15.00 per hour with time and a half for hours in excess of 35 hours per week. Brenda Jones' payroll deductions included the following: Income tax of 25% CPP of 4.95% on earnings (Account for the $3,500 basic annual exemption.) . EI of 1.88% on earnings In addition, Brenda Jones contributed $ 20 per week to her Registered Retirement Savings Plan (RRSP). Brenda Jones worked 40 hours during the week. She had not reached the CPP or EI maximum earning levels. Required: 1. Calculate Brenda Jones's gross pay and net pay for the week. 2. Make an October 17 journal entry in the general journal to record Cool Corner Store's wage expense for Brenda Jones' work, including her payroll deductions and the employer's payroll costs. Round all amounts to the nearest cent. Explanations are not required. Employment Salaries Union Dues Charitable Donations Employee CPP Contributions Employee EI Contributions Employee Income Tax Withheld $ 180,000 4,000 1,000 7,000 3,000 40,000 Part A 1. + 2. DATE General Journal ACCOUNT TITLES AND EXPLANATIONS POST. REF. DEBIT CREDIT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Brenda jones calculation of gross pay and n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started