Answered step by step

Verified Expert Solution

Question

1 Approved Answer

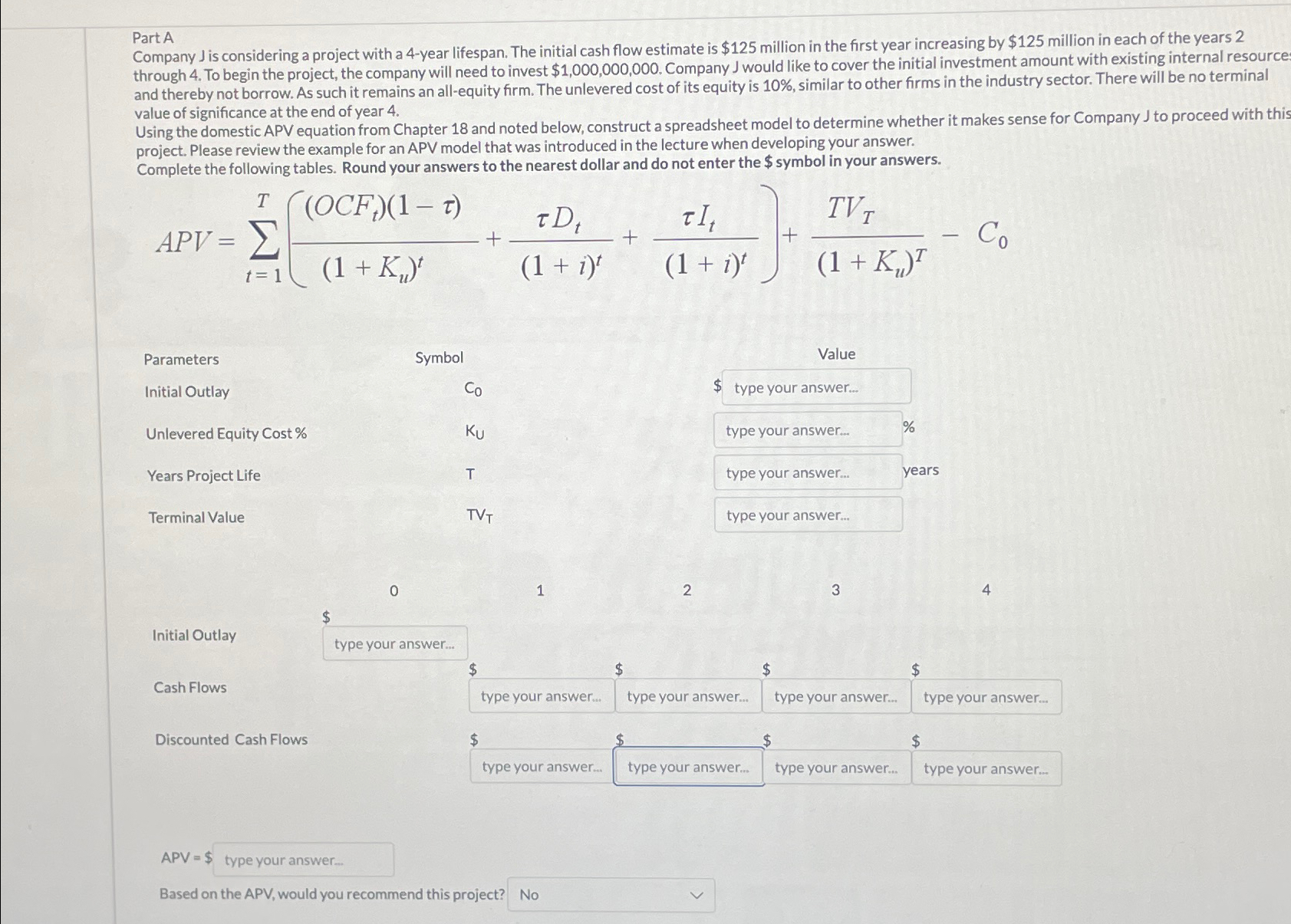

Part A Company J is considering a project with a 4 - year lifespan. The initial cash flow estimate is $ 1 2 5 million

Part A

Company J is considering a project with a year lifespan. The initial cash flow estimate is $ million in the first year increasing by $ million in each of the years through To begin the project, the company will need to invest $ Company J would like to cover the initial investment amount with existing internal resource and thereby not borrow. As such it remains an allequity firm. The unlevered cost of its equity is similar to other firms in the industry sector. There will be no terminal value of significance at the end of year

Using the domestic APV equation from Chapter and noted below, construct a spreadsheet model to determine whether it makes sense for Company J to proceed with this project. Please review the example for an APV model that was introduced in the lecture when developing your answer.

Complete the following tables. Round your answers to the nearest dollar and do not enter the $ symbol in your answers.

APV

Parameters

Initial Outlay

Unlevered Equity Cost

Years Project Life

Terminal Value

$

Initial Outlay

Cash Flows

Discounted Cash Flows

Symbol

T

Value

type your answer...

years

$

$ $ type your answer... $ type your answer...

APV

Based on the APV, would you recommend this project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started